ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

6

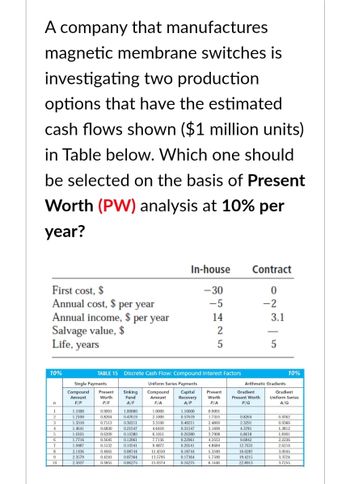

Transcribed Image Text:A company that manufactures

magnetic membrane switches is

investigating two production

options that have the estimated

cash flows shown ($1 million units)

in Table below. Which one should

be selected on the basis of Present

Worth (PW) analysis at 10% per

year?

First cost, $

Annual cost, $ per year

Annual income, $ per year

Salvage value, $

Life, years

10%

n

1

2

3

4

5

6

7

8

9

10

Single Payments

Compound Present

Worth

Amount

F/P

P/F

1.1000

1.2100

1.3310

1.4641

1.6105

1.7716

1.9487

2.1436

2.3579

2.5937

TABLE 15 Discrete Cash Flow: Compound Interest Factors

Uniform Series Payments

Capital

Recovery

A/P

0.9091

0.8264

0.7513

0.6830

0.6209

0.5645

0.5132

0.4665

0.4241

0.3855

Sinking

Fund

A/F

1.00000

0.47619

0.30211

0.21547

0.16380

0.12961

0.10541

0.08744

0.07364

0.06275

Compound

Amount

F/A

1.0000

2.1000

3.3100

4.6410

6.1051

7.7156

9.4872

In-house Contract

-30

0

-5

-2

14

2

5

11.4359

13.5795

15.9374

1.10000

0.57619

0.40211

0.31547

0.26380

0.22961

0.20541

0.18744

0.17364

0.16275

Present

Worth

P/A

0.9091

1.7355

2.4869

3.1699

3.7908

4.3553

4.8684

5.3349

5.7590

6.1446

Gradient

Present Worth

P/G

3.1

Arithmetic Gradients

0.8264

2.3291

4.3781

6.8618

9.6842

12.7631

16.0287

19.4215

22.8913

5

10%

Gradient

Uniform Series

A/G

0.4762

0.9366

1.3812

1.8101

2.2236

2.6216

3.0045

3.3724

3.7255

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Only typed answerarrow_forwardLearning 9g.cengage.com/static/nb/ui/evo/index.html?deploymentld%35982812479578414089770649020&elSBN=978035; A Tax Document E ECSI - TaxSelect Do. SeAccount Quick Car. B Calendar | Navigate Main Street Comm. CENGAGE MINDTAP Homework (Ch 10) Back to Assignment Attempts Keep the Highest/1 4. Understanding different policy options to correct for negativeexternalities Carbon dioxide emissions have been linked to increased air pollution. The following table lists some possible public policies aimed at reducing the amount of carbon dioxide in the air. For each policy isted, identify whether it is a command-and-control policy (regulation), tradable permit system, corrective subsidy, or corrective tax Tradable Permit System Corrective Subsidy Command-and- Corrective Public Policy Control Policy Tax The government orders every factory to adopt a new technology, which reduces carbon-dioxide emissions into the atmosphere. Trees take cartbon dioxide out of the air and convert it to okygen, so the…arrow_forwardQuestion:- Cyber risk insurance that covers both customers and legal settlements would be known asarrow_forward

- What are your thoughts about the future of properties in Los Angeles that are subject to this new tax? Will it help, will it hurt, what are the potential impacts?arrow_forwardFind value of output if:- Net value added at FC = $200 million Intermediate consumption = $150 million Depreciation = $20 million Tax = $40 Subsidy = $20 millionarrow_forwardQuestion 4Calculate the gross value added : Sale - 400 Changein stock -(-20) Depreciation - 30Net indirect taxes - 40 Purchasea of mchinery - 200 Purchaseof an intermediate production - 250arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education