Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Mc

Graw

Hill

Risk and Capital Budgeting

AA

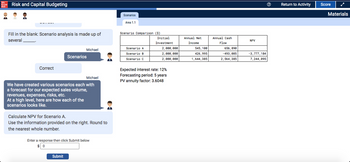

Fill in the blank: Scenario analysis is made up of

several

Correct

Michael

Scenarios

Michael

We have created various scenarios each with

a forecast for our expected sales volume,

revenues, expenses, risks, etc.

At a high level, here are how each of the

scenarios looks like.

Calculate NPV for Scenario A.

Use the information provided on the right. Round to

the nearest whole number.

Submit

Enter a response then click Submit below

$0

Scenarios

Area 1.1

Scenario Comparison ($)

Scenario A

Scenario B

Scenario C

Initial

Investment

2,000,000

2,000,000

2,000,000

Expected interest rate: 12%

Forecasting period: 5 years

PV annuity factor: 3.6048

Annual Net

Income

545, 100

426,995

1,644,385

Annual Cash

Flow

656,890

-493, 005

2,564,385

NPV

-3,777, 184

7,244,095

Return to Activity

Score

Materials

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardSolve required B required A is already solvedarrow_forward- Main View | Course X * CengageNOWV2| Online teachin X University of Sioux Falls, South D x - genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%3D&inpro... eBook Average Rate of Return-Cost Savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $90,000 with a $8,000 residual value and a ten-year life. The equipment will replace one employee who has an average wage of $15,980 per year. In addition, the equipment will have operating and energy costs of $4,350 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. ICarrow_forward

- I Need Help Finding Row 13 and 14 The Income Summary And Retained Earningsarrow_forwardin text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardWhat is the amount of the total paid-in capital? What makes up this amount?arrow_forward

- Given all of the information in the table below, which company seems to be the BEST value? Select one: a. Adobe b. Oracle c. Microsoft d. Block Clear my choicearrow_forwardChapter 1: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell C18 enter the formula "= B6". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts in both the traditional and contribution format income statements match the numbers in Exhibit 1-7. Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking “Browse.” Next, click…arrow_forwardnot use ai pleasearrow_forward

- ion 3 et ered ced out of 1 ag tion evi ◄E Match each of the qualitative characteristics below with the correct description/definition (use the drop-down button). Timeliness Materiality Comparability Choose... Relevance Choose... Predictive Value Neutrality Choose... Choose... Choose... Choose... Choose... Information measured and reported in a similar manner for different companies A company cannot select information to favor one set of interested parties over another. Information available to decision-makers before it loses its capacity to influence decisions Information must be capable of making a difference in a decision. Omitting this information or misstating it could influence decisions that users make on the basis of this information. Has value as an input to predictive processes used by investors to form their own expectations about the future.arrow_forward2 Project: Company Accour X D21. 7-1 Problem Set: Module Sev X CengageNOWv2 | Online tea X Cengage Learning +| x Dw.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator3D&inprogress%3Dfalse eBook Show Me How Current Position Analysis The following items are reported on a company's balance sheet: $365,600 Marketable securities 285,700 Accounts receivable (net) 254,900 Inventory 236,400 Accounts payable 394,000 Determine (a) the current ratio and (b) the quick ratio. Round to one declmal place. a. Current ratio b. Quick ratio Check My Work a. Divide current assets by current liabilities. b. Divide quick assets by current liabilities. Quick assets are cash, temporary investments, and receivables. Check My Work Previous ELE AD dy f4 f12 prt sc 米arrow_forwardLoad the wooldridge package in your R script using the library function: library (wooldridge) Load the wage 2 dataset by writing (in your R script): data = wage 2 This dataset contains information on individuals' monthly wage (the wage variable), number of hours worked per week (the hours variable), IQ (the IQ variable), and other variables. Add a new variable to data (named hourly_wage) which is equal to monthly wage wage divided by 4 times the number of hours worked per week: hourly age = Assign the 4x hours dataframe data (after adding the new variable) to answer1. 2. What is the mean hourly wage? 3. What is the minimum number of years of education in the dataset? 4. What is the number of observations? 5. Estimate the following model: (i(i using the Im function. Assign your model to answer5. 6. What is the coefficient on educ in the model in the previous question? (Hint: Your answer should be a positive number.) Warrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education