FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:es

-

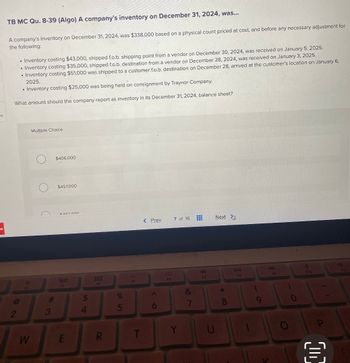

TB MC Qu. 8-39 (Algo) A company's inventory on December 31, 2024, was...

A company's inventory on December 31, 2024, was $338,000 based on a physical count priced at cost, and before any necessary adjustment for

the following:

• Inventory costing $43,000, shipped f.o.b. shipping point from a vendor on December 30, 2024, was received on January 5, 2025.

• Inventory costing $35,000, shipped f.o.b. destination from a vendor on December 28, 2024, was received on January 3, 2025.

• Inventory costing $51,000 was shipped to a customer f.o.b. destination on December 28, arrived at the customer's location on January 6,

2025.

• Inventory costing $25,000 was being held on consignment by Traynor Company.

What amount should the company report as inventory in its December 31, 2024, balance sheet?

W

Multiple Choice

#

3

$406,000

$457,000

#103.000

20

F3

E

$

4

F4

R

%

5

F5

T

< Prev 7 of 16

6

87

&

K

F7

U

Next

* CO

8

DII

F8

1

9

F9

1

O

0

J

F10

{}

41

FIL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waterway Inc. uses a perpetual inventory system. At January 1, 2020, inventory was $211,257,900 at both cost and realizable value. At December 31, 2020, the inventory was $286,249,300 at cost and $262,969,900 at realizable value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method (b) Loss method.arrow_forwardYou have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardA company's inventory on December 31, 2024, was $247,000 based on a physical count priced at cost, and before any necessary adjustment for the following: Inventory costing $ 12,000, shipped f.o. b. shipping point from a vendor on December 30, 2024, was received on January 5, 2025. Inventory costing $14, 000, shipped f.o. b. destination from a vendor on December 28, 2024, was received on January 3, 2025. Inventory costing $70,000 was shipped to a customer f.o. b. destination on December 28, arrived at the customer's location on January 6, 2025. Inventory costing $54,000 was being held on consignment by another company. What amount should the company report as inventory in its December 31, 2024, balance sheet? Please explain your answer in detail of why you included or excluded?arrow_forward

- Seiz Company used perpetual inventory system to record inventory transactions for 2021. Inventory P 1,900,000 Sales 6,500,000 Sales returns 150,000 Cost of goods sold 4,600,000 Inventory losses 120,000 On December 24, the entity recorded a P 150,000 credit sales of goods costing P 100,000. These goods were sold on FOB destination point terms and were in transit on December 31. The goods were included in the physical count. The inventory on December 31 determined by physical count has a cost of P 2,000,000 and a net realizable value of P 1,700,000. Any inventory writedown is not yet recorded. What amount should be reported as Cost of Goods Sold for 2020? a. 5,020,000 b. 4,500,000 c. 4,720,000 d. 4,920,000arrow_forwardDuring January 2019, Marta Company, which maintains a perpetual inventory system, recorded the following information pertaining to its inventory: Units Unit Cost Bal. 1/1/19 Purchased on 1/4/19 Sold on 1/20/18 Purchased on 1/25/18 Under the moving average method, what amount should Metro report as Cost of Sales on January 1,000 40 600 @ 120 900 400 @ 200 31,arrow_forward1. At the beginning of September 2020, Bonita company reported inventory of 8200. During the month, the company purchases of 35900. At September 30 2020, a physical count of inventory reported 8600 on hand. Cost of goods solids for the month is ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education