FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

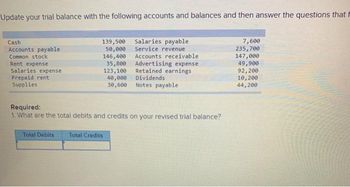

Transcribed Image Text:Update your trial balance with the following accounts and balances and then answer the questions that f

Cash

Accounts payable

Common stock

Rent expense

Salaries expense

Prepaid rent

Supplies

Total Debits

139,500

50,000

146,400

35,800

123,100

40,000

30,600 Notes payable

Salaries payable

Service revenue

Accounts receivable

Required:

1. What are the total debits and credits on your revised trial balance?

Total Credits

Advertising expense

Retained earnings

Dividends

7,600

235,700

147,000

49,900

92,200

10,200

44,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fill in the income summary.arrow_forwardPlease do not give solution in image format thankuarrow_forwardComplete the General Ledger based on the recorded journal entries. Remember to: write the date, explanation, and fill out the value in the corresponding DR or CR column. Your explanation should only contain the other account names as per your journal entries, separated by a "/" where necessary.arrow_forward

- Requirements: 1. Journalize each transaction including explanations. 2. The accounts listed in the trial balance, together with their balances as of March 31,2024, have been opened for you in T-account form. Post the journal entries to the ledger (use T-account format). 3. Prepare the trial balance of Harper Service Center as of April 30, 2024. More info Apr. 2 Borrowed $45,000 from the bank and signed a note payable in the name of the business. Apr. 4 Paid cash of $40,000 to acquire land. Apr. 9 Performed services for a customer and received cash of $5,000. Apr. 13 Purchased office supplies on account, $300. Apr. 15 Performed services for a customer on account, $2,600. Apr. 18 Paid $1,200 on account. Apr. 21 Paid the following cash expenses: salaries, $3,000; rent, $1,500; and interest, $400. Apr. 25 Received $3,100 from a customer on account. Apr. 27 Received a $200 utility bill that will be paid next month. Apr. 29 Received $1,500 for services to be…arrow_forwardGiven the following list of accounts with normal balances, what are the trial balance totals of the debits and credits? Cash Accounts Receivable Capital Withdrawals Service Fees Rent Expense $1,200 700 1,900 500 1,000 500 $2,900 debit, $2,900 credit $3.900 debit, $3,900 credit $2,000 debit, $2,000 credit $1.200 debit, $1.200 creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education