ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

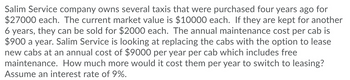

Transcribed Image Text:Salim Service company owns several taxis that were purchased four years ago for

$27000 each. The current market value is $10000 each. If they are kept for another

6 years, they can be sold for $2000 each. The annual maintenance cost per cab is

$900 a year. Salim Service is looking at replacing the cabs with the option to lease

new cabs at an annual cost of $9000 per year per cab which includes free

maintenance. How much more would it cost them per year to switch to leasing?

Assume an interest rate of 9%.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A diesel generator for electrical power can be purchased by a remote community for $350,000 and used for 10 years, when its salvage value is $50,000. Alternatively, it can be leased for $42,500 a year. (Remember that lease payments occur at the start of the year.) The community’s interest rate is 7%.(a) What is the interest rate for buying versus leasing? Which is the better choice?(b) The community will spend $80,000 less each year for fuel and maintenance, than it currently spends on buying power. Should it obtain the generator? What is the rate of return for the generator using the best financing plan? Solve it step by step.arrow_forwardThere are two alternative machines for a manufacturing process. Both machines have the same output rate, but they differ in costs. Machine A costs $20,000 to set up and $8,000 per year to operate. It must be completely replaced every 3 years, and it has no salvage value. Machine B costs $50,000 to set up and $2,160 per year to operate. It should last for 5 years and has no salvage value. The costs of two machines are shown below. 0 1 2 3 4 5 Machine A 20,000 8,000 8,000 8,000 Machine B 50,000 2,160 2,160 2,160 2,160 2,160 Assuming the cost of capital is 10%,1. find the equivalent annual cost of Machine A in Box 1. Round it to a whole dollar, and no comma or the dollar sign.2. find the EAC of Machine B in Box 2. The same format as box 1.3. Based on the equivalent annual cost method, type in Box 3 which machine do you recommend, Machine A or Machine B. Question 20 options: Blank # 1 Blank # 2 Blank #…arrow_forwardCan we take the Replacement Decisions when the required service period is long?arrow_forward

- The purchase of a used pickup for $22,000 is being considered. Records for other vehicles show that costs for oil, tires, and repairs about equal the cost for fuel. Fuel costs are $1950 per year if the truck is driven 12,500 miles. The salvage value after 6 years of use drops about 15¢ per mile. Find the equivalent uniform annual cost if the interest rate is 5%. How much does this change if the annual mileage is 15,000? 10,000?arrow_forwardAnnual operating hours remain constant. True or false?arrow_forwardPlease answer this economics questionarrow_forward

- Solve without using Excel (economics factor table is okay)arrow_forwardA new punching machine will cost $3,698. At the end of its 10 years useful life, the machine can be sold for $780. The new machine will reduce annual expenses by $627. The interest rate is 10%. The Present Worth for this investment is:arrow_forwardPlease show ALL the steps and required formulas and make sure the answer is CORRECT! thank you for your helparrow_forward

- A transit system is considering buying 6 more buses to provide better service. It will cost $100,000 for buying a new bus and $15,000 per year for maintenance and operation for the following 8 years. If the city’s MARR is 8%, what is the equivalent uniform annual cost of this project? Assume the bus has no value at the end of 8 years.arrow_forwardPlease solve this manually step by step. Please don't solve it in Excel. I need a manual step-by-step.arrow_forwardTYPEWRITTEN ONLY PLEASE FOR UPVOTE. DOWNVOTE FOR HANDWRITTEN. DO NOT ANSWER IF YOU ALREADY ANSWERED THISarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education