Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

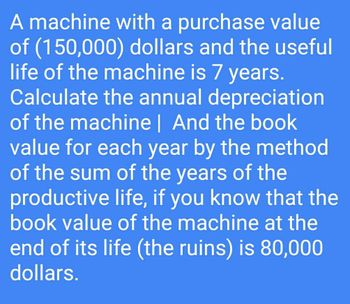

Transcribed Image Text:A machine with a purchase value

of (150,000) dollars and the useful

life of the machine is 7 years.

Calculate the annual depreciation

of the machine | And the book

value for each year by the method

of the sum of the years of the

productive life, if you know that the

book value of the machine at the

end of its life (the ruins) is 80,000

dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A new car is purchased for $48,000. This cost will be allocatd equally over 6 years. This cost allocation is called depreciation. The book value of the car at any time after its purchase is its original cost minus all depreciation up to that point in time. Create a mathematical model that relates the book value of the car to the time since its purchase. If the variable x represents the number of years of depreciation, what are the possible values of x in this problem? When is the book value of the car under $25,000?(Give exact answer)arrow_forwardThe annual depreciation of Php20,000 has been reserved for a machine using straight line for 8 years. If the first cost is Php200,000, determine the salvage value of the machine. help me with this one plsarrow_forwardAn equipment costing 50,000 has a book value of 4,000 after 8yrs. The depreciation is computed by using the constant percentage of the declining book value. Compute for the salvage value after 12 years.arrow_forward

- Daily Enterprises is purchasing a $10.0 million machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. If Daily uses straight-line depreciation, what are the depreciation expenses associated with this machine? The yearly depreciation expenses are $ (Round to the nearest dollar.)arrow_forwardAn injection moulding machine was purchased 2 years ago. The machine has been depreciated on a straight-line basis with $500 salvage value, and it has 6 years of remaining life. Its current book value is $2,600, and it can be sold for $3,000 at this time. Assume, for ease of calculation, that the annual depreciation expense is $350 per year. The firm is offered a replacement machine which has a cost of $8,000 an estimated useful life of 6 years, and an estimated salvage value of $800. This machine falls into the MACRS 5-year class (20%, 32%, 19%, 12%, 12%, 5%). The replacement machine would permit an output expansion, so sales would rise by $1,000 per year; even so, the new machine would cause operating expenses to decline by $1,500 per year. The machine would require that inventories be increased by $2,000 but accounts payable would simultaneously increase by $500. The firm’s marginal federal-plus-state tax rate is 40 percent, and its cost of capital is 15 percent. Should it replace…arrow_forwardA crane rental company has acquired a new heavy-duty crane for $300,000. The company calculates depreciation on this equipment on the basis of number of rentals per year, and the salvage value of the crane at the end of its 10-year life is $30,000. If the crane is rented an average of 120 days per year, what is the depreciation rate per rental?arrow_forward

- Calculate the present worth of all costs for a newly acquired machine with an initial cost of $24,000, no trade-in value, a life of 11 years, and an annual operating cost of $14,000 for the first 6 years, increasing by 10% per year thereafter. Use an interest rate of 10% per year. The present worth of all costs for a newly acquired machine is determined to be $arrow_forwardA machine costing P480,000 is estimated to have a salvage value of 10% of the first cost when retired at the end of 12 years. Depreciation cost using declining balance method. Find the book value at the end of 5 years.arrow_forwardA machine costs $20,000. The machine can be disposed of after 2 years for $10,000. What is the ordinary gain using the following depreciation methods? 100% bonus depreciation. 5-year MACRS. 150% declining balance with N=5 yearsarrow_forward

- 2) The initial cost of a new m/c is $10,000. The annual operating cost is $1,000/yr for first 3 years, and then becomes $3,000/yr after that. The m/c needs a major repair at the end of 5th year, which costs $5,000. The m/c has 10 years useful life with salvage value of $4,000. Calculate EUAC for keeping the m/c for 10 years. (i=10%/yr)arrow_forwardThe machine cost 20,000 pesos with a useful life of 10 years. If the book value at the end of 6th year is 9,280 pesos and worth of money is 3% annually. Determine the salvage valye by sinking fund method of depreciation.arrow_forwardA company will invest in a machine worth 50000$ to produce a new product. The economic life of the machine is 4 years and its scrap value is 1000$. It will be produced on this machine The annual sales revenue of the product is expected to be 25000 $. Annual operation of the machine Expenditure is expected to be 10000 $. A) The amount of depreciation that will be allocated each year for the equipment to be purchased is Find it with the proportional depreciation method. B) The income tax is 40% and the investment will be made with the company’s equity. Assuming, find the net cash flows that will be generated by purchasing the machine.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education