ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

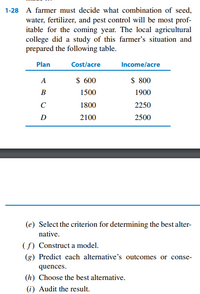

Transcribed Image Text:1-28 A farmer must decide what combination of seed,

water, fertilizer, and pest control will be most prof-

itable for the coming year. The local agricultural

college did a study of this farmer's situation and

prepared the following table.

Plan

Cost/acre

Income/acre

A

$ 600

$ 800

В

1500

1900

C

1800

2250

D

2100

2500

(e) Select the criterion for determining the best alter-

native.

(f) Construct a model.

(g) Predict each alternative's outcomes or conse-

quences.

(h) Choose the best alternative.

(i) Audit the result.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- CS 9 Economics engineering economic analysisarrow_forwardThe cash flows for the following four alternatives are given below. You may assume the benefits occur throughout the year rather than just at the end of the year. Based upon payback period, the alternative that should be selected is given by the following option: Year A B C D 0 -$1000 -$900 -$950 -$2783 1 200 100 350 1200 2 200 200 350 1200 3 1200 300 350 1200 4 1200 300 350 1200 5 1200 700 350 1200 Group of answer choices B C A Select none Darrow_forwardAssume that someone have to pay tuition for four years. Two years at RCC school and then two years at Northeastern University. Two years at RCC cost $25000 for Two years at Northeastern University $144000 That person then get a fulltime engineering job for $90000/yr. What is that person own simple payback period and his/her ROI for paying for school in order to get that Engineering job?arrow_forward

- 2-8 Consider the accompanying breakeven graph for an investment, and answer the following questions as they pertain to the graph. Euros (x104) €40r 585850 35 30 25 20 15 10 s 0 Total Revenue Total Cost 250 500 750 1000 1250 1500 1750 Output (units/year) Give the equation to describe total revenue for x units per year. (b) Give the equation to describe total costs for x units per year. (c) What is the "breakeven" level of x in terms of costs and revenues? (d) If you sell 1500 units this year, will you have a profit or loss? How much?arrow_forwardA series of alternative projects have the following series of discount annualized costs and benefits. Which project is your best choice? What is your second-best choice? Please list your calculation details. Project Alternative A B C D E Present Value of Benefits 100 160 90 70 180 Present Value of Costs 60 90 40 30 120arrow_forwardQuestion 3 For the following cash flows, calculate the annual worth using 10% per year Year 1 2 3 4 Cash Flow, S - 605 100 175 250 325 O A.S 17.23 O B.$ 7.12 OC.S 12.73 O D.S 21.73 O E.S -12.44 A Moving to the next question prevents changes to this answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education