FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Suggest what action management might take with respect to the discoveries resulting from the ABC versus traditional costing analysis. Assume that Drilling Innovations expects to produce a gross profit margin on each product of at least 30 percent of the selling price.

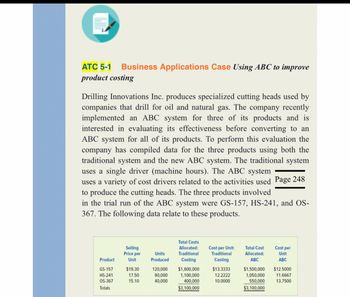

Transcribed Image Text:ATC 5-1 Business Applications Case Using ABC to improve

product costing

Drilling Innovations Inc. produces specialized cutting heads used by

companies that drill for oil and natural gas. The company recently

implemented an ABC system for three of its products and is

interested in evaluating its effectiveness before converting to an

ABC system for all of its products. To perform this evaluation the

company has compiled data for the three products using both the

traditional system and the new ABC system. The traditional system

uses a single driver (machine hours). The ABC system

uses a variety of cost drivers related to the activities used Page 248

to produce the cutting heads. The three products involved

in the trial run of the ABC system were GS-157, HS-241, and OS-

367. The following data relate to these products.

Product

GS-157

HS-241

OS-367

Totals

Selling

Price per

Unit

$19.30

17.50

15.10

Units

Produced

120,000

90,000

40,000

Total Costs

Allocated:

Traditional

Costing

$1,600,000

1,100,000

400,000

$3,100,000

Cost per Unit:

Traditional

Costing

$13.3333

12.2222

10.0000

Total Cost

Allocated:

ABC

Cost per

Unit

ABC

$1,500,000

$12.5000

1,050,000 11.6667

550,000

13.7500

$3,100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Which of the following is an example of qualitative factors that can effect investment decisions? Select one: a. All of the choices b. Over time, how will the quality of goods produced impact the company financially? c. How will any changes affect worker productivity? Will they have any impact on employee morale? d. How will the proposed acquisition or upgrade affect the company’s flexibility?arrow_forwarda) Compare and contrast variable cost-plus pricing and target pricing, and indicate the circumstances in which each might be appropriate. b) Compute the selling price based on the compay’s pricing policy and indicate whether the customer’s maximum price is consistent with the company’s pricing policy. c) Assume that further tests have confirmed the product’s useful life, and that SA Berhad wishes to maximise profits by reducing costs. Indicate techniques which could be used to achieve a reduction in the product cost. d) Define Business Process Re-engineering (BPR).arrow_forwardProblem C: Variable Costing and Absorption Costing The research of Nawaz (2023) concluded that marginal (variable) costing technique is a better costing technique, which could help management in decision-making and other stakeholders to better understand the position of an organization. Comment on this in not more than 70 words. (5 points)arrow_forward

- In order to determine the optimal sales mix for a company, one should evaluate the contribution margin per unit of whatever the scarce resource is True or Faisearrow_forwardWhen evaluating if a company should accept a new contract to produce more product it should: Evaluate all possible fixed cost of accepting the contract. Evaluate the propose contract using a contribution margin approach. Accept the new contract if the sales price for the product is equal to or higher than the current sale price. Accept the new contract if fixed costs will remain the same.arrow_forwardCost-volume-profit (CVP) analysis for revenue planning determines: The desired profit level of a firm. Both revenue maximization and cost minimization. The costs associated with a certain level of revenue. The max amount of revenue a firm can receive. The revenue required to achieve a desired profit level.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education