MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

,./

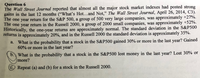

Transcribed Image Text:Question 6

The Wall Street Journal reported that almost all the major stock market indexes had posted strong

gains in the last 12 months ("What's Hot...and Not," The Wall Street Journal, April 26, 2014, C3).

The one year return for the S&P 500, a group of 500 very large companies, was approximately +27%.

The one year return in the Russell 2000, a group of 2000 small companies, was approximately +52%.

Historically, the one-year returns are approximately normal. The standard deviation in the S&P500

returns is approximately 20%, and in the Russell 2000 the standard deviation is approximately 35%.

a. What is the probability that a stock in the S&P500 gained 30% or more in the last year? Gained

60% or more in the last year?

b. What is the probability that a stock in the S&P500 lost money in the last year? Lost 30% or

more?

C Repeat (a) and (b) for a stock in the Russell 2000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- State whether the data described below are discrete or continuous, and explain why. The durations of movies in minutes ... Choose the correct answer below. A. The data are continuous because the data can take on any value in an interval. B. The data are discrete because the data can take on any value in an interval. OC. The data are discrete because the data can only take on specific values. O D. The data are continuous because the data can only take on specific values.arrow_forward2.6.5 Find the domain of the function. f(x) = x2 – 10x – 14 What is the domain of f? O A. (-0,00) B. (- 0,14)U(14,00) Oc. (-0,0)U(0,00) O D. (-0,0)U(0,14)U(14,00)arrow_forward2. (AKS 36) Which of the following tables does not represent a function? A. B. -9 -5 -9 2. -9 -1 -1 6. 2. 2. -9 -2 -9 -2 -5 -2 2-5 9. 24 1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman