FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer the required part: Prepare all indicated

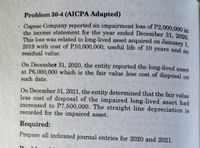

Transcribed Image Text:Problem 30-4 (AICPA Adapted)

, Cognac Company reported an impairment loss of P2,000,000 in

the income statement for the year ended December 31, 2020

This loss was related to long-lived asset acquired on January 1

2019 with cost of P10,000,000, useful life of 10 years and no

,

residual value.

On December 31, 2020, the entity reported the long-lived asset

at P6,000,000 which is the fair value less cost of disposal on

such date.

On December 31, 2021, the entity determined that the fair value

less cost of disposal of the impaired long-lived asset had

increased to P7,500,000. The straight line depreciation is

recorded for the impaired asset.

Required:

Prepare all indicated journal entries for 2020 and 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are scheduled, interim, and past due statements? Please explain.arrow_forwardYou will enter the Topic, Subtopic, Section, Paragraph in a fill in the blank question and your overall conclusion to this case. Example: ASC 100-10-45-4 (you do not need to enter what the guidance content) Research Case #1: Chicago Corporation is building a new facility at a cost of $8 million dollars. Construction began in early January 2021 and will be completed by December 31, 2021. Chicago Corporation borrowed $6 million on January 5, 2021 for the construction of the facility and is using the funding from bonds issued in earlier years to assist in the remaining of the funding for the project. The CFO for Chicago Corporation recalls that interest may be capitalized for the project but is unsure of how to determine the correct amount of interest that the company may capitalize. Chicago Corporation has satisfied the criteria for the capitalization period during all of 2021. The total interest that the company incurred during 2021 that the company would have not incurred if the new…arrow_forwardUsing the given information, calculate the amount in respect of Subscription that is needed to be credited into Income and Expenditure account. Also show various ledger accounts. During the Current year (2020), subscription received in Cash is $ 50,000. It also includes the amount that is receivable during the previous year (2019) of $ 2,500 and amount received in advance for next year (2021) for $1,500. Also there is an outstanding receivable for 2020 of $ 4,500.arrow_forward

- journal entrie for website expensesarrow_forwardThe Des Moines Gazette received newspaper subscriptions in December 2020 for 2021 from customers, who paid $500 in advance. What would be the appropriate journal entry for this event in December 2020?arrow_forwardGansac Publishing Company signed a contract with an author to publish her book. The signing took place on January 1, 2019, and a payment of $20,000 was made to obtain a copyright. Gansac expects to sell 200,000 books evenly between 2019 and 2023 at a price of $10 per book. Required: 1. Prepare journal entries to record the events related to the copyright and sales of the book during 2019 and 2020, assuming that sales were as projected. 2. Next Level How would your answer change if Gansac expected sales of the book to be 100,000 copies in 2019, 80,000 copies in 2020, and 20,000 copies over the remainder of the copyright’s useful life?arrow_forward

- 3. Itco uses a perpetual inventory system. During the month of October the following transactions took place: 10/1 10/5 10/10 10/12 10/15 10/22 A. UTS Balance: 2,000 uts. @ $6.00/ut Purchased: 5,000 uts. @ $6.35/ut Purchased: 8,000 uts. @ $6.50/ut Sold 12,000 uts. for $10.00 ea. Purchased: 4,000 uts. @ $6.75/ut Sold 5,000 uts. for $10.00 ea. I Complete the perpetual inventory record (provided) for the above transactions using the FIFO valuation system. COST TOT UTS COST TOT UTS COST TOTarrow_forwardhow to find the solution to the may 15th entry?arrow_forwardAccess the FASB’s Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Required: Determine the specific nine-digit Codification citation (XXX-XX-XX-XX) for accounting for each of the following items: What are the five key steps to applying the revenue recognition principle? What are indicators that control has passed from the seller to the buyer, such that it is appropriate to recognize revenue at a point in time? Under what circumstances can sellers recognize revenue over time?arrow_forward

- need correct and complete answer with explanation , computation , steps in text form please provide explanation and computation clearly for each steps answer in text formarrow_forwardBased on the following information, determine the maximum loan amount available as of July 31, 2021. T The plan allows for two outstanding loans at a time. The participant took a loan of $45,000 on March 1, 2021. The participant's outstanding loan balance is $0 as of July 31, 2021. The participant's vested account balance is $150,000 . Answers: $0, $5,000, $50,000, or $75,000?arrow_forwardPrepare all necessary journal entries for 2024.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education