ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

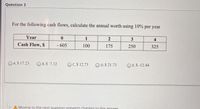

Transcribed Image Text:Question 3

For the following cash flows, calculate the annual worth using 10% per year

Year

1

2

3

4

Cash Flow, S

- 605

100

175

250

325

O A.S 17.23

O B.$ 7.12

OC.S 12.73

O D.S 21.73

O E.S -12.44

A Moving to the next question prevents changes to this answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 2 Income from recycling the paper and cardboard generated in an office building has averaged $4000 per month for the past 6 years. What is the income stream’s future worth at an interest rate of 9% per year, compounded quarterly? Full explain this question and text typing work only plz help me.arrow_forwardK Consider the following two mutually exclusive projects. Net Cash Flow End of year Project A Project B 0 - $1,400 - $1,400 1 $960 $292 $720 $584 $480 $876 $240 $1,168 2 3 4 Click the icon to view the interest factors for discrete compounding when i = 25% per year. (a) At an interest rate of 25%, which project would you recommend choosing? The present worth of Project A is S (Round to the nearest cent)arrow_forwardPlease determine the equal cash flow A (from 1 to 5) for the cash flows provided below when considering at interest of 10% Net cash flow 500 500 500 ZorN3 4 5arrow_forward

- An engineer on the is planning to retire in 10 years. She has accumulated savings of $450,000 that are in an account paying 7% interest compounded quarterly. If she makes no more deposits , how much would her retirement savings be when she retires? O $900,719 O $885,215 O $765,000 O $1,000,750arrow_forwardAnswer the twitter questions please. 3-17 and 3-35 show detail calculation and explanationarrow_forwardA small gold mine yielded an equipment of Php. 500,00.00 during its first year of operation. Php 460,000.00 on its second year, and amount decreasing by Php. 40,000.00 every year, what is its equivalent annual yield if interest rate is 10%? Pls include the cash flow diagramarrow_forward

- b. Mrs. Jones plans to save $750 a month for the next 10 years,at 10% per year, compounded monthly. How much moneywill she have at the end of 10 years?? include a non-excel cashflowarrow_forwardIn the accompanying diagram, what is the value of K on the left-hand cash-flow diagram that is equivalent to the right-hand cash-flow diagram? Let i = 12% per year pls show manual solution and pls write legibly thank youarrow_forwardhelparrow_forward

- Suppose your parents have decided that after your graduation at the end of the year they would start to save money to help pay for your younger sister to attend University to study Food Process Engineering. They plan to save money for 5 years before she starts college and to save during her university years. They plan to contribute GH¢4,000 per year at the start of each of her 4 university years. Your parents would thus make monthly payments for 8 years, 5 year prior to and 3 during your sister's university education. The monthly interest rate earned on their savings is 0.45%. How much must the monthly savings be under this condition?arrow_forwardPlease no written by hand solutionarrow_forwardGiven the cash flows in table below. Determine the value of P. i= 6% per year Year 0 1 2 3 4 5 Cash Flow -P 400 800 1200 1600 1800 Group of answer choices $4709.14 $6125.15 $5125.63 $4978.23arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education