ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

i will 10 upvotes

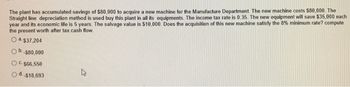

Transcribed Image Text:The plant has accumulated savings of $80,000 to acquire a new machine for the Manufacture Department. The new machine costs $80,000. The

Straight line depreciation method is used buy this plant in all its equipments. The income tax rate is 0.35. The new equipment will save $35,000 each

year and its economic life is 5 years. The salvage value is $10,000. Does the acquisition of this new machine satisfy the 8% minimum rate? compute

the present worth after tax cash flow.

Oa-$37,204

a.

-$80,000

OC. $66,550

Od..$18,693

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Briefly explain the adjustable peg system. Please write the answer in not more than 5 lines?arrow_forwardConsider an imaginary price index, the Undergraduate Price Index (UPI), created to represent the annual purchases made by a typical undergradute. The following table contains information on the market basket for the UPI and the price of each good in 2020, 2021, and 2022. The cost of each good in the basket as well as the basket's total cost are given for 2020. Perform these same calculations for 2021 and 2022, and enter the results in the following table. Streaming services Iced coffees Textbooks Notebooks Energy drinks Total cost Price index Quantity in Basket 1 150 10 8 40 Suppose this price index uses 2020 as the base year. Price (Dollars) 64 Between 2020 and 2021, the UPI increased by 2020 2 80 2 3 Cost (Dollars) 64 300 800 16 120 1,300 100 Price (Dollars) 104 2 85 2 4 2021 Cost (Dollars) In the last row of the table, calculate and enter the value of the UPI for the remaining years. % Between 2021 and 2022, the UPI increased by Price (Dollars) 134 2 105 4 5 % 2022 Cost (Dollars)arrow_forwardWhy is having knowledge of graphing and basic algebra or essential for your understanding of macroeconomics and how they are used in the coursearrow_forward

- 0 Price B Quantity Price Quantity The market for BREAD is represented by the dark solid curves in the two graphs above (demand and supply are shown separately to make the diagram easier to read). Indicate which curve (or curves) we would move to with each of the following changes.arrow_forwardIf change in consumption is $350 and change in income is $720 Find APCarrow_forwardCheeseburger and Taco Company purchases 19, 453 boxes of cheese each year. It costs $19 to place and ship each order and $7.17 per year for each box held as inventory. The company is using Economic Order Quantity model in placing the orders. Calculate Economic Order Quantity. Round the answer to the whole number.arrow_forward

- Robots at Kroger, Walmart, and Whole Foods The grocery industry is stepping up its investment in robot technology. Retailers are spending an estimated $3.6 billion in robot technology globally, and are expected to invest $12 billion by 2023. Source: Forbes, July 29, 2019 Explain how the widespread use of farm robots will change the rental rate of farm land. www. Q Search Most likely, the widespread use of retailers' robots will OA. decrease the value of marginal product of mall land will decrease OB. not change, the prices of the retail goods will not change OC. increase, the quantity of land used for malls will decrease OD. not change; the quantity of land used for malls will increase the rental rate of mall land because Nextarrow_forwardConsider an imaginary price index, the Undergraduate Price Index (UPI), created to represent the annual purchases made by a typical undergradute. The following table contains information on the market basket for the UPI and the price of each good in 2020, 2021, and 2022. The cost of each good in the basket as well as the basket’s total cost are given for 2020. Perform these same calculations for 2021 and 2022, and enter the results in the following table. Quantity in Basket 2020 2021 2022 Price Cost Price Cost Price Cost (Dollars) (Dollars) (Dollars) (Dollars) (Dollars) (Dollars) Streaming services 1 64 64 104 134 Iced coffees 150 2 300 2 2 Textbooks 10 80 800 85 105 Notebooks 8 2 16 2 4 Energy drinks 40 3 120 4 5 Total cost 1,300 Price index 100 Suppose this price index uses 2020 as the base year. In the last row of the table, calculate and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education