FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

E5-6

two picture. It's on two pages

Transcribed Image Text:(a) Prepare separate entries for each transaction on the books of Pais Company.

dise purchased by Pais on June 10 cost McGiver $5,000, and the goods returned cost

Insti

McGiver $310.

E5-5 The adjusted trial balance of Doqe Company shows these data pertaining to sales at

the end of its fiscal year, October 31, 2017: Sales Revenue $900,000, Freight-Out $14,000,

Sales Returns and Allowances $22,000, and Sales Discounts $13,500.

Prepa

state

(LO 4

Instructions

Prepare the sales section of the income statement.

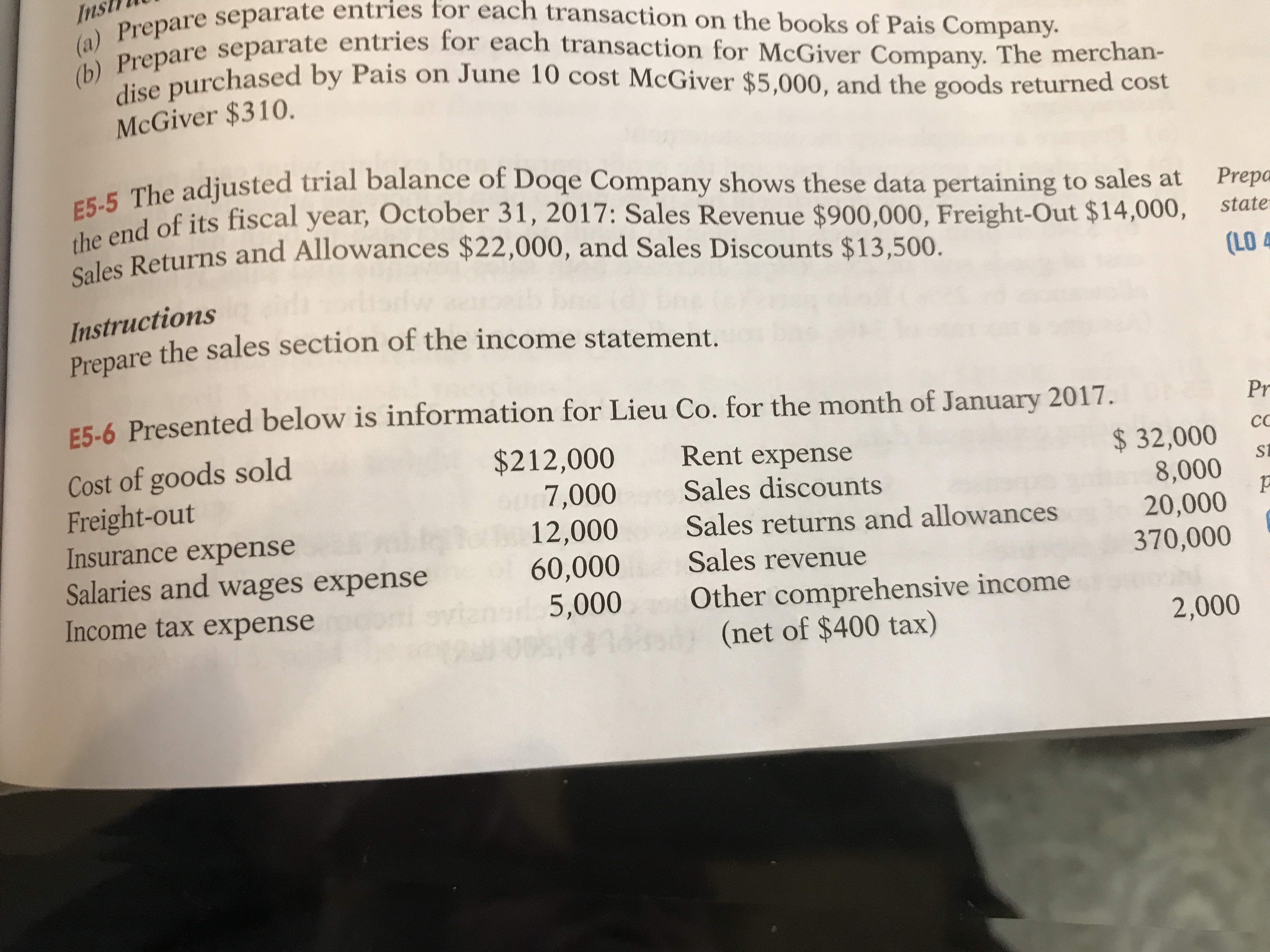

E5-6 Presented below is information for Lieu Co. for the month of January 2017.

Pr

Cost of goods sold

Freight-out

Insurance expense

Salaries and wages expense

$212,000

7,000

12,000

60,000

5,000

Rent expense

$ 32,000

St

8,000

20,000

370,000

Sales discounts

Sales returns and allowances

Sales revenue

Other comprehensive income

(net of $400 tax)

Income tax expense

i svta

2,000

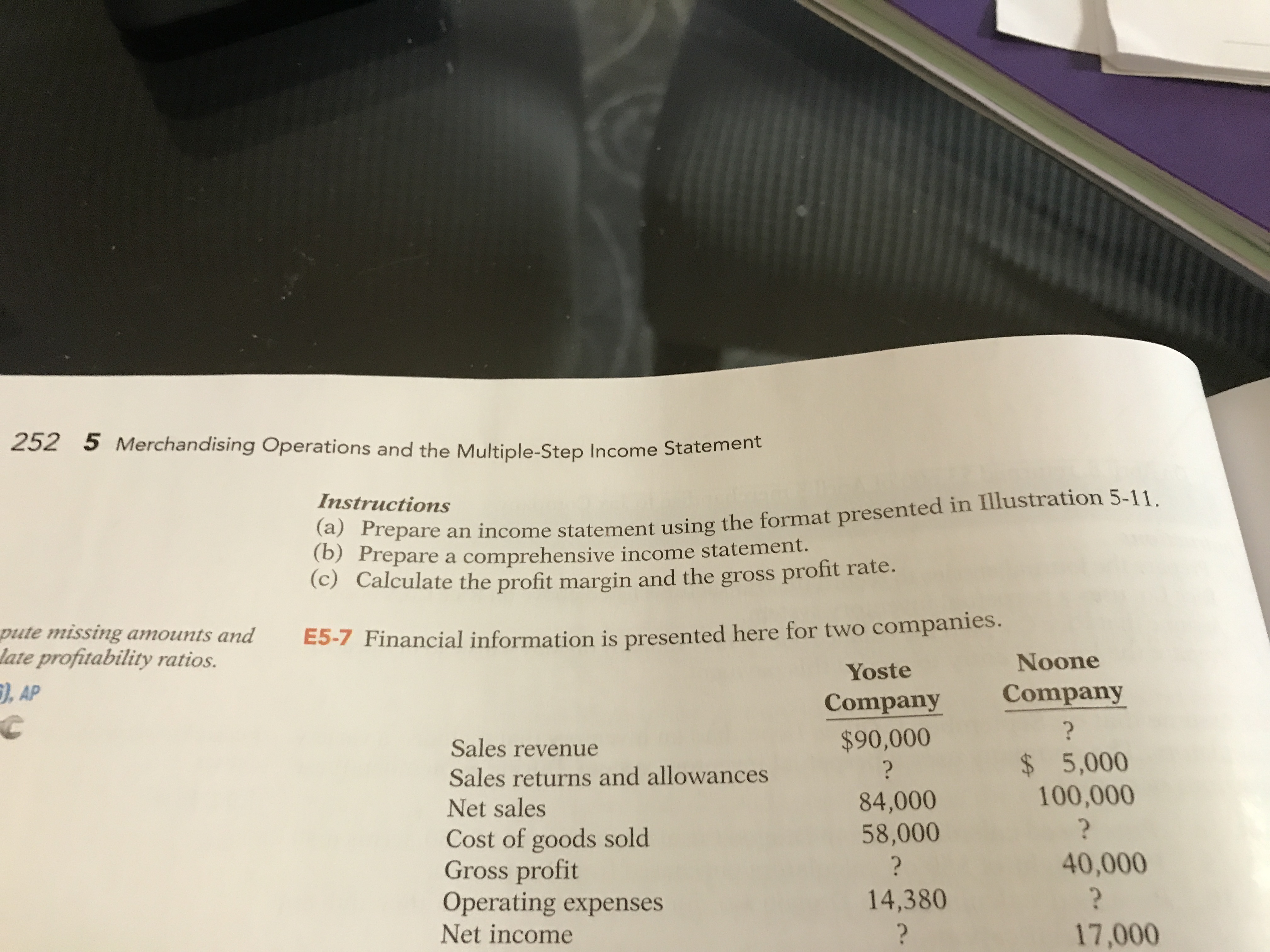

Transcribed Image Text:252 5 Merchandising Operations and the Multiple-Step Income Statement

Instructions

Frepare an income statement using the format presented in Illustration 5-11.

(b) Prepare a comprehensive income statement.

(c) Calculate the profit margin and the gross profit rate.

pute missing amounts and

late profitability ratios.

), AP

E5-7 Financial information is presented here for two companies.

Yoste

Noone

Company

Company

$90,000

Sales revenue

Sales returns and allowances

Net sales

$ 5,000

100,000

?

84,000

58,000

Cost of goods sold

Gross profit

Operating expenses

Net income

?

40,000

14,380

17,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Document95.doox Document94.doox M Inbox (205) - ladybuggsmx C Get Homework Help WithX C P4-4B. LO 4-3 Kateer a https://natlcollegeedu-my.sharepoint.com/:w:/r/personal/hayess_students_an_edu/_layouts/15/Doc.aspx?sourcedoc=(c6 AU ANU Canvas eved O Search (Alt + Q) out References Review View Help Editing v A A B IU ev Av Ao marrow_forwarduni 403 a Cha Pra (Ch Preview File Edit View Go Tools Window Help mgt120h-j17.pdf Page 7 of 10 0 CC Search b. Company B has current assets of $234,000, total assets of $459,000, and equity of $100,000. The company wants to reorganize its liabilities so that is current ratio is 2: 1. If it does, what will its noncurrent liabilities be? S QSun Apr 16 1:23 PMarrow_forwardent95.docx Document94.doox M Inbox (204) - ladybuggsmX C Get Homework Help WithX C P4-4B. LO 4-3 Kareem Esp 8 https://natlcollegeedu-my.sharepoint.com/:w:/r/personal/hayess_students_an_edu/_layouts/15/Doc.aspx?sourcedoc3D(c6 U Canvas P Search (Alt + Q) References Review View Help O Editing v A A B I ニvニv U 2v Aく A ... UIt, dinu Ulrect ilawui ui 920 per UIt. Wildi is tiie LUSI OI eaCIT uit pTOuuteu: ЕАЗ. LO 6.1A company estimated 100,000 direct labor hours and $800,000 in overhead. The actual overhead was $805,100, and there were 99,900 direct labor hours. What is the predetermined overhead rate, and how much was applied during the year? EA4.arrow_forwardCVT Maps O Porter's Five Forc... Assignment 2 mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddi... Upd 7. Closed the revenue account. 8. Closed the expense accounts! Year 1: 1. Issued $16,000 of common stock for cash. 2. Provided $84,600 of services on account. 3. Provided $42,000 of services and received cash. 4. Collected $75,000 cash from accounts receivable. 5. Paid $44,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. DOK Saved Year 2: 1. Wrote off an uncollectible account for $950. 2. Provided $94,000 of services on account. 3. Provided $38,000 of services and collected cash. 4. Collected $87,000 cash from accounts receivable. 5. Paid $71,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts…arrow_forwardM Inbox (909) - camillejeunei @gm i General (BSA 1-1: FAR 2) | Micro O FAR 2 LONG QUIZ /Pages/ResponsePage.aspx?id3DcYWpTercOUiPsQvdXclp-WXyu19p0dpLjDbGCXgjKqpURFVGNzZDSzZDWUhSWkRNTUoxTjBXNzhF The net income from January 1 to September 30, 2019 is P44,000. Also, on this date, cash and liabilities are P40,000 and P90,000, respectively. For Romans to receive P55,200 in full settlement of his interest in the firm, how much must be realized from the sale of the firm's non-cash assets? * Corinthians and Galatians decide to dissolve the partnership on September 30, 2021. neir capital balances and profit ratio on this date, follow: Capital Balances Profit Ratio Romans P50,000 40% Corinthians 60,000 Galatians 20,000 30% P196,000 P177,000 P193,000 国 INarrow_forwardITS-The Political S A M7: Assignment No.1 10201Ox/aMzlzNzk 1NTQxNDg2/details ВА.. e Home | Edmodo O Spoliarium by Juan.. w You searched for Re.. W Operating Performa... 1 Otn.docxlo. Open with Activity No.: Topic : The Worksheet Problems The following are all the steps in the accounting cycle. List them they should be done. 1. the order in which Closing entries are journalized and posted to the ledger. - An unadjusted trial balance is prepared. - An optional end-of-period spreadsheet (worksheet) is prepared. -A post-closing trial balance is prepared. - Adjusting entries are journalized and posted to the ledger. - Transactions are analyzed and recorded in the journal. Adjustment data are assembled and analyzed. -Financial statements are prepared An adjusted trial balance is prepared Transactions are posted to the ledger 2. 7. 8. 6. 10 The balances for the accounts listed below appeared in the Adjusted Tral Balance columns of the work the Income Statement columns or iobtndicato ther cach…arrow_forwardPractice chpt 5 - Co X A ezto.mheducation.com/ext/map/index.html?_con=con&external browser=D0&launchUrl=https%253A%252F%252Fdcccd.blackboar ce chpt 5 A Saved At the end of 2021, Worthy Co's balance for Accounts Receivable is $24,000, while the company's total assets equal $1,540,000. In addition, the company expects to collect all of its receivables in 2022. In 2022, however, one customer owing $4,000 becomes a bad debt on March 14. Record the write off of this customer's account in 2022 using the direct write-off method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Rook View transaction list Journal entry worksheet Print erences Record the write off of this customer's account in 2022 using the direct write off method. Note: Enter debits before credits. Date General Journal Debit Credit March 14, 2022 Record entry Clear entry View general journal raw Type here to search Ps DII PrtScn Hom F3 F7 F8 近arrow_forwardO Mail - Edjouline X E Content - ACG2 X * CengageNOW. X O (58) YouTube * from Towards a X m/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < ☆ STIOW Me TOW Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $410,000; Allowance for Doubtful Accounts has a credit balance of $3,500; and sales for the year total $1,850,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Check My Work Previous Next V O 11:51arrow_forwardQw.17.arrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education