FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

1. At the beginning of September 2020, Bonita company reported inventory of 8200. During the month, the company purchases of 35900. At September 30 2020, a physical count of inventory reported 8600 on hand. Cost of goods solids for the month is ?

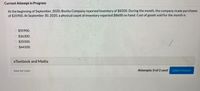

Transcribed Image Text:Current Attempt in Progress

At the beginning of September, 2020, Bonita Company reported Inventory of $8200. During the month, the company made purchases

of $35900. At September 30, 2020, a physical count of inventory reported $8600 on hand. Cost of goods sold for the month is

O $35900.

O $36300.

O $35500.

$44100.

eTextbook and Media

Save for Later

Attempts: 0 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Calculate January's ending inventory and cost of goods sold for the month using FIFO, periodic system.arrow_forwardHaresharrow_forwardAltira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand-3,300 units; cost $7.40 each. 8 Purchased 16,500 units for $6.80 each. 14 Sold 13,200 units for $13.30 each. 18 Purchased 9,900 units for $6.20 each. 25 Sold 12,200 units for $12.30 each. 28 Purchased 5,300 units for $5.80 each. 31 Inventory on hand-9,600 units. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using last-in, first-out (LIFO). Perpetual LIFO: Beg. Inventory Purchases: August 8 August 18 August 28 Total Cost of Goods Available for Sale Cost per unit 3,300 $7.40 $ # of units 16,500 6.80 9,900 6.20 5.8 5,300 35,000 Cost of Goods Available for Sale $ 24,420 112,200 61,380 30,740 228,740 Cost of Goods Sold - August 14 # of units sold 0 Cost per unit Cost…arrow_forward

- The beginning inventory was 490 units at a cost of $8 per unit. Goods available for sale during the year were 1, 870 units at a total cost of $16,930. In May, 790 units were purchased at a total cost of $7,110. The only other purchase transaction occurred during October. Ending inventory was 835 units. Required: Calculate the number of units purchased in October and the cost per unit purchased in October. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method.arrow_forwardLuke's Lamps had a beginning inventory January 1, 2020 of $970,000. They sold goods that cost $770,000 and purchased $300,000 during the month. What should Luke expect its ending inventory balance is at the end of month (January 31, 2020)? a. $1,770,000 b. $500,000 c. $300,000 d. $1,270,000arrow_forwardDuring 2021, a company sells 280 units of inventory for $89 each. The company has the following inventory purchase transactions for 2021: Number of Units 69 169 189 Unit Cost $64 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase Total Cost $ 4,416 10,985 12,663 $28,064 65 67 427 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Ending inventory %24 147 Cost of goods soldarrow_forward

- 2. Calculate January's ending inventory and cost of goods sold for the month using LIFO, periodic system.arrow_forwardLinden Watch Company reported the following income statement data for a 2-year period 2019 2020 Sales $280,000 $320,000 Cost of goods sold Beginning inventory 32,000 44,000 Cost of goods purchased 193,000 225,000 Cost of goods available for sale 225,000 269,000 Ending inventory 44,000 52,000 Cost of goods sold 181,000 217,000 Gross profit $ 99,000 $103,000 Linden uses a periodic inventory system. The inventories on January 1, 2019, and December 31, 2020, are correct. However, the ending inventory on December 31, 2019, was overstated by $5,000.arrow_forwardA small firm has a beginning inventory of $52,000 as of January 1, 2020, and the following accounting information. Month Ending Inventory Cost of Goods Sold January 2020 $75,000 $225,000 February 2020 $56,000 $325,000 March 2020 $25,000 $240,000 April 2020 $85,000 $325,000 May 2020 $125,000 $460,000 June 2020 $95,000 $220,000 July 2020 $72,000 $85,000 August 2020 $45,000 $156,000 September 2020 $52,500 $220,000 October 2020 $120,000 $265,000 November 2020 $162,500 $100,000 December 2020 $255,000 $350,000 Compute the monthly inventory turnover ratio for each of the twelve months. What are the annual cost of goods sold and the average inventory for the year? Compute the annual inventory turnover ratio. What can the purchasing department do to improve the firm’s performance?arrow_forward

- Gadubhaiarrow_forwardDuring 2021, a company sells 356 units of inventory for $93 each. The company has the following inventory purchase transactions for 2021: Number of Units 61 Unit Cost Total Cost $61 63 Date Transaction Jan. 1 Beginning inventory May 5 Purchase Nov. 3 Purchase $ 3,721 10,269 12,078 $26,068 163 183 66 407 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses LIFO. Ending inventory Cost of goods soldarrow_forwardA company has beginning inventory for the year of $14,500. During the year, the company purchases inventory for $190,000 and ends the year with $21,000 of inventory. The company will report cost of goods sold equal to: Multiple Choice $211,000. $190,000. $196,500. $183,500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education