ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

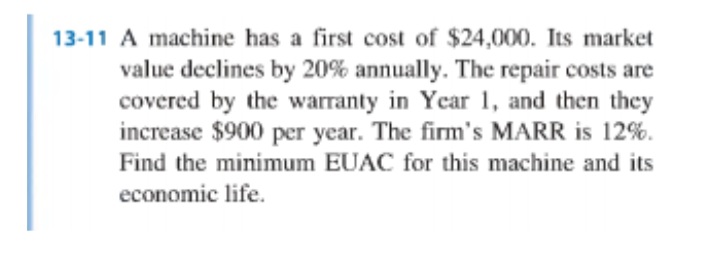

Transcribed Image Text:13-11 A machine has a first cost of $24,000. Its market

value declines by 20% annually. The repair costs are

covered by the warranty in Year 1, and then they

increase $900 per year. The firm's MARR is 12%.

Find the minimum EUAC for this machine and its

economic life.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- type plzarrow_forwardSalim Service company owns several taxis that were purchased four years ago for $27000 each. The current market value is $10000 each. If they are kept for another 6 years, they can be sold for $2000 each. The annual maintenance cost per cab is $900 a year. Salim Service is looking at replacing the cabs with the option to lease new cabs at an annual cost of $9000 per year per cab which includes free maintenance. How much more would it cost them per year to switch to leasing? Assume an interest rate of 9%.arrow_forward1-25 Zoe Garcia is the manager of a small office-support business that supplies copying, binding, and other services for local companies. Zoe must replace a worn-out copy machine that is used for black-and-white copying. Two machines are being considered, and each of these has a monthly lease cost plus a cost for each page that is copied. Machine 1 has a monthly lease cost of $600, and there is a cost of $0.010 per page copied. Machine 2 has a monthly lease cost of $400, and there is a cost of $0.015 per page copied. Customers are charged $0.05 per page for copies. (c) If Zoe expects to make 30,000 copies per month, what would be the cost for each machine? (d) At what volume (the number of copies) would the two machines have the same monthly cost? What would the total revenue be for this number of copies?arrow_forward

- With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine X that will render its AW equal to that of machine Y at an interest rate of 13% per year. Determine the replacement value. Market Value, $ Annual Cost, $ per Year Salvage Value Life, Years Machine X ? -56,500 13,500 3 Machine Y 84,000 -40,000 for year 1,increasing by 2000 per year thereafter. 18,000 5arrow_forwardPlease answer this economics questionarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- You as a businessperson have one million dollars to invest. One option is to invest your money. in a saving account that gives you 8% annual interest rate. But you decide to open a book store instead. You need to rent a place for $7900 per month and hire two workers and pay them each $6000 monthly. The other expenses such as purchases and overhead are $6500 per month. Your store generates $395,000 sales per year. How much is your economic profit? Which business do you choose? explainarrow_forwardThe following tables show the marginal costs of a defender over its remaining four years of service life. If the challenger's minimum EUAC is $29,403, what is the most appropriate replacement decision? Year 1234 Marginal cost $31,053 $26,353 $28,003 $32,803 ○ A. No decision can be made unless additional calculations are made on the challenger B. Replace the defender now OC. No decision can be made unless additional calculations are made on the defender ○ D. Keep the defender for at least one more yeararrow_forwardWe bought a CNC machine 3 years ago for $100,000 with a salvage value of $20,000 after 8 years. It has an annual operating cost of $30,000. A new machine is available at a price of $120,000, a life of 10 years and a salvage value of $30,000. The annual operating cost for this machine is $15,000. The market value for the CNC machine is $70,000 now. At MARR= 10% per year should we keep the CNC machine or replace it?arrow_forward

- A new drill press costs $12,000. It would potentially produce an additional $4,000 of revenue per year and have an operating expense of $1,200. What is the PW of the drill press if the new equipment is expected to last 8 years and i = 10%? Select one: a. $15,534 b. $19,345 c. $14,938 d. $21,735arrow_forward2. One year ago, a machine was purchased at a cost of $2,000, to be used for 6 years.However, the machine has failed to perform properly and has a cost of $500 per year forrepairs, adjustments, and shutdowns. A new machine is available to accomplish thefunctions desired and has an initial cost of $3,500. Its maintenance costs are expected tobe $50 per year during its service of 5 years. The approximate market value of the presentmachine has been roughly $1,200. If the operating cost (other than maintenance) for bothmachines are equal, show whether it is economical to purchase the new machine. Performa before-tax study, using an interest rate of 12% and assume that the salvage values will benegligible.arrow_forwardProblem # 1 A machine has a first cost of $10,000. Its market value declines by 20% annually. The repair costs are covered by the warranty in Year 1, and then they increase $600 per year. The firm's MARR is 15%. Find the minimum EUAC for this machine and its economic life.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education