ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

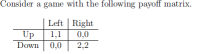

a) How many players does this game have? What are the strategies of each player?

(b) What are the Nash equilibria of this game?

(c) What are the Pareto Efficient outcomes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer items c and darrow_forward(b) ROWENA up Answer 1: up Answer 2: In this simultaneous move game, the iterated dominance equilibrium is (Rowena's . Colin's left left Answer 3: ). This game has two Nash equilibria one of which is the iterated dominance equilibrium. The other Nash equilibrium, which is not the IDE, is (Rowena's down Colin's right down Up Down Answer 4: Left right 0,0 0,0 COLIN Right 0,0 1,1arrow_forwardHelp me sir/mam expertarrow_forward

- QUESTION 9 D 2 C D D, D OD, C C, D C II C (2,2) (4,0) (0,4) (3,3) In the dynamic game represented by the graph above, the numbers inside paranthesis show the payoffs of Player 1 and Player 2, respectively. The Nash equilibrium of this game is for Player 1 to choose O C, C and Player 2 to choosearrow_forwardin every Nash equilibrium, the strategy of every player is a best response to the strategies chosen by the other players. (a) True. (b) False.arrow_forward!arrow_forward

- 1. Firm A Use the following matrix to answer the following questions. Firm B Strategy A B с D -10, -10 -100, 220 200, 140, -100 180 Assume that this is a simultaneous move one shot game. (a) What is each firm's best response to its rival's possible actions? (i) If Firm A chooses low price what is Firm B's best choice? (ii) If Firm A chooses high price what is Firm B's best action? (iii) If Firm B chooses low price what is Firm A's best choice? (iv) If Firm B chooses high price what is Firm A's best choice? (b) What is Firm A's dominant strategy (if they have one)? (c) What is Firm B's dominant strategy (if they have one)? (d) What is the Nash equilibrium? Refer to the normal-form game of price competition in the payoff matrix below. Firm B Low Price 0,0 Firm A Low Price High Price 50,-10 High Price -10, 50 20, 20 Suppose the game is infinitely repeated, and the interest rate is 10 percent. Both firms agree to charge a high price, provided no player has charged a low price in the past.…arrow_forward**Practice*** Amy and Bob are playing the following board game:(I) Amy starts. She has three possible actions: Pass, Attack, or Defend.(II) Bob observes what Amy chose, and then chooses between three actions with the same names: Pass, Attack, or Defend.(III) If either player passes, or one attacks and the other defends, then the game ends. But if either both players attack, or if both players defend, then Amy has to choose between two actions: Respond or Not Respond. The payoffs are as follows:- If both players pass, both players get a payoff of 0.- If a player attacks and the other player defends, the player that attacks gets a payoff of 1, while the player that defended gets a payoff of 2.- If a player passes but the other player attacks or defends, the player who passes gets a payoff of -1, and the player who attacked or defended gets a payoff of 3.- If both players attack or both players defend:– If Amy responds, she gets a payoff of 4, and Bob gets a payoff of 0.– If Amy does…arrow_forwardb 500,0 -10, 30 B 6,-1 0,0 C -1, 20 -20, 100 What is the Nash Equilibrium of this game? A a a. (C, c) O b. (C, b) O c. (A, a) O d. (B, b) C 20, 12 8, -2 7,800arrow_forward

- 12) What is a Nash equilibrium? Why do we generally think that Nash equilibria will be likely outcomes of games?arrow_forwardPlayer 2 Middle Left P1: $45 P1: $70 Up P2: $45 P2: $50 Player 1 P1: $50 P1: $60 Middle P2: $50 P2: $60 P1: $60 P1: $50 Down P2: $60 P2: $70 In the game shown above, list all of the Nash Equilibrium (please check ALL that apply) (up, left) (up, middle) (up, right) (middle, left) (middle, middle) (middle, right) (down, left) (down, middle) (down, right) No equilibrium Right P1: $45 P2: $60 P1: $50 P2: $70 P1: $60 P2: $60arrow_forwardSuppose now we alter the game so that whenever Colin chooses "paper" the loser pays the winner 3 instead of 1: rock paper scissors rock 0. -3 1 1. раper scissors -1 -1 3 (a) Show that xT= (,) and yT= (5) together are not a Nash equilibrium 3'31 for this modified 3'3 game. (b) Formulate a linear program that can be used to calculate a mixed strategy x € A(R) that maximises Rosemary's security level for this modified game. (c) Solve your linear program using the 2-phase simplex algorithm. You should use the format given in lectures. Give a mixed strategy x E A(R) that has an optimal security level for Rosemary and a mixed strategy y E A(C) that has an optimal security level for Colin.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education