MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

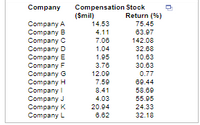

The accompanying data represent the total compensation for 12 randomly selected chief executive officers (CEO) and the company's stock performance in a recent year. Complete parts (a) through (d) below.

(a) One would think that a higher stock return would lead to a higher compensation. Based on this, what would likely be the explanatory variable?

A.Stock return

B.Compensation

(c) Determine the linear correlation coefficient between compensation and stock return.

r=____?

(Round to three decimal places as needed.)

Transcribed Image Text:Compensation Stock

(Smil)

Company

Return (%)

Company A

Company B

Company C

Company D

Company E

Company F

Company G

Company H

Company I

Company J

Company K

Company L

14.53

75.45

4.11

63.97

7.06

142.08

1.04

32.68

1.95

10.63

3.76

30.63

12.00

0.77

7.59

69.44

8.41

58.69

4.03

55.95

20.94

24.33

6.62

32.18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- Waiting times (in minutes) of customers at a bank where all customers enter a single waiting line and a bank where customers wait in individual lines at three different teller windows are listed below. Find the coefficient of variation for each of the two sets of data, then compare the variation. is cou Bank A (single line): 6.5 6.6 Bank B (individual lines): 6.7 6.8 7.1 7.3 7.5 7.6 7.6 7.6 0 rms o 4.3 5.4 5.9 6.1 6.7 7.6 7,7 8.5 9.4 9.8 %. The coefficient of variation for the waiting times at Bank A is (Round to one decimal place as needed.)arrow_forwardProbability and statistics classarrow_forwardA random sample of ten professional athletes produced the following data. The first row is the number of endorsements the athlete has and the second row is the amount of money made (in millions of dollars) by the athlete. What is the slope of the line of best fit? Round to 3 decimal places. Number of Endorsements 0 3 2 1 5 5 4 3 0 4 Profit (in Millions) 2 8 7 3 13 12 9 9 3 10arrow_forward

- The Admission director for a college far from mart and town believes that an inverse relationship exists between a private college's average discount rate(determined by the average amount of scholarships students receive) and the annual yield (the percentage of admitted students who actually attend). The Director's independent variable is a private college's discount rate measured as a percentage, and the dependent variable is the college's annual yield measured as a percentage. The following results were obtained for a sample of 30 private colleges: x- Discount rate(percentage) - range: 35 to 72 percent y- Annual Yield(percentage) - range: 12 o 81 percent Σxi = 1612 Σyi = 898 Σxiyi = 44,377 Σxi2 = 89,790 Σyi2 = 35,704 a. Calculate the sample regression line's slope estimate. Interpret the sample regression line's slope estimate. b. Calculate the sample regression line's intercept estimate. Interpret the sample regression line's intercept estimate. Assume the following sum of…arrow_forwardThe histogram below shows the distribution of annual growth rate in travel spending for 52 companies in the United States. Frequency 20+ 15 10 5 2 0+ 2 0 6 3 11 19 4 1 Annual Growth Rate (%) After creating this graph, it was discovered that the values for the companies with the 20 largest reported annual growth rates were miscalculated. In fact, each of these top 20 companies should have a higher value of annual growth rate than was previously reported. Which of the following statements must be true? (A) If you were to make a graph with the corrected values, the graph would be skewed to the left. (B) If you were to make a graph with the corrected values, the graph would be symmetric. (C) If you were to calculate the median with the corrected values, the new median would be greater than the old median. (D) If you were to calculate the interquartile range (IQR) with the corrected values, the new IQR would be the same as the old IQR. (E) If you were to find the value of the third quartile…arrow_forwarda. Calculate the sample covariance.X Y-3 -913 95 12b. Calculate the sample correlation.c. Describe in words the information given to us by the sample covariance and by the sample correlation.Explain how the correlation gives us more precise information.d. Explain why the covariance is not a good measure of the strength of the linear relationship between the twovariables.e. Sketch a scatterplot of a bivariate dataset with a correlation of 0.9f. Sketch a scatterplot of a bivariate dataset with a correlation of -0.3.arrow_forward

- For each problem, select the best response. (a) In a scatterplot of the average price of a barrel of oil and the average retail price of a gallon of gasoline, you expect to see A. a positive association. B. very little association. C. a negative association. D. None of the above. (b) If the correlation between two variables is close to 0, you can conclude that a scatterplot would show A. a cloud of points with no visible pattern.B. no straight-line pattern, but there might be a strong pattern of another form. C. a strong straight-line pattern. D. None of the above. (c) You have data for many years on the average price of a barrel of oil and the average retail price of a gallon of unleaded regular gasoline. When you make a scatterplot, the explanatory variable on the x -axis A. is the price of gasoline. B. can be either oil price or gasoline price. C. is the price of oil. D. None of the above.arrow_forwardThere are two underlying assets in an asset pool. Each has a 2.8 percentchanges of failing. You own an asset that will pay $1 unless both assets fail. Graph theprobability of your asset not paying as the correlation between the two input assets runsfrom 0.5 to 0.98. For what levels of correlation is the output asset investment gradearrow_forward,./arrow_forward

- A2. A study of test results at different schools shows that as the student-to-teacher ratio increases the average test result tends to decrease, although the relationship is quite weak. Which of the following is plausible value for the correlation between student-to- teacher ratio and average test results? A -0.9 B -0.3 C -0.01 D 0.3 E 0.9arrow_forwardExplain Graphically by drawing hypothetical disgrams when the coefficient of correlation between two variables is (a) perfect positive, (b) perfect Negative, (c) zero?arrow_forward12.2 ONLY!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman