FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

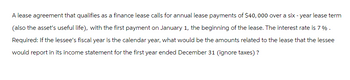

Transcribed Image Text:A lease agreement that qualifies as a finance lease calls for annual lease payments of $40,000 over a six-year lease term

(also the asset's useful life), with the first payment on January 1, the beginning of the lease. The interest rate is 7%.

Required: If the lessee's fiscal year is the calendar year, what would be the amounts related to the lease that the lessee

would report in its income statement for the first year ended December 31 (ignore taxes)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- In a ten-year finance lease, the portion of the annual lease payment in the lease's third year that represents interest is: Multiple Choice More than in the second year. The same as in the fourth year. The same as in the first year. Less than in the second year.arrow_forwardOn January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a operating lease. The lease requires three $18,000 lease payments (the first at the beginning of the lease and the remaining two at December 31 of Year 1 and Year 2) The present value of the three annual lease payments is $51,000, using a 6.003% interest rate. The lease payment schedule follows. Date January 1, Year 1 December 31, Year 1 December 31, Year 2 Required 1 No 1 (A) Beginning (B) Debit Balance of 2 Lease Liability $ 51,000 33,000 16,981 Required 2 3 Interest on Lease Liability 6.003% X (A) Complete this question by entering your answers in the tabs below. Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. 2. Prepare the January 1 journal entry to record the first $18,000 cash lease payment. 3. Prepare the December 31 journal entry to record amortization at the end of (a) Year 1, (b) Year 2, and (c) Year 3. 4. Prepare the…arrow_forwardThree different lease transactions are presented below for Pharoah Enterprises. Assume that all lease transactions start on January 1, 2024. Pharoah does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid at the beginning of each year. Pharoah Enterprises prepares its financial statements using ASPE. Lease term Estimated economic life Yearly rental payment Fair market value of leased asset Present value of lease rental payments Interest rate Manufacturing Equipment 5 years 15 years $16,800 $117,600 $75,852 3.5% Office Equipment 6 years 3 years 7 years 6 years $18,000 $4,680 $102,000 $21,000 $94,356 $12,060 Vehicles 4% 8% Assume that Pharoah Enterprises has purchased the vehicle for $102,000 instead of leasing it and that the amount borrowed was $102,000 at 8% interest, with interest payable at the end of each year. Prepare the entries for 2024. (List all debit entries before credit entries. Credit…arrow_forward

- The following information relates to Wilson, Inc.’s equipment lease with an inception date of January 1: Fair value of equipment at lease inception, $91,200 Lease term, 4 years Economic life of property, 5 years Implicit interest rate, 6% Annual lease payment due on December 31, $25,600 Present value of the lease payments, $88,707 The equipment reverts back to the lessor at the end of the lease term. How much is interest expense on the lease for the first year? Select one: a. $5,472 b. $2,736 c. $5,322 d. $1,331arrow_forwardA six-year lease can be renewed for two additional three-year periods, and it also can be terminated after only three years. How do the lessee and lessor decide the lease term to be used in accounting for the lease?arrow_forwardEach of the four independent situations below describes a sales-type lease in which annual lease payments of $17,500 are payable at the beginning of each year. Each is a finance lease for the lessee. Lease term (years) Asset's useful life (years) Lessor's implicit rate (known by lessee) Residual value: Guaranteed by lessee. Unguaranteed Purchase option: After (years) Exercise price Determine the following amounts at the beginning of the lease: Note: Round your final answers to nearest whole dollar. A. The lessor's: 1. Total lease payments 2. Gross investment in the lease 3. Net investment in the lease B. The lessee's: 4. Total lease payments 5. Right-of-use asset 6. Lease liability $ 1 70,000 2 Situation 1 70,000 4 4 8% $0 $0 none 3 2 70,000 Situation 4 Reasonably certain? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 8% $ 7,000 $0 4 $ 8,500 no 4 5 8% $3,500 $ 3,500 $ 2,500 no 4 4 7 8% $0 $ 7,000 3 $ 4,500 yesarrow_forward

- Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return (known by lessee) Lessee's incremental borrowing rate Fair value of lease asset Situation 1 Situation 2 Situation 3 Lease Payments Right-of-use Asset/Lease 1 Payable 11 10% 11% $640,000 Situation 2 15 8% 9% $1,000,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar. 3 6 11% 10% $205,000arrow_forwardThe following information relates to an equipment lease with an inception date of January 1: Fair value of equipment at lease inception, $56,000 Lease term, 5 years Economic life of property, 6 years Implicit interest rate, 7% Annual lease payment due on December 31, $13,200 The equipment reverts back to the lessor at the end of the lease term. How much is recorded as the lease liability on the lease inception date? Select one: a. $66,000 b. $56,000 c. $57,911 d. $54,123arrow_forwardLessee enters into a 10-year lease of property with annual lease payments of P50,000, payable at the beginning of each year. The contract specifies that lease payments will increase every two years on the basis of the increase in the Consumer Price Index for the preceding 24 months. The Consumer Price Index at the commencement date is 125. The rate implicit in the lease is not readily determinable. Lessee’s incremental borrowing rate is 5 per cent per annum, which reflects the fixed rate at which Lessee could borrow an amount similar to the value of the right-of-use asset, in the same currency, for a 10-year term, and with similar collateral. Discount factor for 5% for 9 periods is 7.10782.Lessee expects to consume the right-of-use asset’s future economic benefits evenly over the lease term and, thus, depreciates the right-of-use asset on a straight-line basis.At the beginning of the third year of the lease the Consumer Price Index is 135.Determine the amount of lease liability…arrow_forward

- Each of the four independent situations below describes a finance lease in which annual lease payments are pay- able at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Situation Lease term (years) Lessor's rate of return Fair value of lease asset Lessor's cost of lease asset Residual value: Estimated fair value Guaranteed fair value 1 4 10% $50,000 $50,000 0 2 7 11% $350,000 $350,000 $ 50,000 0 3 5 9% $75,000 $45,000 $7,000 $7,000 Required: For each situation, determine: a. The amount of the annual lease payments as calculated by the lessor. b. The amount the lessee would record as a right-of-use asset and a lease liability. 4 8 12% $465,000 $465,000 10 $ 45,000 $ 50,000arrow_forwardOn 1 July 2020, Table Ltd leased equipment from Chair Ltd. The following are details of the equipment and the lease contract: On 1 July 2020 equipment has a fair value of $110,000 (at fair value in Chair Ltd’s accounts) Lease term is 5 years, useful life of the equipment is 6 years, and Table Ltd will return the equipment at the end of the lease term Lease payments are in advance and will be paid on 1 July of each year, starting 1 July 2020, with $24,000 as the annual payment Residual value of the equipment at the end of the lease term is $8,000, with Table Ltd guaranteeing 75% of the residual value The interest rate implicit in the lease arrangement is 6%. In setting up the lease arrangement Table Ltd incurred costs of $2,354, while Chair Ltd incurred costs of $3,141. Required: a) Prepare the necessary journal entries for Table Ltd on 1 July 2020. b) Calculate interest and depreciation expense incurred on 30 June…arrow_forwardOn July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lease requires quarterly lease payments of $4,500. The first lease payment is due on September 30, 2020. The lease was reported as a finance lease using an 8% annual interest rate. a. Prepare the journal entry to record the commencement of the lease on July 1, 2020. b. Prepare the journal entries that would be necessary on September 30 and December 31, 2020. c. Post the entries from parts a and b in their appropriate T-accounts. d. Prepare a financial statement effects template to show the effects template to show the effects of the entries from parts a and b on the balance sheet and income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education