ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

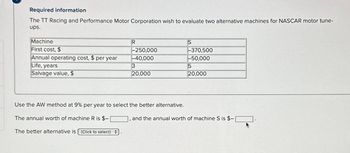

Transcribed Image Text:Required information

The TT Racing and Performance Motor Corporation wish to evaluate two alternative machines for NASCAR motor tune-

ups.

Machine

First cost, $

Annual operating cost, $ per year

Life, years

Salvage value, $

R

-250,000

-40,000

3

20,000

Use the AW method at 9% per year to select the better alternative.

The annual worth of machine R is $-

The better alternative is (Click to select)

S

-370,500

-50,000

5

20,000

and the annual worth of machine S is $-

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Nonearrow_forwardA consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle? 10 16 -22)arrow_forwardDexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 8% per year, which alternative has the lower present worth?arrow_forward

- Required information PEMEX, Mexico's petroleum corporation, has an estimated budget for oil and gas exploration that includes equipment for three offshore platforms as shown. Use PW analysis to select the best alternative at a MARR of 16% per year. Platform First cost, $ million Y Z -300 -450 -510 M&O, $ million per year -320 -290 -230 Salvage value, $ million 75 50 90 Estimated life, years 20 20 20 Select platform X, Y, or Z using tabulated factors. The present worth of platform X is $- 2298.4 worth of platform Z is $- 1944.14 million, the present worth of platform Y is $- 2262.15 million, and the present million. The platform selected based on the present worth is platform Zarrow_forwardThere are 5 national projects with infinite life time listed below. Select the best two projects if MARR is 8% per year using rate of return analysis? Project First Cost A 2000 B 1000 C 1500 D 7000 E 5000 ORDER: Annual income 200 130 150 600 260 Calculate i* for each alternativearrow_forwardYou have two machines under consideration for an improved automated wrapping process for Snickers Fun Size candy bars as detailed below. Using an AW analysis, determine which should be selected at i = 15% per year. Machine First cost, $ Annual cost, $/year Salvage value, $ Life, years C -40,000 -10,000 12,000 3 D -65,000 -12,000 25,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education