ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

answer c and d

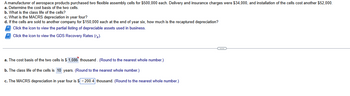

Transcribed Image Text:A manufacturer of aerospace products purchased two flexible assembly cells for $500,000 each. Delivery and insurance charges were $34,000, and installation of the cells cost another $52,000.

a. Determine the cost basis of the two cells.

b. What is the class life of the cells?

c. What is the MACRS depreciation in year four?

d. If the cells are sold to another company for $150,000 each at the end of year six, how much is the recaptured depreciation?

Click the icon to view the partial listing of depreciable assets used in business.

Click the icon to view the GDS Recovery Rates (rk).

a. The cost basis of the two cells is $ 1,086 thousand. (Round to the nearest whole number.)

b. The class life of the cells is 10 years. (Round to the nearest whole number.)

c. The MACRS depreciation in year four is $-200.4 thousand. (Round to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A manufacturer of aerospace products purchased three flexible assembly cells for $500,000 each. Delivery and insurance charges were $35,000, and installation of the cells cost another $50,000. Solve, a. Determine the cost basis of the three cells. b. What is the class life of the cells? c. What is the MACRS depreciation in year five? d. If the cells are sold to another company for $120,000 each at the end of year six, how much is the recaptured depreciation?arrow_forwardMalMax purchased a depreciable asset. What would be the difference in total assets at the end of the first year if MalMax chooses straight-line depreciation versus double-declining-balance depreciation?arrow_forwardA manufacturer of aerospace products purchased three flexible assembly cells for $500,000 each. Delivery and insurance charges were $35,000, and installation of the cells cost another $50,000. a. Determine the cost basis of the three cells. b. What is the class life of the cells? c. What is the MACRS-GDS depreciation in year five? d. If the cells are sold to another company for $120,000 each at the end of year six, what is the BV at that time?arrow_forward

- An asset with a cost of $100,000 and accumulated depreciation of $80,000 is sold for $8000.What is the amount of the gain or loss on disposal of the plant asset?arrow_forwardHow are depreciation deductions different from other production or service expenses such as labor, material, and electricity?arrow_forwardWhat would be the value of depreciation if Gross domestic capital formation is $33000 and net domestic capital formation is $29,000arrow_forward

- Does the inclusion of a depreciation expense reflect the true cost of doing business?arrow_forwardConcepcion Industries paid $308,000 in federal taxes last year. If business expenses and depreciation charges were $345,000, what were their gross sales for the year?arrow_forwardNote: The answer should be typed.arrow_forward

- A crane rental company has acquired a new heavy-duty crane for $280,000. The company calculates depreciation on this equipment on the basis of number of rentals per year, and the salvage value of the crane at the end of its 12-year life is $40,000. If the crane is rented an average of 133 days per year, what is the depreciation rate per rental? The depreciation is per day of rent. (Round to the nearest dollar.)arrow_forwardWhat are the two different ways most firms calculate depreciation?arrow_forwardAn oil refinery has decided to purchase some new drilling equipment for $570,000. The equipment will be kept for 13 years before being sold. The estimated SV for depreciation purposes is to be $16,000. Using the SL method, what is the annual depreciation on the equipment? ..... Choose the correct answer below. A. The annual depreciation on the equipment is $42,615. B. The annual depreciation on the equipment is $45,077. C. The annual depreciation on the equipment is $41,385. D. The annual depreciation on the equipment is $43,846.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education