ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

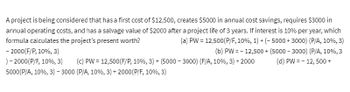

Transcribed Image Text:A project is being considered that has a first cost of $12,500, creates $5000 in annual cost savings, requires $3000 in

annual operating costs, and has a salvage value of $2000 after a project life of 3 years. If interest is 10% per year, which

formula calculates the project's present worth?

(a) PW = 12,500(P/F, 10%, 1) + (-5000+3000) (P/A, 10%, 3)

(b) PW = -12,500+ (5000-3000) (P/A, 10%,3

(d) PW = -12, 500+

- 2000 (F/P, 10%, 3)

) - 2000(P/F, 10%, 3) (c) PW = 12,500 (F/P, 10%, 3) + (5000-3000) (F/A, 10%, 3) +2000

5000 (P/A, 10 %, 3) - 3000 (P/A, 10 %, 3) + 2000 (P/F, 10%, 3)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (engineering economic) Four alternatives with cash flows (million rupiah) as follows: Determine the best alternative based on a 12% MARR using the following methods: (a) Rate of Return; (b) Payback Periodarrow_forwardHow much will Sonja have in a savings account 12 years from now if she deposits $3000 now and $5000 four years from now? The account earns interest at a rate of 10% per year. (a) $10,720 (b) $9,415 (c) $20,133 (d) $15,630 (e) Greater than $22,000arrow_forwardMechanical engineer at Company B is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which should be selected (a) if they are independent, and (b) if they are mutually (c) Explain why your selection in part (b) is correct. First Cost, $ Net Annual Income, $/Year Life, Years A -20,000 +5,500 4 B −10,000 +2,000 6 C −15,000 3,800 6 D −60,000 +11,000 12 E −80,000 +9,000 12arrow_forward

- Use the table to determine the discounted payback period using 7% per yearPeriod (n) Cash flow (An) Cost of funds (7%) Ending balance 0 -85,000 0 - 85,000 1 15,000 2 25,000 3 35,000 4 45,000 5 45,000 6 35,000arrow_forwardNonearrow_forwardExample A company is considering two types of equipment for its manufacturing plant. Pertinent data are as follows: Freeze Type A Type B First cost P200,000 P300,000 Annual Operating Cost P32,000 P24,000 D Annual Labor Cost P50,000 P32,000 Insurance and Property Taxes 3% 3% Payroll Taxes 4% 4% Estimated Life TO 10 If the minimum required rate of return is 15%, which equipment should be selected?arrow_forward

- A consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle? 10 16 -22)arrow_forward12.9 A three-year maintenance contract for a local computer network costs $4000. The network is expected to be needed for fifteen years and the maintenance contract will be purchased for the same price at the beginning of every three year period. If the interest rate is 6%, the present equivalent cost of the maintenance contract is nearest: (A) $12,950 (B) $14,500 (C) $15,400 (D) $16,000arrow_forwardWhat is the equivalent present amount to an accumulation of $25,000 10 years from now at 5% interest? (a)$15,000 (b)$15, 348 (c)$15, 982 (d)$16, 571arrow_forward

- If $1000 is invested annually at 6% continuous compounding for each of 10 years, how much is in the account after the last deposit? (a) $1822 (b) S10,000 (c) $13,181 (d) $13,295arrow_forwardP = 10000S = 1000Annual Savings = 4000Annual Maintenance Cost = 3000i = 5%,n = 7 years Which formula below will correctly calculate NPW? -10000 (P/A, 5%, 7) + 1000 (P/F, 5%, 7) + 4000 (P/A, 5%, 7) - 3000 (P/A, 5%, 7) -10000 (A/P, 5%, 7) + 1000 (A/F, 5%, 7) + 4000 - 3000 None of the above -10000 + 1000 + 4000 - 3000 -10000 (A/P, 5%, 7) + 1000 (A/F, 5%, 7) + 4000 + 3000arrow_forwardRequired information The TT Racing and Performance Motor Corporation wish to evaluate two alternative machines for NASCAR motor tune- ups. Machine First cost, $ Annual operating cost, $ per year Life, years Salvage value, $ -254,000 -40,000 The better alternative is machine S 3 20,400 Use the AW method at 9% per year to select the better alternative. The annual worth of machine R is $- S -360,500 -50,000 5 19,600 47694, and the annual worth of machine S is $- 10970arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education