Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

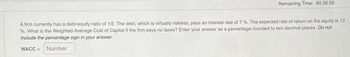

Transcribed Image Text:Remaining Time: 80:36:08

A firm currently has a debt-equity ratio of 1/2. The debt, which is virtually riskless, pays an interest rate of 7 %. The expected rate of return on the equity is 12

%. What is the Weighted-Average Cost of Capital if the firm pays no taxes? Enter your answer as a percentage rounded to two decimal places. Do not

include the percentage sign in your answer.

WACC =

Number

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that Firms U and L are in the same risk class and that both have EBIT=$500,000. Firm U uses no debt financing, and its cost of equity is rsU=14%. Firm L has $1 million of debt outstanding at a cost of rd=8%. There are no taxes. Assume that the MM assumptions hold. Graph (a) the relationships between capital costs and leverage as measured by D/V and (b) the relationship between V and D. Now assume that Firms L and U are both subject to a 40% corporate tax rate. Using the data given in Part b, repeat the analysis called for in b(1) and b(2) using assumptions from the MM model with taxes.arrow_forwardAssume the firm has a tax rate of 23 percent. c-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is Issued. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-3. Calculate the return on equity (ROE) under each of the three economic scenarios assuming the firm goes through with the recapitalization. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-4. Given the recapitalization, calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round…arrow_forwardIn the Merton model of corporate equity which is based on the Black Scholes formula, what is the quantity (S0/KT)? Assume that interest rates are zero (r=0) so the time value of money can be ignored, therefore S0 = ST. (a) Debt-to-equity ratio. (b) Debt-to-assets ratio. (c) Assets-to-debt ratio. (d) Assets-to-equity ratio. (e) Equity-to-assets ratiarrow_forward

- Compute the WACC of a firm that currently has $1 million in debt and $2 million in equity and $1 million in preferred stock. The current yield to maturity on the firms debt is 2%. Equity holders require a 6% return and preferred stock holders require a 3.8% return. The current tax rate that applies to the firm is 30%. Write your answer as a decimal.arrow_forwardPlease show proper steps thanks. All parts.arrow_forwardonly looking for parts c-1 and c-3arrow_forward

- 23) can i please get help?arrow_forwardA firm has a cost of debt of 6.6 percent and a cost of equity of 12.1 percent. The debt-equity ratio is 78. There are no taxes. What is the firm's weighted average cost of capital? Multiple Choice 10.20% 8.07% 9.69% 8.94% 8.72%arrow_forwardWhich statement is correct?a. The cost of debt is determined by taking the present value of the interest payments and principal times one minus the tax rate.b. The difference in computing the cost of capital between using the accumulated profits and issuance of new ordinary shares is the growth rate.c. Increase in flotation costs, increase in the company’s beta and increase in the expected inflation will all lead to d. increase the company’s weighted average cost of capital.e. Increasing the company’s dividend payout would mitigate the company’s need to raise new ordinary shares.f. none of the abovearrow_forward

- The assets of company X have a beta equal to 1. Assume that the company's debt has a beta equal to 0.5 and that X's equity has a beta equal to 2. Consider an investor who holds 10% of the company's total debt liabilities and 10% of the company's equity. The beta of the investor's portfolio is equal to A) 0.1 B)1 C) 0.25 D) 1.25arrow_forward4. Rivoli Inc. hired you as a consultant to help estimate its cost of capital. You have been provided with the following data: D0 = $0.80; P 0 = $25.00; and g = 8.00% ( constant). Based on the DCF approach, what is the cost of equity from retained earnings? Do not round your intermediate calculations. a . 9.85% b. 14.32% c. 11.46% d . 9.74% e. 13.17%arrow_forwardWhat is its cost of equity if there are no taxes or other imperfections? The firm has a debt-to-equity ratio of 0.60. Its cost of debt is 8%. Its overall cost of capital is 12%. A) 18% B) 14.4% C) 10%. D) 13.5%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education