FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

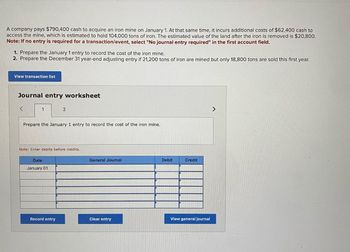

Transcribed Image Text:A company pays $790,400 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $62,400 cash to

access the mine, which is estimated to hold 104,000 tons of iron. The estimated value of the land after the iron is removed is $20,800.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

1. Prepare the January 1 entry to record the cost of the iron mine.

2. Prepare the December 31 year-end adjusting entry if 21,200 tons of iron are mined but only 18,800 tons are sold this first year.

View transaction list

Journal entry worksheet

1

2

Prepare the January 1 entry to record the cost of the iron mine.

Note: Enter debits before credits.

Date

January 01

General Journal

Debit

Credit

View general journal

Record entry

Clear entry

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Match each item to a bank statement adjustment, a company books adjustment, or either.arrow_forwardA company pays $813,200 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $64,200 cash to access the mine, which is estimated to hold 107,000 tons of iron. The estimated value of the land after the iron is removed is $21,400. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Prepare the January 1 entry to record the cost of the iron mine. 2. Prepare the December 31 year-end adjusting entry if 22,100 tons of iron are mined but only 19,400 tons are sold this first year. View transaction list Journal entry worksheet 1 > Prepare the January 1 entry to record the cost of the iron mine. Note: Enter debits before credits. Date General Journal Debit Credit January 01 Iron Mine 877,400 Cash 877,400 Record entry Clear entry View general journal G Search or type URL < ** #3 $4 2 3 6 7 8. W T. Y U G H. J K L V F. C3 DIarrow_forwardWolfpack Corp. has determined it should record depreciation expense of $40,000 for the year ending 12/31/X7. Required: In the general journal below, complete the year-end entry to record depreciation. Debit Credit Dec 31 ? 40,000 ? 40,000arrow_forward

- Required information [The following information applies to the questions displayed below.] Precision Construction entered into the following transactions during a recent year. January 2 Purchased a bulldozer for $282,000 by paying $36,000 cash and signing a $246,000 note due in five years. January 3 Replaced the steel tracks on the bulldozer at a cost of $36,000, purchased on account. The new steel tracks increase the bulldozer's operating efficiency. January 30 Wrote a check for the amount owed on account for the work completed on January 3. February 1 Repaired the leather seat on the bulldozer and wrote a check for the full $2,400 cost. March 1 Paid $13,200 cash for the rights to use computer software for a two-year period. Required: 1-a. Complete the table below, for the above transactions. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Date Assets = Liabilities + Stockholders' Equity January 02…arrow_forwardA company acquires a zinc mine at a cost of $750,000 on January 1. At that same time, it incurs additional costs of $100,000 to access the mine, which is estimated to hold 200,000 tons of zinc. The estimated value of the land after the zinc is removed is $50,000. 1. Prepare the January 1 entry(ies) to record the cost of the zinc mine. 2. Prepare the December 31 year-end adjusting entry if 50,000 tons of zinc are mined, but only 40,000 tons are sold the first year.arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- can you please show work/math xomputations for how to arrive to each answerarrow_forwardHow to calculate the Amortization Expense?arrow_forwardplease solve correct and complete with working thanks On January 2, 2021, Archer Company, a skateboard manufacturer, installed a computerized machin$158,000. The machine's useful life was estimated at four years or a total of 187,500 units with a $Company's year-end is December 31.Calculate depreciation for each year of the machine's estimated useful life under each of the follaintermediate calculations.)a. Straight-lineb. Double-declining-balancec. Units-of-production, assuming actual units produced were:YearUnitsYear2021202220232024Total202138,700202241,750202353,000202460,000Straight-Line Double-Declining-BalanceUnits-of-Productionarrow_forward

- 2arrow_forwardplease answer within 30 minutes.arrow_forwardMetlock, Inc., spent $48,600 in attorney fees while developing the trade name of its new product, the Mean Bean Machine. Prepare the journal entries to record the $48,600 expenditure and the first year's amortization, using an 6-year life. Use the account title "Trade Names". (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record expenditure of trade names) (To record amortization expense)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education