ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

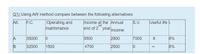

Transcribed Image Text:Q1) Using AW method compare between the following alternatives:

Operating and

maintenance

Alt.

S.V.

Useful life i.

Income at the Annual

nd

end of 2 year

F.C.

Income

A

35000

3500

2800

7000

8

8%

32000

1500

4700

2500

8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A solid-waste recycling plant is considering two types of storage bins. Use ROR evaluation and an MARR of 46% per year to determine which should be selected. Storage Bin First Cost, $ AOC, $ per Year Salvage Value, $ Life, Years P -24,000 -4000 1800 3 Q -35,000 -2000 2600 6 Since A/* is (Click to select) MARR of 46%, (Click to select) should be selected.arrow_forward12:42 PM 74 Coal 4 to 9 Natural gas Wind 4 to 10.5 8.6 4.8 to 9.1 8.2 4.5 to 15.5 8.8 Solar National average cost of electricity to residential custom- ers: 11e/kWh 46% utilizes coal and natural gas as the primary fuel source. What about the ethical aspects of the govemment's allow- ance for these plants to continue polluting the atmosphere with the emissions that may cause health problems for citizens and further the effects of global warming? What types of regulations, if any, should be developed for PEC (and other generators) to follow in the future? 3. You developed an interest in the LEC relation and the publicized cost of electricity of 10.27e/kWh for this year. You wonder if the addition of 60 MW of wind-sourced electricity will make any difference in the LEC value for this next year. You did learn the following: This is year 11 for LEC computation purposes 1-25 years i=5% per year Case Study E-5.052 billion kWh 57 LEC last year was 10.22 e/kWh (last year's breakeven cost to…arrow_forwardPlz read carefully questions and then answer don't copy other answerarrow_forward

- Q1).Using AW method compare between the following alternatives: Operating and maintenance Alt. F.C. Income at the Annual nd S.V. Useful life i. end of 2 yearIncome A 35000 3500 2800 7000 8 8% B. 32000 1500 4700 2500 8%arrow_forwardFrom the data shown, determine the ESL of the asset. (Note: Values in the table are AW values, not individual year end values.) AW of First Cost, $ AW of Salvage Value, $ AW of Operating Cost, $ -48000 164000 99,000 -36000 38,095 47000 18,127 -53000 6464 49000 3276 Years Retained 1 2 3 4 5 The ESL of the asset is year(s). -148000 -162000 134000 154000arrow_forwardwhich process line should be built for a new chemical? the expected market for the chemical is 16 years. an 18% rate is used to evaluate new process facilities, which are compared with present worth. how much does the better choice save? First cost O &M cost/year salvage life A $14 M $2.5 M $2 M 8 years B 22 M 3 M 7.5 M 16 yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education