Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General accounting questions answer

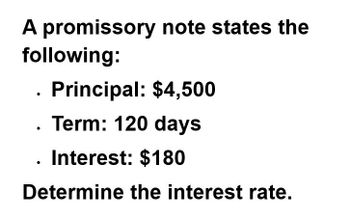

Transcribed Image Text:A promissory note states the

following:

•

Principal: $4,500

Term: 120 days

Interest: $180

Determine the interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The interest on a $29000, 6%, 90-day note receivable isarrow_forwardCalculate the amount of interest to be charged on a $12,000, 8.5%, 90-day interest-bearing note.arrow_forwardCompute interest and find the maturity date for the following notes. (a) date of note: June 10 Principal: $80,000 Interest Rate: 6% Term: 60 days (b) Date of Note: July 14 Principal: $50,000 Interest Rate: 7% Term: 90 days (c) Date of Note: April 27 Principal:$12,000 Interest Rate: 8% Term: 75 daysarrow_forward

- Assuming a 360-day year, when a $11,200, 90-day, 5% interest-bearing note payable matures, the total payment will be Oa. $560 Ob. $140 Oc. $11,760 Od. $11,340 0 0 0 0arrow_forwardAssuming a 360-day year, when a $11,392, 90-day, 10% interest-bearing note payable matures, total payment will be a. $11,677 Ob. $12,531 Oc. $1,139 Od. $285 That's Built PlueAarrow_forwardAssuming a 360-day year, when a $11,918, 90-day, 10% interest-bearing note payable matures, total payment will be a.$13,110 b.$1,192 c.$298 d.$12,216arrow_forward

- For an interest-bearing promissory notes, compute the sale proceeds, when the issue amount is $18,200, term of the note is 4 1/2 years with interest rate 9.45% compounded monthly, the date of sale before maturity is 1.7 years with a discount rate 15% compounded quarterly. Select one: O a. 21634.97 Ob. 21642.76 O c. 21580.47 d. nonearrow_forwardA non-interest bearing promissory note has a face value of $950. Find the proceeds of this note if it is discounted 3½ years before its maturity date at 8% compounded quarterly. Select one: a. $719.98 b. $771.65 c. $657.22 d. $725.67arrow_forwardCan you please answer the financial accounting question?arrow_forward

- A $12,000 non-interest-bearing promissory note is discounted at 6% compounded monthly, three years before maturity. What are the proceeds from the sale of the note?arrow_forwardCompute the size of the final payment for the following loan. Principal $ Periodic Payment $ Payment Period Payment Made at: Interest Rate % Compounding Period 8100 520 3 months beginning 8 quarterly The size of the final payment is $_ .?arrow_forwardDetermine the maturity date solve this accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning