FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

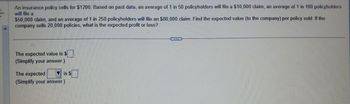

Transcribed Image Text:An insurance policy sells for $1200. Based on past data, an average of 1 in 50 policyholders will file a $10,000 claim, an average of 1 in 100 policyholders

will file a

$50,000 claim, and an average of 1 in 250 policyholders will file an $80,000 claim. Find the expected value (to the company) per policy sold. If the

company sells 20,000 policies, what is the expected profit or loss?

The expected value is $

(Simplify your answer.)

The expected

(Simplify your answer.)

is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dée Trader opens a brokerage account and purchases 100 shares of Internet Dreams at $58 per share. She borrows $2,200 from her broker to help pay for the purchase. The interest rate on the loan is 12%. Required:a. What is the margin in Dée’s account when she first purchases the stock? b. If the share price falls to $48 per share by the end of the year, what is the remaining margin in her account? c. If the maintenance margin requirement is 30%, will she receive a margin call?multiple choice Yes No Correct d. What is the rate of return on her investment? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Dée Trader opens a brokerage account and purchases 100 shares of Internet Dreams at $58 per share. She borrows $2,200 from her broker to help pay for the purchase. The interest rate on the loan is 12%. Required:a. What is the margin in Dée’s account when she first purchases the stock? b. If the share price falls to…arrow_forwardCc. 177.arrow_forwardAt the beginning of the month, you owned $5,000 of General Dynamics, $4,000 of Starbucks, and $7,000 of Nike. The monthly returns for General Dynamics, Starbucks, and Nike were 7.50 percent, -1.66 percent, and -0.69 percent. What is your portfolio return? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Portfolio return 2.44 %arrow_forward

- (i) A client at ZBX Fin Planning deposits $85,000 in an account today in hope that it grows to $150,000 in 6 years. What annual compounded rate would the client need to earn? (Provide answer to nearest basis point, as in "12.34%" or "0.1234") (ii) Now suppose the client realizes she can expect to earn 9.96% APR compounded monthly in another portfolio marketed by ZBX. If the client earns that rate, how many years would it take to realize the above $150,000 goal? (Round number of years to nearest hundredth, as in "1.23" years)arrow_forwardSuppose you purchased a house in San Diego in January of 1994 for $75,000. You then sold that house in December of 2006 for $350,000. Assume that the CPI rose in that period from 107 to 180. What was your total nominal rate of return? How about your annual nominal rate of return? What was your total real return? How about you annual real return?arrow_forwardDee Trader opens a brokerage account and purchases 200 shares of Internet Dreams at $50 per share. She borrows $3,300 from her broker to help pay for the purchase. The interest rate on the loan is 6%. Required: a What is the margin in Dee's account when she first purchases the stock? b. If the share price falls to $40 per share by the end of the year, what is the remaining margin in her account?arrow_forward

- Seven months ago, you purchased 400 shares of stock on margin. The initial margin requirement on your account is 70 percent and the maintenance margin is 30 percent. The call money rate on the margin loan is 6.65 percent. The purchase price was $16 a share. Today, you sold these shares for $18.00 each. What is your annualized rate of return? O 64.64 percent O 56.87 percent O 33.35 percent O 42.77 percent O 29.39 percent O Oarrow_forwardWhen purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is an 80% loan at 4% with monthly payments of $591.75 for 15 years. The second loan is 90% loan at 5% with monthly payments of $526.13 over 25 years. What is the incremental cost of borrowing the extra money assuming the loan will be held for the full term? O 6.50% O 13.21% O 7.20% O 13.70%arrow_forwardSimple Interest An investor purchased 250,000 USD in 364-day T-bills 315 days before maturity to yield 1.12%. The purchase price was 247,606.69 USD. He sold the T-bills 120 days later to yield 1.47%. What annualized rate of return did the investor realize on the investment? Also, can this be done with a financial calculator?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education