FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ces

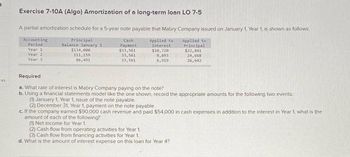

Exercise 7-10A (Algo) Amortization of a long-term loan LO 7-5

A partial amortization schedule for a 5-year note payable that Mabry Company issued on January 1, Year 1, is shown as follows.

Accounting

Principal

Period

Balance January 1

Cash

Payment

Applied to

Interest

Applied to

Principal

Year 1

Year 2

Year 3

$134,000

111,159

86,491

$33,561

$10,720

33,561

8,893

33,561

6,919

$22,841

24,668

26,642

Required

a. What rate of interest is Mabry Company paying on the note?

b. Using a financial statements model like the one shown, record the appropriate amounts for the following two events:

(1) January 1, Year 1, issue of the note payable.

(2) December 31, Year 1, payment on the note payable.

c. If the company earned $90,000 cash revenue and paid $54,000 in cash expenses in addition to the interest in Year 1, what is the

amount of each of the following?

(1) Net income for Year 1.

(2) Cash flow from operating activities for Year 1.

(3) Cash flow from financing activities for Year 1.

d. What is the amount of interest expense on this loan for Year 4?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accrued Product Warranty General Motors Corporation (GM) disclosed estimated product warranty payable for comparative years as follows: (in millions) Year 2 Year 1 Current estimated product warranty payable $3,059 $2,884 Noncurrent estimated product warranty payable 4,327 4,147 Total $7,386 $7,031 Presume that GM's sales were $135,592 million in Year 2 and that the total paid on warranty claims during Year 2 was $3,000 million. a. The distinction between short- and long-term liabilities is important to creditors in order to accurately evaluate the near-term cash demands on the business relative to the quick current assets and other longer-term demands . Feedback Review the need for a classified balance sheet. b. Provide the journal entry for the Year 2 product warranty expense. Product Warranty Expense Product Warranty Payablearrow_forwardLime Co. incurs a $4,000 note with equal principal installment payments due for the next eight years. What is the amount of the current portion of the noncurrent note payable due in the second year? A. $800 B. $1,000 C. nothing, since this is a noncurrent note payment D. $500arrow_forward(Algo) Amortization schedule for an installment note LO 10-1 On January 1, Year 1, Beatie Company borrowed $220,000 cash from Central Bank by issuing a five-year, 7 percent note. The principal and interest are to be paid by making annual payments in the amount of $53,656. Payments are to be made December 31 of each year, beginning December 31, Year 1. Required Prepare an amortization schedule for the interest and principal payments for the five-year period. (Round your answers to the nearest dollar amount.)arrow_forward

- A debt of $13,000 with interest at 5% compounded semi-annually is repaid by payments of $1,850 made at the end of every 3 months. Construct an amortization schedule showing the total paid and the total cost of the debt. Complete the amorization schedule. (Round to the nearest cent as needed.) Outstanding Principal Balance $13,000 Payment Number Amount Paid Interest Paid Principal Repaid 1 $1,850 2 $1,850 3 $1,850 $ $ 4 $1,850 $ 5 $1,850 $4 6 $1.850 $ 7 $1,850 $ $ 8 $0 The total paid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The total interest is Sarrow_forward1.arrow_forwardmam.7arrow_forward

- Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $27,000,000 of 5-year, 9% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Ebert receiving cash of $24,964,830. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. b. Compute the amount of the bond interest expense for the first year. Round to the nearest dollar. Annual interest paid Discount amortized Interest expense for first…arrow_forwardAccrued Product Warranty Lachgar Industries disclosed estimated product warranty payable for comparative years as follows: (in millions) Current estimated product warranty payable Noncurrent estimated product warranty payable Year 2 $16,211 9,860 $26,071 Year 1 $15,542 8,690 $24,232 Total Presume that Lachgar's sales were $211,240 million in Year 2. Assume that the total paid on warranty claims during Year 2 was $16,712 million. a. The distinction between short- and long-term liabilities is important to creditors in order to accurately evaluate the near-term cash on the business relative to the quick current assets and other longer-term b. Provide the journal entry for the Year 2 product warranty expense. c. What two conditions must be met in order for a product warranty liability to be reported in the financial statements?arrow_forwardAccrued Product Warranty Harbour Company disclosed estimated product warranty payable for comparative years as follows: (in millions) Current Year Prior Year Current estimated product warranty payable $11,050 $10,595 Noncurrent estimated product warranty payable 6,721 5,924 Total $17,771 $16,519 Assume that Harbour's sales were $130,324 million in current Year and that the total paid on warranty claims during the current year was $11,392 million. a. The distinction between short- and long-term liabilities is important to creditors in order to accurately evaluate the near-term cash the business relative to the quick current assets and other longer-term . b. Provide the journal entry for the current Year product warranty expense. Enter your answers in millions. If an amount box does not require an entry, leave it blank. fill in the blank d3bc3bf67fec01d_2 fill in the blank d3bc3bf67fec01d_3 fill in the blank…arrow_forward

- Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $25,000,000 of 5-year, 9% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Ebert receiving cash of $23,115,584. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Cash Discount on Bonds Payable Bonds Payable 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Cash 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Cash b. Compute the amount of…arrow_forwardOn the first day of the fiscal year, a company issues a $621,000, 11%, 10-year bond that pays semiannual interest of $34,155 ($621,000 × 11% × 1/2), receiving cash of $652,050. Required: Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds…arrow_forwardCurrent portion of long-term debt Connie's Bistro, Inc. reported the following information about its long-term debt in the notes to a recent financial statement (in millions): Long-term debt consists of the following: December 31 December 31 Current Year Preceding Year Total long term-debt $784,700 $431,600 Current portion (227,600) (211,900) Long-term debt $557,100 $219,700 a. How much of the long-term debt was disclosed as a current liability on the current year's December 31 balance sheet? million b. How much did the total current liabilities change between the preceding year and the current year as a result of the current portion of long-term debt? million Increase c. If Connie's Bistro did not issue additional long-term debt next year, what would be the total long-term debt on December 31 of the upcoming year? millionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education