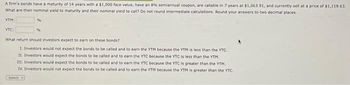

A firm's bonds have a maturity of 14 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 7 years at $1,063.91, and currently sell at a price of $1,119.63. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: YTC: % -Select- v % What return should investors expect to earn on these bonds? I. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC.

Step by stepSolved in 3 steps with 1 images

- Zero-Coupon Bonds (ZCBS) with maturity in 1 and 5 years are available on the market. Their redemption value is £100, and they sell for £90 (1-year ZCB) and £84 (5-year ZCB). Find the spot rates corresponding to the ZCBs' prices 数字 i1 = % i5 数字 Enter a percentage correct to 2 decimal places % Calculate the forward rate 1,5 i1,5 数字 Enter a percentage correct to 2 decimal places %arrow_forwardPlease solve step by step with explaarrow_forwardGive typing answer with explanation and conclusionarrow_forward

- need help on both questions , thank youarrow_forwardWhat is the price of a $1,000 par value semi-annual bond with 22 years to maturity and a coupon rate of 4.8% and a yield-to-maturity of 6.9%? (Round answer to 2 decimal places. Do not round intermediate calculations) Karrow_forwardA firm's bonds have a maturity of 12 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 6 years at $1,209.43, and currently sell at a price of $1,365.89. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? I. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. III. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC.arrow_forward

- A firm's bonds have a maturity of 8 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 4 years at $1,047.04, and currently sell at a price of $1,091.13. What is their nominal yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. What is their nominal yield to call? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwarddo not use image only typing answer fully calculation.arrow_forwardA firm's bonds have a maturity of 12 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 6 years at $1,211.14, and currently sell at a price of $1,370.78. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM.arrow_forward

- An insurance company is analyzing the following three bonds, each with five years to maturity, annual interest payments, and is using duration as its measure of interest rate risk. What is the duration of each of the three bonds? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. $10,000 par value, coupon rate=9.7%, r 0.17 b. $10,000 par value, coupon rate 11.7%, r= 0.17 c. $10,000 par value, coupon rate = 13.7%, p=0.17 Duration of the bond yearsarrow_forwardA firm's bonds have a maturity of 8 years with a $1,000 face value, have an 8% semlannual coupon, are callable in 4 years at $1,048.54, and currently sell at a price of $1,094.91. What are their nominal yield to maturity and their nominal yield to call? Do not round Intermediate calculations. Round your answers to two decimal places. YTM: YTC: What return should investors expect to earn on these bonds? I. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. II. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. IV. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. -Select-arrow_forwardQc 2.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education