Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

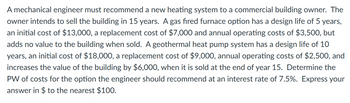

Transcribed Image Text:A mechanical engineer must recommend a new heating system to a commercial building owner. The

owner intends to sell the building in 15 years. A gas fired furnace option has a design life of 5 years,

an initial cost of $13,000, a replacement cost of $7,000 and annual operating costs of $3,500, but

adds no value to the building when sold. A geothermal heat pump system has a design life of 10

years, an initial cost of $18,000, a replacement cost of $9,000, annual operating costs of $2,500, and

increases the value of the building by $6,000, when it is sold at the end of year 15. Determine the

PW of costs for the option the engineer should recommend at an interest rate of 7.5%. Express your

answer in $ to the nearest $100.

Expert Solution

arrow_forward

Step 1

The present value method is known as the discounting technique, in which the current value of an item is determined as a discounted rate of return over a certain period of time.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which proposal should the company accept? Why?arrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. a. Calculate the initial outlay, annual after-tax cash flow for each year, and the terminal cash flow.arrow_forwardA mechanical engineer must recommend a new heating system to a commercial building owner. The owner intends to sell the building in 15 years. A gas fired furnace option has a design life of 5 years, an initial cost of $12,000, a replacement cost of $6,000 and annual operating costs of $3,500, but adds no value to the building when sold. A geothermal heat pump system has a design life of 10 years, an initial cost of $16,000, a replacement cost of $9,000, annual operating costs of $2,500, and increases the value of the building by $7,000, when it is sold at the end of year 15. Determine the equivalent uniform annual cost (EUAC) of costs for the option the engineer should recommend at an interest rate of 6.3%. Express your answer in $ to the nearest $10.arrow_forward

- A commercial oven with a book value of $87,000 has an estimated remaining 5-year life. A proposal is offered to sell the oven for $8,500 and replace it with a new oven costing $110,000. The new machine has a 5-year life with no residual value. The new machine would reduce annual maintenance costs by $23,000. Provide a differential analysis, in good form, on the proposal to replace the commercial oven.arrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. Using Goal Seek, calculate the minimum ticket price that must be charged in the first year in order to make the project acceptable.arrow_forwardYou purchased a box-making machine that cost $50,000 five years ago At that time, the system was estimated to have a service life of five years with salvage value of $5,000. These estimates are still good. The property has been depreciated at a declining balance CCA rate of 30%. Now (at the end of year 5 from pur chase) you are considering selling the machine for $10,000. What UCC should you use in determining the disposal tax effect?arrow_forward

- Yoga Ltd is requesting a purchase of an upgraded class streaming system with an installed cost of $574,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the system can be sold tor $20,000. The old system will be sold off for $10,000. The system will generate new tuition of $116,000 per year with negligible changes to operating costs. In year three the software license will need to be renewed at a cost of 15,000. The system requires an initial investment in net working capital of $15,000. If required rate of return is 10 percent, what is the present value of net cash flow for Year 3 (rounded to a whole number)?arrow_forwardAssume that Walmart Inc. has decided to surface and maintain for 10 years a vacant lot next to one of its stores to serve as a parking lot for customers. Management is considering the following bids involving two different qualities of surfacing for a parking area of 11,300 square yards. Bid A: A surface that costs $5.25 per square yard to install. This surface will have to be replaced at the end of 5 years. The annual maintenance cost on this surface is estimated at 25 cents per square yard for each year except the last year of its service. The replacement surface will be similar to the initial surface. Bid B: A surface that costs $10.75 per square yard to install. This surface has a probable useful life of 10 years and will require annual maintenance in each year except the last year, at an estimated cost of 12 cents per square yard. Click here to view factor tables. Compute present value of the bids. You may assume that the cost of capital is 12%, that the annual maintenance…arrow_forwardSheep Ranch Golf Academy is evaluating new golf practice equipment. The "Dimple- Max" equipment costs $110,000, has a 4-year life, and costs $9,100 per year to operate. The relevant discount rate is 12 percent. Assume that the straight-line depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $8,300 at the end of the project's life. The relevant tax rate is 24 percent. All cash flows occur at the end of the year. What is the equivalent annual cost (EAC) of this equipment? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) EACarrow_forward

- RR must build a tunnel to maintain his access around the mountain. The tunnel could be fabricated of normal steel for an initial cost of $45,000 and should last for 18 years. Maintenance will cost $1,000 per year. Another option would be to use corrosion resistant steel, which will last for 18 years, with annual maintenance cost of $100. In 18 years there would be no salvage value for either bridge. RR pays combined federal and state taxes at the 48% marginal rate and uses straight-line depreciation. If the after tax MARR is 10%, what is the maximum amount that should be spent on the corrosion-resistant tunnel? Enter your answer as follow: 123456.78arrow_forwardA private gym is looking at a new set of sports equipment with an installed cost of $450,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sports equipment can be scrapped for (TIP: "scrapped for" = sold for) $55,000. The sports equipment will save the gym $140,000 per year in pretax operating costs, and the equipment requires an initial investment in net working capital of $25,500. If the tax rate is 24 percent and the discount rate is 12 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardAn electric company must decide between two options for managing the blowdown water from its cooling tower. Option 1 is to continue the lease on 50 acres of land for another 5-year period and dispose of the water by spray irrigation. The landowner will move the pipe around as necessary and maintain the spray nozzles and valves. The previous lease cost $125,000 per year with payments due midway through each year. Now the landowner will require beginning of year payments of $180,000 each year. Option 2, which releases the 50 acre tract of land, involves purchasing a treatment system that will allow the recycling of most of the blowdown water. This system will have an initial cost of $1,600,000 and an AOC of $58,000 per year. However, the company will save $220,000 per year because it will not have to purchase as much make-up water as with option 1. At the end of 5 years, the company will be able to sell the equipment back to the local equipment supplier for 30% of the first cost. If the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education