FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

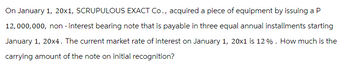

Transcribed Image Text:On January 1, 20x1, SCRUPULOUS EXACT Co., acquired a piece of equipment by issuing a P

12,000,000, non-interest bearing note that is payable in three equal annual installments starting

January 1, 20x4. The current market rate of interest on January 1, 20x1 is 12%. How much is the

carrying amount of the note on initial recognition?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 8, Action Co. issued an $80,000, 6%, 90-day note payable to Scanlon Co. Assuming a 360-day year, what is the maturity value of the note? a.$84,800 b.$78,800 c.$80,000 d.$81,200arrow_forwardLucky company borrowed an amount of money from ZER Finance Co. In return, ZER Finance Co received a $ 200,000, 4 year, 6% note from Lucky. On the date of the transaction, the market rate on interest was 8% for a similar note. Instructions: Calculate the net carrying value of the notes receivable on the books of ZER Finance, at the end of year one assuming that Zer is using effective interest method to amortize discount or premium on note receivable The following information might help you: Present value of a future sum factor, 6%, 4 years= 0.7921 Present value of a future sum factor, 8%, 4 years= 0.7350 Present value of an ordinary annuity factor, 6%, 4 years= 3.5 Present value of an ordinary annuity factor, 8%, 4 years= 3.3 (When writing your answer do not use commas or sign of the dollar. For example, if your answer is $1,500, write it as 1500) Answer:arrow_forwardLeon Acrobats lent $12,174 to Donaldson, Inc., accepting Donaldson's 2-year, $15,000, zero-interest-bearing note. The implied interest rate is 11%. Prepare Leon's journal entries for the initial transaction, recognition of interest each year, and the collection of $15,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) Debit Credit [] |||||arrow_forward

- On June 8, Williams Company issued an $75,972, 6%, 120-day note payable to Brown Industries. Assuming a 360-day year, what is the maturity value of the note? When required, round your answer to the nearest dollar. Oa. $75,972 Ob. $77,491 Oc. $80,530 Od. $4,558 > Other fav tarrow_forwardOn May 1, the Morse Company accepted a 60-day, $15,000 non-interest-bearing note from U Corporation. What is the maturity value of the note?arrow_forwardOn January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 90-day note with a face amount of \( \$ 44, 400 \). Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of \(8\% \). b. Determine the proceeds of the note, assuming the note is discounted at \(8\% \),arrow_forward

- On January 1, 2025, Vaughn Co. sold equipment in exchange for an $930000 zero-interest-bearing note due on January 1, 2028. The prevailing rate of interest for a note of this type at January 1, 2025 was 10%. The present value of $1 at 10% for three periods is 0.75131. What amount of interest revenue should be reported in Vaughn's 2026 income statement? O $93000 $69872 O $0 O $76859arrow_forwardAdams Acrobats lent $17,147 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero-interest-bearing note. The implied interest rate is 8%. Prepare Adams's journal entries for the initial transaction, recognition of interest each year, and the collection of $20,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) (To record the collection of the note) Debit Credit INTarrow_forward8arrow_forward

- On Sept 1, 20X1, Orange Co borrowed P240,000 from ABC Bank to fund a new business venture. Orange issued a 6-month 12% promissory note. Principal and interest is payable on maturity date . REQUIRED: Journal entries from Sept 1 until the note matures.arrow_forwardOn June 8, Williams Company issued an $80,000, 5%, 120-day note payable to Brown Industries. Assuming a 360-day year, what is the maturity value of the note? When required, round your answer to the nearest dollar. a. $82,600 b. $84,000 c. $81,333 d. $88,200arrow_forwardOn January 1, 2020, South Company purchased five delivery trucks for P 10,000,000 from West Company.South Company gave West Company 1 year non-interest bearing note (stated interest/nominal interest rate is 0) payable on January 1, 2021. At the date of purchase, the interest rate for this type of purchase is 13%. Round present value factors to four decimal places. Prepare an amortization table. Required: 1. What is the amount of Notes Payable that shall be reflected in the statement of financial position on December 31, 2020?______________ 2. What is the interest expense that shall be reported in the statement of financial performance on December 31, 2020?____________________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education