FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer within 30 minutes.

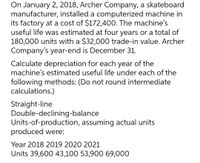

Transcribed Image Text:On January 2, 2018, Archer Company, a skateboard

manufacturer, installed a computerized machine in

its factory at a cost of $172,400. The machine's

useful life was estimated at four years or a total of

180,000 units with a $32,000 trade-in value. Archer

Company's year-end is December 31.

Calculate depreciation for each year of the

machine's estimated useful life under each of the

following methods: (Do not round intermediate

calculations.)

Straight-line

Double-declining-balance

Units-of-production, assuming actual units

produced were:

Year 2018 2019 2020 2021

Units 39,600 43,100 53,900 69,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A woman opens an account with $750 and then adds $500 at the end of each 6-month period for 10 years. The account earns 6% interest per year, compounded every 6 months. Find the total value of the investment (in $) at the end of the 10 years. Give the answer to 2 decimal places, and do not use the $ sign in the answer box. Type your answerarrow_forwardA career counselor decides to make monthly payments of $150 on credit card debt of $3,496.55 and discontinue using that credit card. Assuming the monthly interest rate is 1.85%, it will take the counselor approximately 31 months to repay the debt. How many fewer months would it take to repay the debt if the counselor makes monthly payments of $200? (Round your answer to the nearest month.) months Need Help? Watch It Read Itarrow_forward4. Five transactions for Jodry & Associates follow. A. Journalize the five transactions under a GST/PST system. The rate of GST is 5%; PST is 8%. Both taxes are charged on all sales, and both percentages are calculated on the original amount of the invoice. Use the following accounts: A/R - Booker Industries A/R - Genco Corporation A/R - Hall Industries A/P- Bell Cellphones HST Payable HST Recoverable PST Payable Sales Office Supplies Expense Telephone Expense A/P- Great Stationers GST Payable GST Recoverable TRANSACTIONS October 19 Sales Invoice No. 459 to Booker Industries, $1250 plus GST and PST. 19 Sales Invoice No. 460 to Genco Corporation, $1500 plus GST and PST. 20 Sales Invoice No. 461 to Hall Industries, $2700 plus GST and PST. 22 Purchase Invoice No. 49390 from Bell Cellphones, $313.20 plus GST. (Note: This transaction is exempt from PST because it is a service not covered by the provincial tax regulations.) 25 Purchase Invoice From Great Stationers, No. 15586 for office…arrow_forward

- A friend agreed to lend you money today. You must repay your friend by making payments of $30 per month for the next six months. The first payment must be paid today. In addition, you must pay 2 percent interest per month. How much total interest will you end up paying your friend? Multiple Choice о $9.50 О $4.50 о $4.68 C $8.60arrow_forwardTuition of $2075 will be due when the spring term begins in 6 months. What amount should a student deposit today, at 7.51%, to have enough to pay the tuition? The student should deposit $ (Simplify your answer. Round to the nearest dollar as needed.)arrow_forwardCalculate the amount of interest that the following note will earn (for the life of the note). Please show work! $1,000 Face 7% interest Term: 90 daysarrow_forward

- Please send me the question in 20 minutes it's very urgent plz findarrow_forwarda cellphone plan cost 1200 a month.the plan includes 120 fee minutes and charges 5 for each additional minute of usage.find the monthly cost incurred if the owner used 100 minutes?arrow_forwardProblem #1. You have a Visa credit card account with a 26.49% annual percentage rate calculated on the average daily balance. The billing date is the first day of each month, and the billing cycle is the number of days in that month. Your credit card balance on April 1 was $552. On April 10th you made a $119 purchase. You made another purchase, a $25 gift card, on April 24th. You made a $150 payment on April 29th. Show your work for all parts of the problem. (a) What is the average daily balance for April? (b) What is your finance charge on the account as of May 1st? (c) What is your new credit card balance?arrow_forward

- b) Starting from 1* June 2021 with a fresh bank account, Ah Guan save RM320.00 into the bank account every month. A fixed interest of 0.8% is given on the last day of every month. Determine the date (the last day of a month after the interest is given) where he will be able to purchase a smartphone worth RM3126.00 *display your final answer as: [last day of the month] / month / yeararrow_forwardThe collection of a 1200 account after the 2 percent discount period will result in aarrow_forwardOn October 25, you plan to purchase a $1,500 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates interest based on the average daily balance. Both cards have a $0 balance as of October 1. The closing date is the end of the month for each card. Your plan is to make a $500 payment in November, make a $500 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10th of each month. No other charges will be made on the account. (Round your answers to the nearest cent.) (a) Based on this information, calculate the interest (in $) charged by each card for this purchase. Silver Card Gold Card $7 $ 7.6 X (b) Which card is the better deal and by how much (in $)? The ---Select--- is the better deal by $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education