ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A

of private investors borrowed $34 million to build 200 new luxury apartments near a large university. The money was borrowed at 5% annual interest, and the loan is to be repaid in equal annual amounts over a 30-year period. Annual

group

operating, maintenance, and insurance expenses are estimated to be $3,000 per apartment. This expense will be incurred even if an apartment is vacant. The rental fee for each apartment will be $11,000 per year, and the worst-case occupancy

rate is projected to be 85%. Investigate the sensitivity of annual profit (or loss) to (a) changes in the occupancy rate and (b) changes in the annual rental fee.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year.

.....

Complete the table below. (Round to the nearest thousands.)

Occupancy Rate, $

85%

Rental Fee

75%

80%

90%

95%

100%

$5,000

150

160

170

180

190

200

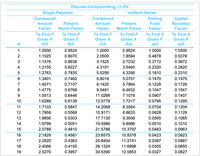

Transcribed Image Text:Discrete Compounding; i= 5%

Single Payment

Compound

Uniform Series

Compound

Sinking

Fund

Capital

Recovery

Factor

Amount

Present

Amount

Present

Factor

Worth Factor

Factor

Worth Factor

Factor

To Find F

To Find P

To Find F

To Find P

To Find A

To Find A

Given P

Given F

Given A

Given A

Given F

Given P

FIP

PIF

FIA

PIA

AIF

AIP

1

1.0500

0.9524

1.0000

0.9524

1.0000

1.0500

2

1.1025

0.9070

2.0500

1.8594

0.4878

0.5378

3

1.1576

0.8638

3.1525

2.7232

0.3172

0.3672

4

1.2155

0.8227

4.3101

3.5460

0.2320

0.2820

1.2763

0.7835

5.5256

4.3295

0.1810

0.2310

6

1.3401

0.7462

6.8019

5.0757

0.1470

0.1970

7

1.4071

0.7107

8.1420

5.7864

0.1228

0.1728

8

1.4775

0.6768

9.5491

6.4632

0.1047

0.1547

9

1.5513

0.6446

11.0266

7.1078

0.0907

0.1407

10

1.6289

0.6139

12.5779

7.7217

0.0795

0.1295

11

1.7103

0.5847

14.2068

8.3064

0.0704

0.1204

12

1.7959

0.5568

15.9171

8.8633

0.0628

0.1128

13

1.8856

0.5303

17.7130

9.3936

0.0565

0.1065

14

1.9799

0.5051

19.5986

9.8986

0.0510

0.1010

15

2.0789

0.4810

21.5786

10.3797

0.0463

0.0963

16

2.1829

0.4581

23.6575

10.8378

0.0423

0.0923

17

2.2920

0.4363

25.8404

11.2741

0.0387

0.0887

18

2.4066

0.4155

28.1324

11.6896

0.0355

0.0855

19

2.5270

0.3957

30.5390

12.0853

0.0327

0.0827

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If specific duty is $2 per dozen and ad valorem duty is 20%, find the total duty on 12 dozen padlocks valued at $650.arrow_forwardThe consultancy Imagination Inc. is working with its manufacturing client Parts-R-Us to improve their on-time performance. The firm can earn a bonus of up to $1,000,000 based on how much the on-time performance actually improves. It's current (baseline) on-time performance is 90%. The company typically completes approximately 1,000 orders per month, with approximately 100 orders delayed. The bonus payment is prorated according to the following criteria: · The on-time performance improvement is calculated based on a reduction in late events or an improvement in on-time performance. · No bonus is earned for the first 25% reduction in late events, say from 100 to 75. Maximum bonus is earned once Parts-R-Us achieves 95% on-time performance. Please answer the following: Write down a formula to determine the total bonus amount to be received Using your formula, show how much bonus would be paid if Parts-R-Us achieves 94% on-time performance.arrow_forwardA steam generation system at a biomass-fueled power plant uses an electrostaticprecipitator (ESP) to clean its gaseous effluents. The power plant has consistently made use ofthe same type of ESP over the past several years. The installed cost of a new ESP has beenrelatively constant at $100,000. Records of operation and maintenance expenses indicate thefollowing average expenses per year as a function of the age of the ESP. The MVs of the ESP arealso reasonably well known as a function of age. Data graph in image attached. Determine the best time to replace the ESP if the MARR is 15% per year.arrow_forward

- You are considering an investment project with the financial information provided below. Suppose the company is most concerned about the impact of its price estimate on the project's rate of return. How would you address this concern? The break-even value of unit price is ?arrow_forwardAssume a pool of 115 people in an insurance pool (a group of people insured through community rating). It is estimated that a small number in the pool will have significant pre- existing conditions as indicated in the table. Based on the age of these 115 people, the insurance company estimates the following distribution of health care claims (which includes necessary profit and administrative costs of the insurance company). Number of Insured Antidipated Heath Costs/Year/Person $1,400 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 $2,200 $2.300 $2,400 $2,500 $2,700 $2,000 $2,900 $3,000 $3,100 $3.200 $3.300 $4,000 57,00 $10,000 Everyone joins the poal ad pays the necessary premum in the first year. The clams experience of the customers is faund to be generaly consstent with expeclations of the insurance company. A) What would be the premium In the third year if there is no inflation, based on the company's oxperience from the past year? B) If those customers who have anticipated…arrow_forwardIf the profit function for selling smart phone screen magnifier is -4500p2 + 561500p – 11898000, what is the maximum profit that can be expected from selling smart phone screen magnifiers? Question 1 options: $ 0, no profit $ 5,617,681 $ 1,717,764 -$ 8,004,171arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education