FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

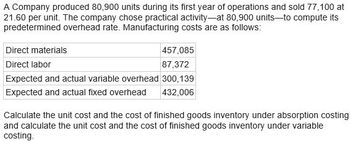

Transcribed Image Text:A Company produced 80,900 units during its first year of operations and sold 77,100 at

21.60 per unit. The company chose practical activity-at 80,900 units to compute its

predetermined overhead rate. Manufacturing costs are as follows:

Direct materials

Direct labor

Expected and actual variable overhead

Expected and actual fixed overhead

457,085

87,372

300,139

432,006

Calculate the unit cost and the cost of finished goods inventory under absorption costing

and calculate the unit cost and the cost of finished goods inventory under variable

costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Compute the product margins for the XT-100 and LT-200 under the company’s traditional costing system. 2. Compute the product margins for XT-100 and LT-200 under the activity-based costing system.arrow_forwardOlmo, Incorporated, manufactures and sells two products: Product KO and Product H9. The annual production and sales of Product of KO is 900 units and of Product H9 is 900 units. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Activity Cost Pools Labor-related Production orders: Order size Activity Measures DLHS orders MHS Estimated Overhead Cost $ 550, 208 53, 219 835,816 $ 1,439, 243 Expected Activity Product Ke Product H 5,400 1,000 3,100 2,700 600 4,000 Total 8,100 1,690 7,100 The overhead applied to each unit of Product H9 under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardSultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Labor-related Purchase orders Parts management Board etching General factory Activity Measure Direct labor-hours Number of orders Number of part types Number of boards Machine-hours Expected Overhead Cost $ 284,000 $ 6,790 $ 71,340 $ 57,900 $ 229,900 Product A 3,000 43 22 530 3,600 Expected Activity 35,500 DLHS Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: 194 orders 82 part types 1,930 boards 20,900 MHs Expected Activity Product B 22,800 Activity Cost Pool Product C Product D 3,900 5,800 Labor-related (DLHS) Purchase orders (orders) 20 48 83 Parts management (part types) 15 32 13 Board etching (boards) 750 650 0 General factory (MHS) 7,300 3,900 6,100 Using the…arrow_forward

- Koontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz’s controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 Sales $ 3,000,000 $ 2,000,000 $ 5,000,000 Cost of goods sold 2,300,000 1,350,000 3,650,000 Gross margin 700,000 650,000 1,350,000 Selling and administrative expenses 720,000 480,000 1,200,000 Net operating income (loss) $ (20,000) $ 170,000 $ 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead…arrow_forwardDhapaarrow_forward2.A company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $82,749 and the cost drivers for Product 1 is 359 and 282 for Product 2. The assembling activity pool has estimated costs of $63,039 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 497and 303 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting? Round your final answer to the nearest whole dollar and do not put a dollar sign in your answer.arrow_forward

- Windsor Company uses activity-based costing to determine product costs. Some of the entries have been completed to the manufacturing overhead account for the current year, as shown by entry (a) below: Manufacturing Overhead (a) 2,341,000 Required: 1. What does entry (a) represent? multiple choice Machine-hours Actual manufacturing overhead cost incurred Overhead applied 2. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Activity Measure EstimatedOverhead Cost Expected Activity Labour related Direct labour-hours $ 585,000 39,000 DLHs Purchase orders Number of orders 46,500 1,500 orders Parts management Number of part types 357,000 403 part types Board etching Number of boards 450,000 1,990 boards General factory Machine-hours 656,910 81,100 MHs Compute the activity rate (i.e., predetermined overhead rate)…arrow_forwardA company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $84,399 and the cost drivers for Product 1 is 200 and 500 for Product 2. The assembling activity pool has estimated costs of $65,366 and the cost drivers for Product 1 is 350 and 275 for Product 2. Direct labor hours for Product 1 is 323 and 371 for Product 2. What is the total manufacturing overhead rate to be used under traditional cost accounting?arrow_forwardPlease answer the multiple-choice question.arrow_forward

- Feauto Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, 163E and E761, about which it has provided the following data: I63E E76I $22.20 $66.60 $17.50 $ 52.50 Direct labor-hours per unit 0.50 84,000 Annual production (units) 1.50 28,000 The company's estimated total manufacturing overhead for the year is $3,141,600 and the company's estimated total direct labor-hours for the year is 84,000. The company is considering using a form of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Direct materials per unit Direct labor per unit Activities and Activity Measures Assembling products (direct labor-hours) Preparing batches (batches) Product support (product variations) Total Direct labor-hours Batches Product variations…arrow_forwardGodiva company has two products, A and B. The company uses activity-based costing to allocate overhead costs of $100,000. Data relating to the company's activity pools for the current year are given below: Cost Pool Total cost in Total Number of Activity Measures Used Cost Pool Product A Product B Total Activity 1 $42,000 100 200 300 Activity 2 $10,000 20 5 25 Activity 3 $48,000 3,000 3,000 6,000 Compute the activity rate (allocation rate) for Activity 2: $500 $2,000 $400 $140arrow_forwardThe following are standard costs related to a product of Jacobs, SRL: Inputs: Unit of Input Units per item Price or rate Direct Materials: square feet 80 $22/square foot Direct Labor: direct labor hours 24 $38/direct labor hour Variable Overhead: direct labor hours $49/direct labor hour The company applies variable overhead on the basis of direct labor hours. In April, the following results were reported: Actual output: 506 items Raw Materials used: 45,684 square feet Raw Material purchased: 42,335 square feet Actual direct labor hours: 14,168 hours Actual cost of raw materials purchased: $973,705 Actual direct labor cost: $609,224 Actual variable overhead cost: $665,896 The direct material purchases variance is computed when the materials are purchased. Determine each of the following variances and whether they are favorable or unfavorable: Part 1: Direct Material quantity variance: 114,488 Unfavorable 114,488 Favorable 83,145 Favorable 83, 145…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education