Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

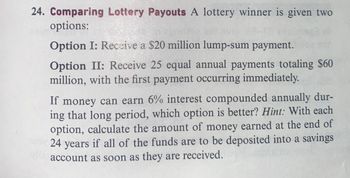

Transcribed Image Text:24. Comparing Lottery Payouts A lottery winner is given two

options:

Option I: Receive a $20 million lump-sum payment.

Option II: Receive 25 equal annual payments totaling $60

million, with the first payment occurring immediately.

If money can earn 6% interest compounded annually dur-

ing that long period, which option is better? Hint: With each

option, calculate the amount of money earned at the end of

24 years if all of the funds are to be deposited into a savings

account as soon as they are received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If you could solve option 5 with the formulas please Option 5: Half the required money is taken out of an investment account that pays monthly interest at a 3% annual rate. The rest of the money is borrowed from a bank at a 4% annual interest rate, should payback within 3 years in equal monthly payments. Find the future value of the money taken from the investment account at the end of the shop development and periodic payments to the bank. Calculate Cumulative interest and principal payments.arrow_forwardAa.37.arrow_forwardUsing the TVM calculator, compare the following if the investment pays 7%/a compound annually and payments are made until age 65. Calculate the future value of each investment and the total amount paid in. which would you choose? a) depositing $1500 every year starting at age 20. b) depositing $4500 every year starting at age 50.arrow_forward

- A borrower bought a house for $300,000; he can obtain an 80% loan with a 20-year fully amortizing, 7% interest rate and monthly payment. Alternatively, he could get a 30-year fully amortizing 90% loan at 9% What is the incremental cost of borrowing the additional fund?arrow_forwardthe lottery commission wants to be able to withdraw $400,000 at the beginning of each year for twenty years to cover annual payments due to Randy who won 8 million. How much does the commission need to invest today in an account paying 3.6% compounded annually to provide these payments?arrow_forwardImagine that you won $100 million in the lottery and were offered the choice between two payment plans: Plan A: Receive $61 million in a lump sum today Plan B: Receive an initial payment of $1.5 million today and annual payments that increase by 5% annually over the next 29 years (30 payments total) a. Determine the net present value of each plan without discounting. Which plan is the better option? b. Assuming an interest rate of 4%, determine the future value of each plan at the end of the 29 years with discounting. Which plan is the better option?arrow_forward

- You like to buy lottery tickets every week. The lottery pays an insurancecompany that pays the winner an annuity. If you win a $60,000,000 lotteryand elect to take an annuity, you get $3,000,000 per year at the beginningof each year for the next 20 years.a. How much must the state pay the insurance company if money can earn3 percent?b. How much interest is earned on this lump-sum payment over the 20 years?c. If you take the cash rather than the annuity, the state pays you $30,000,000in one lump sum today. You must pay 40 percent of this in taxes. If you arecurrently working and invest this money at 6 percent, how much moneywill you have in a mutual fund at the end of 20 years?d. Are you better off with the annuity, or should you take the cash? Explain.arrow_forwardWhen purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is an 80% loan at 4% with monthly payments of $591.75 for 15 years. The second loan is 90% loan at 5% with monthly payments of $526.13 over 25 years. What is the incremental cost of borrowing the extra money assuming the loan will be held for the full term? O 6.50% O 13.21% O 7.20% O 13.70%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education