FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

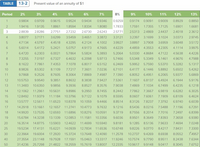

Transcribed Image Text:## Present Value of an Annuity of $1 (Table 13-2)

### Overview

This table displays the present value of an annuity of $1, given different interest rates and time periods. The values in the table are important for financial calculations, particularly for determining how much a series of future payments is worth in today's dollars.

### Table Description

The table lists periods from 1 to 50 in rows, and interest rates ranging from 2% to 13% in columns. The intersection of each row and column gives the present value of an annuity of $1 for a particular period and interest rate.

### How to Use the Table

- **Period:** Represents the duration (in years) for which the annuity is received.

- **Interest Rate Columns:** Lists the interest rates from 2% to 13%.

- **Present Value:** The numerical value at the intersection of the period row and interest rate column represents the present value of an annuity of $1 for that duration and interest rate.

### Example

- **Period:** 1 year

- **Interest Rate:** 8%

- **Present Value:** 0.9259

This means that the present value of receiving $1 annually for 1 year at an 8% interest rate is $0.9259 today.

### Detailed Example

- **Period:** 3 years

- **Interest Rate:** 6%

- **Present Value:** 2.6730

This indicates that the present value of receiving $1 annually for 3 years at a 6% interest rate is $2.6730 today.

### Graphs and Diagrams

This table is purely numerical and does not contain any graphical representations. If one were to create a graph based on this data, it would typically display the relationship between the interest rates and the present values over different periods of time.

Such a graph might show:

- **X-axis:** Periods (1 to 50 years)

- **Y-axis:** Present Value of an annuity of $1

- **Lines or curves:** Representing different interest rates (2% to 13%)

This table is a powerful tool for financial professionals and students alike, helping to simplify complex calculations involved in determining the present value of future cash flows.

![### Land Sale Offers: Morton Company vs. Flynn Company

**Scenario:**

Mike Macaro is selling a piece of land. He has received two offers, each with different payment structures. Here's a detailed breakdown of the offers:

**Offers:**

1. **Morton Company**

- Down payment: $48,000

- Annual payment: $35,800 for the next 4 years

2. **Flynn Company**

- Down payment: $29,000

- Annual payment: $38,800 for the next 4 years

**Assumption:**

- Money can be invested at 9% compounded annually.

- Reference table: [Table 13.2]

### Questions:

**a. What is the value of these offers?**

*(Do not round intermediate calculations. Round your answers to the nearest cent.)*

Below is the table for recording the computed values:

| Company | Value |

|-------------------|--------------|

| Morton Company | |

| Flynn Company | |

**b. Which offer is better for Mike?**

- Morton Company

- Flynn Company

**Graph/Diagram Explanation:**

The diagram provides a comparative table and visual for transcribing the offers’ values. Additionally, it outlines the option selection for determining the better financial offer for Mike based on computed values from the given interest rate and payment structures.](https://content.bartleby.com/qna-images/question/84e09e5b-10a3-44ad-9aa5-0e7c6771312d/4fa90f39-3f1f-4d73-9018-59a26d094d16/ybf10pl_thumbnail.png)

Transcribed Image Text:### Land Sale Offers: Morton Company vs. Flynn Company

**Scenario:**

Mike Macaro is selling a piece of land. He has received two offers, each with different payment structures. Here's a detailed breakdown of the offers:

**Offers:**

1. **Morton Company**

- Down payment: $48,000

- Annual payment: $35,800 for the next 4 years

2. **Flynn Company**

- Down payment: $29,000

- Annual payment: $38,800 for the next 4 years

**Assumption:**

- Money can be invested at 9% compounded annually.

- Reference table: [Table 13.2]

### Questions:

**a. What is the value of these offers?**

*(Do not round intermediate calculations. Round your answers to the nearest cent.)*

Below is the table for recording the computed values:

| Company | Value |

|-------------------|--------------|

| Morton Company | |

| Flynn Company | |

**b. Which offer is better for Mike?**

- Morton Company

- Flynn Company

**Graph/Diagram Explanation:**

The diagram provides a comparative table and visual for transcribing the offers’ values. Additionally, it outlines the option selection for determining the better financial offer for Mike based on computed values from the given interest rate and payment structures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A local entreprenuer asks you to invest $10,000 in a business venture. Based on your estimate, you would receive nothing for three years at the end of the four you would receive $4900, and at the end of year five you would receive $14500. If you estimates are correct, what would be the IRR on this investmenet?arrow_forwardYou went to the car dealer to lease a car. The car is valued at $30,000 and you can drive away without putting any money down. The dealer offers you a 5 year lease with a $5,000 residual payment at the end if you want to buy the car. Assuming monthly payments of $508.32, what is the implied APR? Your answer should be close to a round number. Use a % symbol and round to the nearest 1 decimal point.....3.0% would be the form of a correct answer.arrow_forwardCc. 177.arrow_forward

- Please answer this question in a comprehensive and detailed manner with step by step solution. Reject any form of excel's sheet answer format. Just do it manually.arrow_forwardYour uncle offers you a choice of $106,000 in 10 years or $43,000 today. Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. If money is discounted at 9 percent, what is the present value of the $106,000? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value a-2. Which offer should you choose? $106,000 after 10 years O $43,000 todayarrow_forwardYou have been offered a contract from Comp Co. You will receive $120,000 up front from Comp Co. In exchange, you will provide $50,000 in services each year for 3 years. Your cost of capital is 10%. Find the NPV and IRR of the deal. Should you accept the contract? Explain.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward7. What is the payback period? ?arrow_forwardInvestment X offers to pay you $5,400 per year for 9 years, whereas Investment Y offers to pay you $7,500 per year for 5 years. If the discount rate is 6 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) If the discount rate is 21 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Bill Padley expects to invest $6,000 for 3 years, after which he wants to receive $6,945.60. What rate of interest must Padley earn? (PV of $1. EV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Present Value Table Factor Interest Rate %arrow_forwardWhat excel function do I use? Or is there a equation? I tried referring to the other answer on bartleby but it is wrongarrow_forwardYou agree to purchase a car with a competitive value of $44,500 for the following loan contract: Purchase the car for $44,250 with $2,000 down and borrow the remainder over 5 years with monthly payments based on a rate of interest of 6.6%. Your market rate of return is 5.25%. How much value did you destroy with this purchase? (Round to dollars and cents; round the car payment to dollars and cents.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education