FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

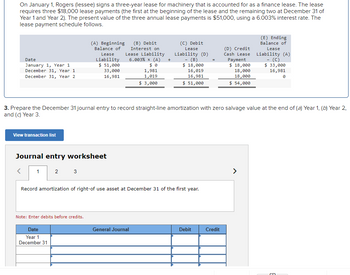

Transcribed Image Text:On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a finance lease. The lease

requires three $18,000 lease payments (the first at the beginning of the lease and the remaining two at December 31 of

Year 1 and Year 2). The present value of the three annual lease payments is $51,000, using a 6.003% interest rate. The

lease payment schedule follows.

Date

January 1, Year 1

December 31, Year 1

December 31, Year 2

View transaction list

1

Journal entry worksheet

2

(A) Beginning

Balance of

Lease

Liability

3

$ 51,000

33,000

16,981

Note: Enter debits before credits.

Date

Year 1

December 31

(B) Debit

Interest on

Lease Liability

6.003% X (A)

3. Prepare the December 31 journal entry to record straight-line amortization with zero salvage value at the end of (a) Year 1, (b) Year 2,

and (c) Year 3.

1,981

1,019

$ 3,000

+

General Journal

(C) Debit

Lease

Liability (D)

(B)

$ 18,000

16,019

16,981

$ 51,000

Record amortization of right-of use asset at December 31 of the first year.

Debit

(D) Credit

Cash Lease

Payment

$ 18,000

18,000

18,000

$ 54,000

Credit

(E) Ending

Balance of

Lease

Liability (A)

(C)

$ 33,000

16,981

0

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the proper accounting treatment to record a variable lease payment indexed off the CPI? Group of answer choices Record the lease liability based on highest annual increase in the CPI for the past 10 years. Calculate the lease liability based on the base payment and debit an additional expense in subsequent years based on the change in the CPI. Calculate the lease liability based on expected payments over the life of the lease after considering increases in the CPI. Capitalize and depreciate the increased payments based on CPI indexing.arrow_forwardCurrent liabilities are expected to be paid within one year or the operating cycle, whichever is shorter. True Falsearrow_forwardVisnoarrow_forward

- Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return (known by lessee) Lessee's incremental borrowing rate Fair value of lease asset Situation 11 Situation 2 Situation 3 Lease Payments 10 11% 12% Right-of-use Asset/Lease Payable $780,000 Situation 20 9% 10% $1,150,000 3 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar. 6 12% 11% $365,000arrow_forwardA finance lease situation is most likely when the lease term is equal to or greater than Select one: a. 75% of the expected economic life of the leased asset. b. 90% of the expected economic life of the leased asset. c. 50% of the expected economic life of the leased asset. d. 80% of the expected economic life of the leased asset.arrow_forwardEach of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) Lessor's rate of return 4 10% 7 11% 5 8 9% 12% Fair value of lease asset $ 56,000 $ 356,000 $ 81,000 $ 471,000 Lessor's cost of lease asset $ 56,000 $ 356,000 $ 51,000 $ 471,000 Residual value: Estimated fair value 0 $ 56,000 Guaranteed fair value 0 0 $ 13,000 $13,000 $ 51,000 $ 56,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the essee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Lease Payments Residual…arrow_forward

- Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return (known by lessee) Lessee's incremental borrowing rate Fair value of lease asset Situation 1 Situation 2 Situation 3 Lease Payments Right-of-use Asset/Lease 1 Payable 10 10% 11% $780,000 Situation 2 15 8% 9% $1,070,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar. 3 5 11% 10% $275,000arrow_forwardNonearrow_forwardManjiarrow_forward

- am. 127.arrow_forwardEach of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return Fair value of lease asset Lessor's cost of lease asset Residual value: Estimated fair value Guaranteed fair value Situation 1 Situation 2 Situation 3 $ Situation 4 $ $ Lease Payments 14,340 62,310 $ 16,590 × $ 79,947 1 4 10% $ 50,000 $50,000 0 0 0 $ $ $ 5,000 $ 0 2 $ 350,000 $ 350,000 Situation $ 50,000 0 PV of Lease Payments 7 11% 50,000 325,917 70,336 × $ 444,806 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest…arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education