FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

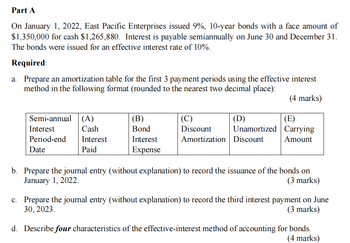

Transcribed Image Text:Part A

On January 1, 2022, East Pacific Enterprises issued 9%, 10-year bonds with a face amount of

$1,350,000 for cash $1,265,880. Interest is payable semiannually on June 30 and December 31.

The bonds were issued for an effective interest rate of 10%.

Required:

a. Prepare an amortization table for the first 3 payment periods using the effective interest

method in the following format (rounded to the nearest two decimal place):

(4 marks)

Semi-annual (A)

Interest

Period-end

(B)

(C)

(D)

(E)

Cash

Bond

Discount

Interest

Interest

Amortization Discount

Unamortized Carrying

Amount

Date

Paid

Expense

b. Prepare the journal entry (without explanation) to record the issuance of the bonds on

January 1, 2022.

(3 marks)

c. Prepare the journal entry (without explanation) to record the third interest payment on June

30, 2023.

(3 marks)

d. Describe four characteristics of the effective-interest method of accounting for bonds.

(4 marks)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On September 30, 2023, when the market interest rate is 9 percent, Score Ltd. issues $8,000,000 of 11-percent, 20-year bonds for $9,472,126. The bonds pay 30. Score Ltd, amortizes bond premium by the effective-interest method. Required 1. Prepare an amortization table for the first four semi-annual interest periods. Score amortizes a bond premium by the effective-interest method. 2. Record the issuance of the bonds on September 30, 2023, the accrual of interest on December 31, 2023, and the semi-annual interest payment on March 3 Requirement 1. Prepare an amortization table for the first four semi-annual interest periods. (Round your answers to the nearest whole dollar.) B: Interest Expense (4.5% of Preceding Bond Carrying Amount) A: Interest Payment Semi-annual Interest (5.5% of Maturity Period Values) Issue date. March 31, 2024 September 30, 2024 March 31, 2025 September 30, 2025 440,000 440,000 440,000 440,000 426,245 C: Premium Amortization (A-B) 13,755 D: Unamortized Premium…arrow_forwardSheridan Inc. issues $5,000,000, 5-year, 10% bonds at 101, with interest payable annually on January 1. The straight-line method is used to amortize bond premium. a) Prepare the journal entry to record the sale of these bonds on January 1, 2022 b)arrow_forwardEllis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871. The annual market rate is 7.5% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Please need answer for all with working please answer do not waste time or question by holding attempt if you can otherwise skiparrow_forward

- Determining the present value of bonds payable and journalizing using the effective-interest amortization method Brad Nelson, Inc. issued $600,000 of 7%, six-year bonds payable on January 1, 2018. The market interest rate at the date of issuance was 6%, and the bonds pay interest semiannually. Requirements How much cash did the company receive upon issuance of the bonds payable? (Round to the nearest dollar.) Prepare an amortization table for the bond using the effective-interest method, through the first two interest payments. (Round to the nearest dollar.) Journalize the issuance of the bonds on January 1, 2018, and the first and second payments of the semiannual interest amount and amortization of the bonds on June 30, 2018, and December 31, 2018. Explanations are not required.arrow_forward26. Bonds Issued at a Premium (Effective Interest) Charger Battery issued $100,000 of 11%, seven-year bonds on December 31, 2022, for $104,868. Interest is paid annually on December 31. The market rate of interest is 10%. Required: Prepare the amortization table using the effective interest rate method. For those boxes in which no entry is required, leave the box blank. If the amount is zero, enter "0". If required, round your answers to the nearest whole dollar.arrow_forwardCoronado Inc. issued $920,000 of 10%, 10-year bonds on June 30, 2025, for $814,472. This price provided a yield of 12% on the bonds. Interest is payable semiannually on December 31 and June 30. If Coronado uses the effective-interest method, determine the amount of interest expense to record if financial statements are issued on October 31, 2025. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.) Interest expense to be recordedarrow_forward

- issued $ 480,000 of 4%, 10-year bonds payable at a price of 94. The market interest rate at the date of issuance was 5%, and the bonds pay interest semiannually. The journal entry to record the first semiannual interest payment using the effective interest amortization method is?arrow_forwardOn January 1, $980,000, 5-year, 10% bonds were issued for $950,600. Interest is paid semiannually on January 1 and July 1. If the issuing company uses the straight-line method to amortize a discount on bonds payable, the semiannual amortization amount isarrow_forwardOn April 1, 2021, Marigold Corporation issued $352.000, 5-year bonds. On this date, Shoreline Corporation puurchased the bonds from Marigold to earn interest. Interest is received semi-annually on April 1 and October 1 and Shoreline's year end is March 31 Below is a partial amortization schedule for the first three interest periods of the bond issue Semi-Annual Interest Received Interest Interest Period Revenue Amortization Bond Amortized Cost April 1. 2021 $368.231 October 1, 2021 $7.040 $5.523 $1.517 366.714 April 1.2022 7.040 5.501 1.539 365,175 October 1, 2022 7.040 5,478 1,562 363,613 Were the bonds purchased at a discount or at a premium? Bonds purchased at a What is the face value of the bonds? Face value of the bonds s eTextbook and Media What will the bonds' amortized cost be at the maturity date? Bonds' amortized cost at the maturity date eTextbook and Media /1 E What is the bonds' contractual interest rate? The market interest rate? (Round answers to 2 decimal places, eg…arrow_forward

- On August 1, 2027, Concord Corporation issued $500,400, 9%, 10-year bonds at face value. Interest is payable annually on August 1. Concord's year-end is December 31. Prepare a tabular summary to record the following events. (a) The issuance of the bonds. (b) (c) The accrual of interest on December 31, 2027. The payment of interest on August 1, 2028. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) (a) Aug. 1, 2027 $ (b) Dec. 31, 2027 (c) Aug. 1, 2028 Assets Cash $ Bonds Payable Liabilities + $ Interest Payable + $ Paid in Capital Common Stock $ Revenue Stockholders' Equity $ Expense Retained Earnings $ Dividend Bonds payable Discount on bonds Interest expense Premium on bondsarrow_forwardOn March 1, 2020, Quinto Mining Inc. issued a $690,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. 1. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue 2. Using the effective interest method, prepare an amortization schedule. (Image attached) This question has a follow up, posted separately. Thanks!arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education