FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

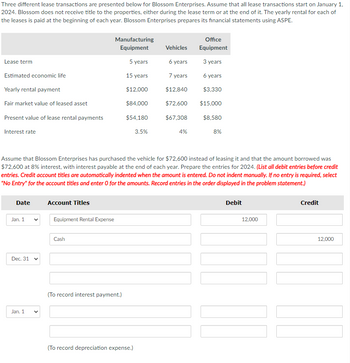

Transcribed Image Text:Three different lease transactions are presented below for Blossom Enterprises. Assume that all lease transactions start on January 1,

2024. Blossom does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of

the leases is paid at the beginning of each year. Blossom Enterprises prepares its financial statements using ASPE.

Lease term

Estimated economic life

Yearly rental payment

Fair market value of leased asset

Present value of lease rental payments

Interest rate

Date

Jan. 1

Dec. 31 v

Jan. 1

Account Titles

Assume that Blossom Enterprises has purchased the vehicle for $72,600 instead of leasing it and that the amount borrowed was

$72,600 at 8% interest, with interest payable at the end of each year. Prepare the entries for 2024. (List all debit entries before credit

entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.)

Equipment Rental Expense

Manufacturing

Equipment

5 years

15 years

$12,000

$84,000

$54,180

Cash

(To record interest payment.)

3.5%

(To record depreciation expense.)

Vehicles

6 years

7 years

$12,840

$72,600

$67,308

4%

Office

Equipment

3 years

6 years

$3,330

$15,000

$8,580

8%

Debit

12,000

Credit

12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2022, ABC Company signed a 5-year non-cancelable lease for a building. This is also the period when the contract is enforceable.The terms of the lease called the ABC to make annual payments of P500,000 at the beginning of each year starting January 1, 2022. The contract provides that ABC will obtain the ownership at the end of the lease term. The building has an estimated useful life of 6 years and a P120,000 guaranteed residual value at the end of the five-year lease term. ABC has a constructive obligation to restore the machine to a condition still suitable for use at the end of the lease term. Estimated cost of restoration is P200,000. ABC incurred directly attributable cost of P90,000 to install the machine. The rate implicit in this contract is not readily determinable at the time of inception of the contract and incremental borrowing rate is at 9%. How much depreciation expense will be taken up by ABC?arrow_forwardA lease agreement that qualifies as a finance lease calls for annual lease payments of $26,269 over a six-year lease term (also the asset’s useful life), with the first payment on January 1, the beginning of the lease. The interest rate is 5%. Required: Complete the amortization schedule for the first two payments. If the lessee’s fiscal year is the calendar year, what would be the amount of the lease liability that the lessee would report in its balance sheet at the end of the first year? What would be the interest payable?arrow_forwardOn January 1, 2019, Ashly Farms leased a hay baler from Agrico Company. The lease requires Ashly to make $3,000 payments on January 1 of each year for 5 years beginning in 2019. The interest rate is 12%. Calculate the present value of Ashly's lease payments as of January 1, 2019.arrow_forward

- The following facts pertain to a non-cancelable lease agreement between Cullumber Leasing Company and Crane Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, 2025 Residual value of equipment at end of lease term, guaranteed by the lessee January 1, 2025 $125,377 $54,000 Expected residual value of equipment at end of lease term $49,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, 2025 $660,000 Lessor's implicit rate 8 % Lessee's incremental borrowing rate 8 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Click here to view factor tables. (a) Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to O decimal places e.g. 5,275.) Date 1/1/25 $ 1/1/25…arrow_forwardProvide all journal entries that Kelly K. inc. will record over the whole term of the lease.arrow_forward19 On September 30, 2024, Truckee Garbage leased equipment from a supplier and agreed to pay $125,000 annually for 15 years beginning September 30, 2025. Generally accepted accounting principles require that a liability be recorded for this lease agreement for the present value of scheduled payments. Accordingly, at inception of the lease, Truckee recorded a $1,214,031 lease liability. Determine the interest rate implicit in the lease agreement. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forward

- On July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lease requires quarterly lease payments of $4,500. The first lease payment is due on September 30, 2020. The lease was reported as a finance lease using an 8% annual interest rate. a. Prepare the journal entry to record the commencement of the lease on July 1, 2020. b. Prepare the journal entries that would be necessary on September 30 and December 31, 2020. c. Post the entries from parts a and b in their appropriate T-accounts. d. Prepare a financial statement effects template to show the effects template to show the effects of the entries from parts a and b on the balance sheet and income statement.arrow_forwardOn January 1, 2024, Stone leased an office building. Terms of the lease require Stone to make 20 annual lease payments of $124, 000 beginning on January 1, 2024. An 11% interest rate is implicit in the lease agreement. At what amount should Stone record the lease liability on January 1, 2024, before any lease payments are made? Note: Round your final answers to nearest whole dollar amount. Show less Table, Excel, or calculator function Table, Excel, or calculator function: Payment: n = i : Liability: =arrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education