Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:1

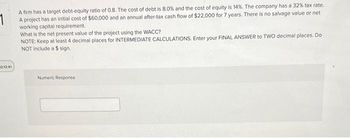

A firm has a target debt-equity ratio of 0.8. The cost of debt is 8.0% and the cost of equity is 14%. The company has a 32% tax rate.

A project has an initial cost of $60,000 and an annual after-tax cash flow of $22,000 for 7 years. There is no salvage value or net

working capital requirement.

2:12:41

What is the net present value of the project using the WACC?

NOTE: Keep at least 4 decimal places for INTERMEDIATE CALCULATIONS. Enter your FINAL ANSWER to TWO decimal places. Do

NOT include a $ sign,

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a project to produce solar water heaters. It requires a $10 million investment and offers a level after-tax cash flow of $1.64 million per year for 10 years. The opportunity cost of capital is 10.35%, which reflects the project's business risk. a. Suppose the project is financed with $4 million of debt and $6 million of equity. The interest rate is 6.55% and the marginal tax rate is 21%. An equal amount of the debt will be repaid in each year of the project's life. Calculate APV. Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole number. b. If the firm incurs issue costs of $650,000 to raise the $6 million of required equity, what will be the APV? Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole number. Negative amount should be indicated by a minus sign. a. Adjusted present value b. Adjusted present…arrow_forwardA firm is considering taking a project that will produce $12 million of revenue per year. Cash expenses will be $5 million, and depreciation expenses will be $1 million per year. If the firm takes that project, then it will reduce the cash revenues of an existing project by $3 million. What is the free cash flow on the project, per year, if the firm uses a 40 percent marginal tax rate? O$2.8 million O $2.4 million 0 $4.6 million $3.4 millionarrow_forwardCondor Company is considering an investment in a project that has an internal rate of return of 12%. The project has a 5-year useful life but has no salvage value. Cash inflows from this project are $20,000 per year in each of the 5 years. Condor uses a 14% discount rate to make capital budgeting decisions. What is the net present value of this project? O $(3,440) O $(11,340) O $6,880 O $7.900 O None of the abovearrow_forward

- A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation.a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.)arrow_forwardA project will cost $30 in year 1 and generate earnings before interest, taxes and depreciation of $20 in year 1, $15 in year 2 and $10 in year 3. The inital cost is to be linearly depreciated over three years. The company has a marginal corporate income tax rate of 21% and the appropriate unlevered cost of capital for the project is 12%. a: What is the NPV of the project if the firm is all equity-financed? b: What is the APV of the project if the firm uses $30 debt finance in the first year at an expected rate of return of 5%? The company will pay interest in years 2 and 3 and pay off the loan in year 3arrow_forward6. Lucron Corp. is considering a project that will cost $310,000 and will generate after-tax cash flows of $96,000 per year for 5 years. The firm's WACC is 12% and its target D/E ratio is 2/3. The flotation cost for debt is 4% and the flotation cost for equity is 8%. What would be the new cost of the project after adjusting for flotation costs? A) $328,390 B$329,787 $331,197 D) $329,840 E) $290,160 7. When calculating weights for the WACC, it has become relatively common to use Net Debt. How is Net Debt calculated? A) Net Debt = Total amount of debt - Cash & Risk-Free Securities B) Net Debt = Total amount of debt + Cash & Risk-Free Securities C) Net Debt = Long-term Debt - Short-term Debt D) Net Debt Short-term Debt-Long-term Debt E) Net Debt- Long-term Debt-Short-term Debt + Cash & Risk-Free Securities Please use the following information to answer the next THREE questions. LNZ Corp. is thinking about leasing equipment to make tinted lenses. This equipment would cost $3,400,000 if…arrow_forward

- A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27, 300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim a 100% bonus depreciation immediately on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation. Calculate the project NPV for each company. What is the IRR of the after-tax cash flows for each company?arrow_forwardConsider a project to produce solar water heaters. It requires a $10 million investment and offers a level after-tax cash flow of $1.68 million per year for 10 years. The opportunity cost of capital is 11.15%, which reflects the project's business risk. a. Suppose the project is financed with $4 million of debt and $6 million of equity. The interest rate is 7.15% and the marginal tax rate is 21%. An equal amount of the debt will be repaid in each year of the project's life. Calculate APV. (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number.) X Answer is complete but not entirely correct. Adjusted present value S 120,980 x b. If the firm Incurs issue costs of $610,000 to raise the $6 million of required equity, what will be the APV? (Enter your answer in dollars, not millions of dollars. Do not round Intermediate calculations. Round your answer to the nearest whole number. Negative amount shoud be…arrow_forwardUniversal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education