FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

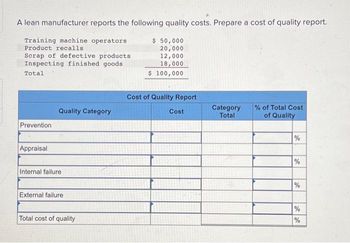

Transcribed Image Text:A lean manufacturer reports the following quality costs. Prepare a cost of quality report.

$ 50,000

Training machine operators

Product recalls

20,000

12,000

18,000

$ 100,000

Scrap of defective products

Inspecting finished goods

Total

Prevention

Appraisal

Quality Category

Internal failure

External failure

Total cost of quality

Cost of Quality Report

Cost

Category

Total

% of Total Cost

of Quality

%

%

%

de se

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E10-3Using variable costing and absorption costing The chief executive officer of Acadia, Inc. attended a conference in which one of the sessions was devoted to variable costing. The CEO was impressed by the presentation and has asked that the following data of Acadia, Inc. be used to prepare comparative statements using variable costing and the company’s absorption costing. The data follow: Direct materials $99,000 Direct labor 126,000 Variable factory overhead 72,000 Fixed factory overhead 171,000 Fixed marketing and administrative expense 211,500 The factory produced 90,000 units during the period, and 78,750units were sold for $787,500. 1.Prepare an income statement using variable costing. 2.Prepare an income statement using absorption costing.(Round unit costs to three decimal places.)arrow_forwardanswer full question pleasearrow_forwardActivity-Based Environmental Cost Assignments Pinter Company had the following environmental activities and product information: 1. Environmental activity costs Activity Costs Design products (to reduce pollution) $ 129,600 Test for contamination 230,400 Treat toxic waste 720,000 Operate pollution control equipment 576,000 2. Driver data Solvent X Solvent Y Design hours 2,900 1,900 Testing hours 5,100 7,700 Pounds of waste 600 15,400 Machine hours 2,900 61,100 3. Other production data Solvent X Solvent Y Nonenvironmental production costs $2,176,000 $4,128,000 Units produced 320,000 320,000 What if the design costs increased to $219,600 and the cost of toxic waste decreased to $360,000? Assume that Solvent Y uses 3,800 out of 7,600 design hours. Also assume that waste is cut by 50 percent and that Solvent Y is responsible for…arrow_forward

- Cost of Quality and Value-Added/Non-Value-Added Reports for a Service Company Three Rivers Inc. provides cable TV and Internet service to the local community. The activities and activity costs of Three Rivers are identified as follows: a. Identify the cost of quality classification for each activity and whether the activity is value-added or non-value-added. Value-Added/ Non-Value-Added Classification Quality Control Activities Billing error correction Cable signal testing Reinstalling service (installed incorrectly the first time) Repairing satellite equipment Repairing underground cable connections to the customer Replacing old technology cable with higher quality cable Replacing old technology signal switches with higher quality switches Responding to customer home repair requests Training employees Total activity cost Activity Cost $35,400 108,800 76,000 34,000 23,000 151,400 173,000 42,400 36,000 $680,000 Quality Cost Classification Maxarrow_forwardSolve the word problem for the portion, rate, on base. A quality control process finds 25.6 defects for every 6400 units of production. What percent of the production is defective? 40 Ex %arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Qw.140.arrow_forward35 Hours lost on machine breakdowns clowing the production of goods causing limited customer supplies is a measure he Oa. Customer Perspective O b. Learning and Growth Perspective Oc. Financial Perspective Od. Internal Business Process Perspectivearrow_forwardSchedule of Activity Costs Quality Control Activities Product testing Assessing vendor quality Recalls Rework Scrap disposal Product design Training machine operators Warranty work Process audits Activity Cost $55,000 26,000 18,000 29,000 8,000 30,000 46,000 12,000 22,000 From the provided schedule of activity costs, determine the internal failure costs.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education