Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

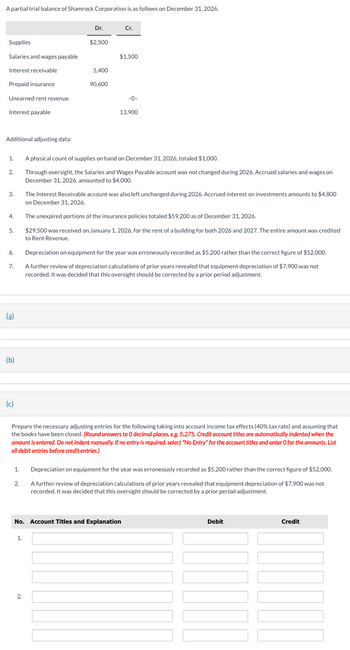

Transcribed Image Text:A partial trial balance of Shamrock Corporation is as follows on December 31, 2026.

Dr.

Cr.

Supplies

$2,500

Salaries and wages payable

$1,500

Interest receivable

5,400

Prepaid insurance

90,600

Unearned rent revenue

-0-

Interest payable

13,900

Additional adjusting data:

1.

A physical count of supplies on hand on December 31, 2026, totaled $1,000.

2.

3.

4.

5.

6.

7.

Through oversight, the Salaries and Wages Payable account was not changed during 2026. Accrued salaries and wages on

December 31, 2026, amounted to $4,000.

The Interest Receivable account was also left unchanged during 2026. Accrued interest on investments amounts to $4,800

on December 31, 2026.

The unexpired portions of the insurance policies totaled $59,200 as of December 31, 2026.

$29,500 was received on January 1, 2026, for the rent of a building for both 2026 and 2027. The entire amount was credited

to Rent Revenue.

Depreciation on equipment for the year was erroneously recorded as $5,200 rather than the correct figure of $52,000.

A further review of depreciation calculations of prior years revealed that equipment depreciation of $7,900 was not

recorded. It was decided that this oversight should be corrected by a prior period adjustment.

(a)

(b)

(c)

Prepare the necessary adjusting entries for the following taking into account income tax effects (40% tax rate) and assuming that

the books have been closed. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List

all debit entries before credit entries.)

1.

2.

Depreciation on equipment for the year was erroneously recorded as $5,200 rather than the correct figure of $52,000.

A further review of depreciation calculations of prior years revealed that equipment depreciation of $7,900 was not

recorded. It was decided that this oversight should be corrected by a prior period adjustment.

No. Account Titles and Explanation

1.

2.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On 1.7.2019 XY company received rental revenue in advance from customer of OMR 3600 for two years. in the journal entry, the credit side is: Select one: a. Accrued rent 3600 b. Unearned rental revenue 3600 O c. Accrued rent 3600 O d. Unearned rental revenue 1800 e. Rent outstanding 3600arrow_forwardOn the 1.7.2019 XY company received rental revenue in advance from customers of OMR 2400 for two years. in the journal entry, the credit side is: Select one: a. None of These b. Prepaid rent 2400 c. unearned revenue 2400 d. Accrued rent 2400.arrow_forwardplease note every entry should have narration , explanation , calculation answer in text form show full working for each entry and partsarrow_forward

- The Delivery Equipment account of Freedom Company showed the following details for 2022:Delivery Equipment01.01.22 Balance 1,500,00001.15 5,000 08.30 225,00009.30 535,000 10.31 180,000 Your examination disclosed the following:a. The P5,000 charged to the Delivery Equipment account on January 15, 2022 represents paymentof LTO registration fees for the company’s delivery equipment for the year 2022.b. The company bought a second-hand delivery truck on September 30 for P535,000, whichincludes P35,000 worth of comprehensive insurance for one year effective October 1, 2022.c. The company wrote-off a fully depreciated truck with an original cost of P225,000 on August 30;further verification disclosed that this truck is still being used by the company.d. The credit of P180,000 on October 31 represents proceeds from sale of one truck costingP350,000, which is 50% depreciated as of December 31, 2021.e. There is only one entry made to the Accumulated Depreciation account during 2022, a debit…arrow_forwardFor the following independent cases, in the space provided, calculate the amount of revenue that should be recorded in 2019 under the revenue recognition principle (point of sale). O they collect dvane rent 1. ompany 18,000 19 a customer paid a uipment. The was delivered on January 16, 2020 and the balance was pad that date. equipment. On December $50,000 2. wards the eq 3. On December 29, 2019 Company C ships $15,000 worth of goods to a customer, F. O. B. destination. The goods arrive on January 3, 2020at the customer's office. The customer pays for the goods On February 1, 2020.arrow_forwardA credit sale of $3,600 is made on July 15, terms 2/10, n/30, on which a retur of $200 is granted on July 18. What amount is receved as payment in full on uly 247arrow_forward

- Rasheed Company uses net method to record the sales made on credit. On June 30, 2019, it made a sales of OMR 25,000 with term 3/15, n/45. Prepare the required journal entries, if: (a) On July 7 Rasheed company received full payment. (b) On July 22 Rasheed company received full payment.arrow_forwardA credit sale of $1800 is made on July 15, terms 4/10, net/30, on which a return of $100 is granted on July 18. What amount is received as payment in full on July 24? a.) $1632 b.) $1800 c.) $1728 d.) $1775arrow_forwardGalaxy S21+ 5G Problem 4-2 (IAA) Credible Company provided the following T-account summarizing the transactions affecting the accounts receivable for the current year: Jan. 1 balance Charge sales Shareholders' subscriptions Deposit on contract Claims against common carrier for damages IOUS from employees Cash advance to affiliates Advances to a supplier Accounts Receivable 600,000 Collections from customers 5,300,000 6,000,000 Writeoff 35,000 Merchandise returns 200,000 Allowances to customer 120,000 40,000 for shipping damages Collections on carrier claims 100,000 Collection on subscriptions 10,000 100,000 50,000 25,000 40,000 50,000 Required: a. Compute the correct amount of accounts receivable. b. Prepare one compound entry to adjust the accounts receivable. c. Compute the amount to be presented as "trade and other receivables" under current assets. d. Indicate the classification and presentation of the other items. Problem 4-3 (ACP) Problem 4-4 (ACP) credit to accounts receivable.…arrow_forward

- On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances:Accounts Debit CreditCash $23,800Accounts Receivable 5,200Supplies 3,100Land 50,000Accounts Payable $ 3,200Common Stock 65,000Retained Earnings 13,900Totals $82,100 $82,100During January 2021, the following transactions occur:January 2 Purchase rental space for one year in advance, $6,000 ($500/month).January 9 Purchase additional supplies on account, $3,500January 13 Provide services to customers on account, $25,500.January 17 Receive cash in advance from customers for services to be provided in the future, $3,700.January 20 Pay cash for salaries, $11,500.January 22 Receive cash on accounts receivable, $24,100.January 29 Pay cash on…arrow_forwardThe Sky Blue Corporation has the following adjusted trial balance at December 31.Debit CreditCash $ 1,310Accounts Receivable 2,800Prepaid Insurance 3,100Notes Receivable (long-term) 3,800Equipment 16,000Accumulated Depreciation $ 4,200Accounts Payable 6,220Salaries and Wages Payable 1,400Income Taxes Payable 3,700Deferred Revenue 760Common Stock 3,200Retained Earnings 1,320Dividends 380Sales Revenue 49,230Rent Revenue 380Salaries and Wages Expense 23,200Depreciation Expense 2,100Utilities Expense 5,020Insurance Expense 2,200Rent Expense 6,800Income Tax Expense 3,700Total $ 70,410 $ 70,410How would you make the adjusted trial balance sheetarrow_forwardData for item nos. 16 and 17 The following accounts and their balances in an unadjusted trial balance of Record of Youth Company as of December 31, 2020: Cash and cash equivalents- P400,000; Trade and other receivable P2,000,000; Subscription receivable- P375,000; Inventory- P500,000; Trade and other payables- P670,000; Income tax payable- P196,500. Additional information are as follows: • Trade and other receivables include long term advances to company officers amounting to P430,000. • The subscription receivable has the following call dates: June 30, 2021, P200,000; December 31, 2021, P100,000; and June 30, 2022, P75,000. • Inventory of P500,000 was determined by physical count. At December 31, 2020, goods costing P125,000 are in transit from a supplier. Terms of purchase of said goods is FOB shipping point. The goods and the related invoice have not been received as of year-end. • Trade and other payables include dividends payable amounting to P170,000, of which P70,000 is payable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning