FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

want the correct answer please provide it

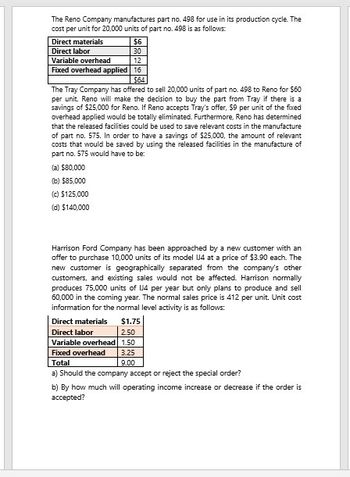

Transcribed Image Text:The Reno Company manufactures part no. 498 for use in its production cycle. The

cost per unit for 20,000 units of part no. 498 is as follows:

Direct materials

Direct labor

Variable overhead

Fixed overhead applied

$6

30

12

16

$64

The Tray Company has offered to sell 20,000 units of part no. 498 to Reno for $60

per unit. Reno will make the decision to buy the part from Tray if there is a

savings of $25,000 for Reno. If Reno accepts Tray's offer, $9 per unit of the fixed

overhead applied would be totally eliminated. Furthermore, Reno has determined

that the released facilities could be used to save relevant costs in the manufacture

of part no. 575. In order to have a savings of $25,000, the amount of relevant

costs that would be saved by using the released facilities in the manufacture of

part no. 575 would have to be:

(a) $80,000

(b) $85,000

(c) $125,000

(d) $140,000

Harrison Ford Company has been approached by a new customer with an

offer to purchase 10,000 units of its model U4 at a price of $3.90 each. The

new customer is geographically separated from the company's other

customers, and existing sales would not be affected. Harrison normally

produces 75,000 units of 14 per year but only plans to produce and sell

60,000 in the coming year. The normal sales price is 412 per unit. Unit cost

information for the normal level activity is as follows:

Direct materials

Direct labor

$1.75

2.50

Variable overhead 1.50

Fixed overhead

Total

3.25

9.00

a) Should the company accept or reject the special order?

b) By how much will operating income increase or decrease if the order is

accepted?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education