FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

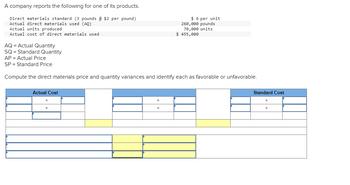

Transcribed Image Text:A company reports the following for one of its products.

Direct materials standard (3 pounds @ $2 per pound)

Actual direct materials used (AQ)

Actual units produced

Actual cost of direct materials used

AQ = Actual Quantity

SQ = Standard Quantity

AP = Actual Price

SP = Standard Price

Actual Cost

$6 per unit

X

260,000 pounds

70,000 units

Compute the direct materials price and quantity variances and identify each as favorable or unfavorable.

$ 455,000

Standard Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direct materials information Standard pounds per unit..... Standard price per pound... Actual quantity purchased and used per unit ...... Actual price paid for material per pound.. Direct materials price variance..... Direct materials quantity variance.... Total direct material variance.. Number of units produced Medium speed Large speed bump bump $ $ 15 1.00 $ ? 1.80 $ $1,120 U 100 F ? 100 ? 1.80 16 2.10 $1,920 U ? $480 U 400arrow_forwardA company reports the following for one of its products. Direct materials standard (4 pounds @ $2 per pound) Actual direct materials used (AQ) Actual units produced Actual cost of direct materials used AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Actual Cost Compute the direct materials price and quantity variances and identify each as favorable or unfavorable. X X X $ 8 per unit 340,000 pounds 72,000 units X $ 612,000 Standard Cost X Xarrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 2,800 actual units of product are as follows: Standard CostsDirect materials 1,040 kilograms at $8.51 Actual CostsDirect materials 2,800 kilograms at $8.05 The direct materials price variance is a. $478 favorable b. $478 unfavorable c. $1,288 favorable d. $1,288 unfavorablearrow_forward

- Rancho Cucamonga Inc. established the following direct materials and direct labor standards for its product. Item Price Quantity Total Direct materials $2 3 lbs $6 Direct labor $6 2 hrs $12 The firm expected to make, and made, ten (10) units of finished goods inventory. Use the table above to complete the following direct materials variance table and to answer the following questions: Complete the following direct materials variance table. The left column reports the actual cost data and has been completed for you. Direct Materials Variances Actual Price x Actual Quantity Standard Price x Actual Quantity $3lb x (4lbs x 10 units) = $120 $ _x (_ x _) = $_ Report the variance and indicate each variance as either favorable "F" or unfavorable "U" (for example, 30U). Do not include dollar signs or spaces. Direct materials quantity variance $___ Direct materials price variance $ ___ Total direct materials variance $___arrow_forward9arrow_forwardanswerarrow_forward

- Acme Inc. has the following information available: Actual price paid for material Standard price for material Actual quantity purchased and used in production Standard quantity for units produced Actual labor rate per hour Standard labor rate per hour Actual hours Standard hours for units produced Variance Material Price NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F" (for Favorable) or "U" (for Unfavorable) - capital letter and no quotes. Complete the following table of variances and their conditions: Material Quantity Total DM Cost Variance Labor Rate Labor Efficiency Total DL Cost Variance $1.00 $0.90 100 90 15 14 Variance Amount $ $ 200 190 Favorable (F) or Unfavorable (U)arrow_forwardSunny Corporation has collected the following data for one of its products: Direct materials standard (3 pounds per unit @ $0.40/lb.) Actual direct materials purchased Actual Direct Materials Used (AQU) Actual Price (AP) paid per pound How much is the direct materials price variance? O A. $1,610 unfavorable B. $2,240 favorable C. $1,610 favorable O D. $2,240 unfavorable $1.20 per finished good 32,000 pounds 23,000 pounds $0.47arrow_forwardPreparing a standard cost income statement Use the following information to prepare a standard cost income statement for Whitmer Company for 2021. Cost of Goods Sold at standard $ 367,000 Direct Labor Efficiency Variance $ 18,000 F Sales Revenue at standard 550,000 Variable Overhead Efficiency Variance 3,400 U Direct Materials Cost Variance 8,000 U Fixed Overhead Volume Variance 12,000 F Direct Materials Efficiency Variance 2,800 U Selling and Administrative Expenses 77,000 Direct Labor Cost Variance 42,000 U Variable Overhead Cost Variance 700 F Fixed Overhead Cost Variance 1,900 Farrow_forward

- Please do not give solution in image format thankuarrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 2,300 actual units of product are as follows: Standard Costs Direct materials Direct materials Actual Costs The direct materials price variance is Oa. $166 unfavorable Ob. $368 favorable Oc. $166 favorable Od. $368 unfavorable 1,040 kilograms at $8.51 2,300 kilograms at $8.35arrow_forwardZillow Inc. has the following data related to direct materials costs for the current month: actual cost for 7,000 pounds of material at $2.50 per pound and standard cost for 6,700 pounds of material at $3.20 per pound. What is the direct materials quantity or efficiency variance? Group of answer choices -$4,900 favorable $4,900 unfavorable $960 unfavorable -$960 favorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education