FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

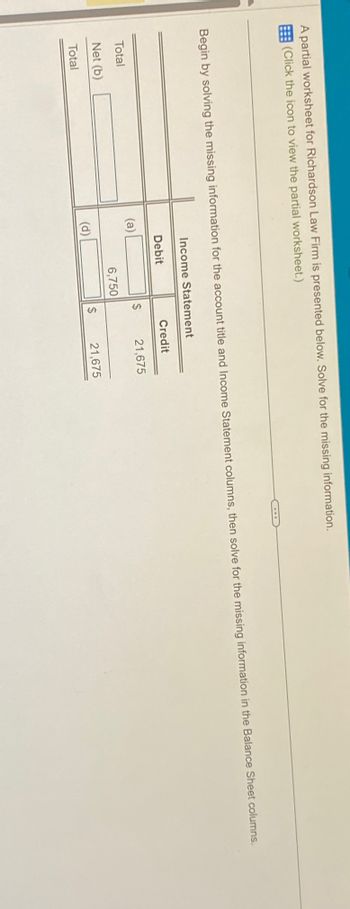

Transcribed Image Text:A partial worksheet for Richardson Law Firm is presented below. Solve for the missing information.

(Click the icon to view the partial worksheet.)

Begin by solving the missing information for the account title and Income Statement columns, then solve for the missing information in the Balance Sheet columns.

Total

Net (b)

Total

(a)

Income Statement

Debit

(d)

6,750

$

$

Credit

21,675

21,675

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On December 31, Hawkin's records show the following accounts. Cash $ 8,500 Accounts Receivable 1,200 Supplies 3,200 Equipment 15,300 Accounts Payable 7,700 Hawkin, Capital, December 1 18,700 Hawkin, Withdrawals 2,300 Services Revenue 17,700 Wages Expense 8,000 Rent Expense 3,200 Utilities Expense 2,400 QS 1-17 (Algo) Preparing a balance sheet LO P2 Use the above information to prepare a December balance sheet for Hawkin. Assets HAWKIN Balance Sheet December 31 Liabilities Equity Total Assets Total Liabilities and Equityarrow_forwardRequired: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Transaction a. Note: Enter debits before credits. 3 The firm was organized and the stockholders invested cash of $8,800. Record entry 4 5 6 7 General Journal 8 Clear entry Assessment Tool iFrame Debit 14 Credit View general journalarrow_forwardVikrambhaiarrow_forward

- (a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forwardA partial worksheet for Rickman Law Firm is presented below. Solve for the missing information. View the partial worksheet. Begin by solving the missing information for the account title and Income Statement columns, then solve for the missing information in the Balance Sheet columns. Total Net (b) Total (a) (d) Income Statement Debit 6,350 Credit $ 21,100 $ 21,100 Partial worksheet Gr 6 32 Total 33 Net (b) 34 Total A Income Statement Debit Credit (a) 6,350 (d) Print K $ Debit 21,100 $ 210,050 Balance Sheet Credit $203,700 (c) (f) 21,100 (e) Done M Xarrow_forwardIn the columns Below insert the entry that would be made for each transaction under each accounting basis use an appropriate debit and credit account titlesarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardUse the following T-accounts: Accounts Receivable Bal. 46,500 Fees Earned Revenue Bal. 63,000 Commission Expense Bal. 7,500 Supplies Expense Bal. 5,900 Wages Expense Bal. 47,000 Dividends Bal. 3,800 Retained Earnings Bal. 54,000 Prepare the four journal entries required to close the books. If an amount box does not require an entry, leave it blank.arrow_forwardPlease help, thanks in advance ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education