Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

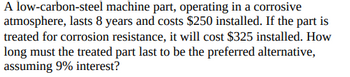

Transcribed Image Text:A low-carbon-steel machine part, operating in a corrosive

atmosphere, lasts 8 years and costs $250 installed. If the part is

treated for corrosion resistance, it will cost $325 installed. How

long must the treated part last to be the preferred alternative,

assuming 9% interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,060,000, and it would cost another $20,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $488,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $18,000. The sprayer would not change revenues, but it is expected to save the firm $358,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is the additional…arrow_forwardModern Artifacts can produce keepsakes that will be sold for $50 each. Nondepreciation fixed costs are $2,500 per year, and variable costs are $30 per unit. The initial investment of $2,000 will be depreciated straight-line over its useful life of 5 years to a final value of zero, and the discount rate is 10%. Note: For all the requirements, do not round intermediate calculations. Round your answer up to the nearest whole unit. a. What is the accounting break-even level of sales if the firm pays no taxes? b. What is the NPV break-even level of sales if the firm pays no taxes? c. What is the accounting break-even level of sales if the firm's tax rate is 40%? d. What is the NPV break-even level of sales if the firm's tax rate is 40%? a. Acounting break-even level of sales b. NPV break-even level of sales c. Acounting break-even level of sales d. NPV break-even level of sales units units units unitsarrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,130,000, and it would cost another $21,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $591,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $13,500. The sprayer would not change revenues, but it is expected to save the firm $316,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is the additional Year-3 cash flow (i.e, the after-tax…arrow_forward

- A physics lab is considering leasing a diagnostic scanner that costs $5,800,000, and it would bedepreciated straight-line to zero over four years. Because of radiation contamination, it will actuallybe completely valueless in four years. You can lease it for four years. Assume tax rate is 21% for theleasing company (lessor) and zero for the lab. The cost of borrowing is 8%. Over what range of leasepayments will the lease be profitable for both lessee and lessor?arrow_forwardCosts associated with the manufacture of miniature high-sensitivity piezoresistive pressure transducers is $85,000 per year. A clever industrial engineer found that by spending $19,000 now to reconfigure the production line and reprogram two of the robotic arms, the cost will go down to $52,000 next year and $58,000 in years 2 through 5. Using an interest rate of 15% per year, determine the present worth of the savings due to the reconfiguration. The present worth of the savings is determined to be $arrow_forwardA commercial 3D printer is purchased for $350,000. The salvage value of the printer decreases by 30% each year that it is held. The cost to operate and maintain the machine the first year it is used is $14,000; these costs increase by $5,000 each year. What is the optimal replacement interval and minimum EUAC for the printer, assuming a MARR of 13% is used? Click here to access the TVM Factor Table Calculator. years ORI: EUAC*: $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is ±5 for the EUAC*.arrow_forward

- The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $920,000, and it would cost another $20,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $500,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $304,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 25%. a. What is the Year-0 cash flow? b. What are the cash flows in Years 1, 2, and 3? c. What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? d. If the project’s cost of capital is 12%, what is the NPV?arrow_forwardASAParrow_forwardA low-carbon-steel machine part, operating in a corrosive atmosphere, lasts 8 years and costs $250 installed. If the part is treated for corrosion resistance, it will cost $325 installed. How long must the treated part last to be the preferred alternative, assuming 9% interest?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education