Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

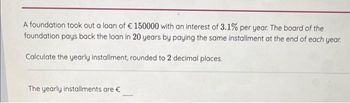

Transcribed Image Text:A foundation took out a loan of € 150000 with an interest of 3.1% per year. The board of the

foundation pays back the loan in 20 years by paying the same installment at the end of each year.

Calculate the yearly installment, rounded to 2 decimal places.

The yearly installments are €

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the amount of each payment to be made into a sinking fund which earns 8% compounded quarterly and produces $49,000 at the end of 4.5 years. Payments are made at the end of each period. The payment size is $ . (Round to the nearest cent.)arrow_forwardFor the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to amount to the financial objective (future value of the annuity). (Round your answer to the nearest cent.) Sinking Fund Payment $ 27658 x Payment Frequency every year Time Period (years) 14 Interest Nominal Rate (%) Compounded annually 8 Future Value (Objective) $750,000arrow_forwardAn endowment fund is providing an annual scholarship of P50,000 for the first five years, P60,000 for the next five years, and P90,000 thereafter. The fund will be established today and will award the first scholarship after a year. The fund earns 4.5 % annual interest. Find the present worth of this cost.arrow_forward

- How much can be paid in scholarship at the beginning of each month if $231,500 is deposited in a trust fund if interest is 5.6% compounded monthly?arrow_forwardIn a sequence of 10 annual payments of 2,000 pesos each, the first one is due at the end of 6 years. Find the present and future value of the deferred annuity if money is worth 6% compounded annually.arrow_forwardDobsen Door Manufacturer s sets up sinking fund to raise $75000 to pay off the maturity value of a three year note. If the sinking fund earns 3.8% compounded monthly how much should they set aside each month?arrow_forward

- blem #1: $10,000 is used to purchase an appropriate size annuity that has level annual payments for 18 years. The price of the annuity is based on an effective annual rate of 11.2%. As each payment is received, it is put into a fund that earns an effective annual rate of 7%. (a) Determine the accumulated value of the investment at the end of 18 years. (b) If the $10,000 were put into a fund that was to produce the same final value after 18 years, what annual effective rate would that fund have to offer?arrow_forwardUse the sinking fund formula shown to the right to determine the semiannual payments with 8% interest are compounded semiannually for 4 years to accumulate $24,000.arrow_forwardA machine has the following cash flows for the last two years of service. The MARR is 10% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. Calculate the EUAC of the machine if kept in service over the remaining two years O A. $49,600 O B. $24,929 O C. $37,500 O D. $27,500 O E. $22,100 (b) Calculate the marginal cost of the machine for year 2. OA. $37,500 O B. $22,100 OC. $24,929 O D. $27,500 O E. $49,600 Year 0 1 2 Market Value $45,000 31,000 24,000 (・・・ O&M Costs $9,000 12,000arrow_forward

- How much can be paid in scholarship at the beginning of each month if $238,500 is deposited in a trust fund if interest is 4.6% compounded monthly?arrow_forwardtrust fund for a childs education is being set up by a single payment so that at the end of 15 years there will be shs 24,000,000. If the fund earns interest at the rate of 7% compounded semi-annually how much money should be paid into the fund initially?arrow_forwardFind the periodic payment for each sinking fund that is needed to accumulate the given sum under the given conditions. (Round your answer to the nearest cent.) FV = $1,500,000, r = 4.7%, compounded semiannually for 25 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education