Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

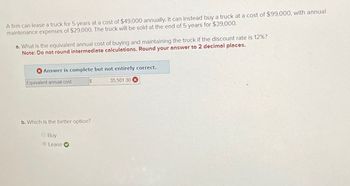

Transcribed Image Text:A firm can lease a truck for 5 years at a cost of $49,000 annually. It can instead buy a truck at a cost of $99,000, with annual

maintenance expenses of $29,000. The truck will be sold at the end of 5 years for $39,000.

a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Answer is complete but not entirely correct.

Equivalent annual cost

S

35,501.30x

b. Which is the better option?

Buy

Lease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- You are trying to decide between two mobile phone carriers. Carrier A requires you to pay$185 for the phone and then monthly charges of $54 for 24 months. Carrier B wants you to pay $105 for the phone and monthly charges of $68 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 3.9%APR, compounded monthly. Based on cost alone, which carrier should you choose? The EAA for plan A isThe EAA for plan B isThe EAA for plan C isarrow_forwardVishuarrow_forwardDeutsche Transport can lease a truck for four years at a cost of €38,000 annually. It can instead buy a truck at a cost of €88,000, with annual maintenance expenses of €18,000. The truck will be sold at the end of four years for €24,500. Ignore taxes. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Enter your answer in euros. Round your answer to the nearest whole number. b. Which is the better option: leasing or buying? a. Equivalent annual cost b. Better optionarrow_forward

- milgard barbers decides to lease another barbershop for a 5- year period. the has a cash price of $240,000. milgard borrowed money to purchase the shop, it would have had to pay 20% interest read the (use the present value and future value tables, a financial calculator, or a spreadsheet for your calculations. if using present and future value tables or the formula method, use factor amounts rounded to five decimal places. round your final answer to the nearest cent. (click the icon to view the future value of ) (click the icon to view the future value of an ordinary annuity table .) (click the icon to view the future value of an annuity due to table) a. what are the required payments if the lease agreement requires annual payments beginning one year from today? the required payments are $ B. what are the required payments if the lease agreement requires semiannual payments beginning six months from the required payments are. C. what are the required payments if the lease agreement…arrow_forwardYou went to the car dealer to lease a car. The car is valued at $30,000 and you can drive away without putting any money down. The dealer offers you a 5 year lease with a $5,000 residual payment at the end if you want to buy the car. Assuming monthly payments of $508.32, what is the implied APR? Your answer should be close to a round number. Use a % symbol and round to the nearest 1 decimal point.....3.0% would be the form of a correct answer.arrow_forwardAssume the car can be purchased for 0% down for 60 months (in lieu of rebate). A car with a sticker price of $36,500 with factory and dealer rebates of $4,200 (a) Find the monthly payment if financed for 60 months at 0% APR. (Round your answer to the nearest cent.)$ (b) Find the monthly payment if financed at 2.5% add-on interest for 60 months. (Round your answer to the nearest cent.)$ (c) Use the APR approximation formula to find the APR for part (b). (Round your answer to one decimal place.)%(d) State whether the 0% APR or the 2.5% add-on rate should be preferred.arrow_forward

- Suppose you obtain a five-year lease for a Porsche and negotiate a selling price of $157,000. the annual interest-rate is 8.4%, the residual value is $76,000, and you make a down payment of $5000. Find each of the following. A) the net capitalized cost B) the money factor (round to 4 decimal places) C) the average monthly finance charge (round to the nearest cent) D) the average monthly depreciation (round to the nearest cent) and E) the monthly lease amount (round to the nearest cent)arrow_forwardalso find the monthly paymentarrow_forwardCalculate how much money a prospective homeowner would need for closing costs on a house that costs $190,000. Calculate based on a 15 percent down payment, 1.3 discount points on the loan, a 1.2 point origination fee, and $820 in other fees. The closing costs would be $. (Round to the nearest dollar.)arrow_forward

- Vaughn Excavating Inc. is purchasing a bulldozer. The equipment has a price of $97,600. The manufacturer has offered a payment plan that would allow Vaughn to make 10 equal annual payments of $15.883.95, with the first payment due one year after the purchase. x Your answer is incorrect. How much total interest will Vaughn pay on this payment plan? (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal places, eg. 458.5811 Total interest 501877 Your answer is partially correct. Vaughncould borrow $97,600 from its bank to finance the purchase at an annual rate of 9% Click here to view factor tables Should Vaughn borrow from the bank or use the manufacturer's payment plan to pay for the equipment? (Round factor values to decimal places, s 1.25124 and final answer to O decimal places, eg 7%) 15.00 % Manufacturer's rate from the Daarrow_forwarda. Renting a machine will need monthly payments of $6,000 for the next 5 years (i.e., at t = 1, 2, …, 60). However,if we choose to buy the machine today,which is (t = 0) will cost $320,000. Assume the machine's value is zero after 5 years. It is possible to borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would it be better to buy or to lease? Explain. b.We are currently at year 0. It is worthy to note that there is a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Evaluate the present value of this perpetuity. c.Assume the CAPM is valid.The return on asset ABC is perfectly correlated with the return on market portfolio. Your friend makes the following statetment: a portfolio that had a dollar invested and at the same time,shorting one dollar of the market portfolio will have no systematic risk. Comment on this and whether it is feasible.arrow_forwardA house that you are interested in has the following facts listed online: Price = $214,000 APR = 1.15% Down Payment must be 9.5% Loan time frame is 35 years The Loan you must take out is 193670 What is the Monthly price you must pay on this house.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education