Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

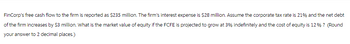

Transcribed Image Text:FinCorp's free cash flow to the firm is reported as $235 million. The firm's interest expense is $28 million. Assume the corporate tax rate is 21% and the net debt

of the firm increases by $3 million. What is the market value of equity if the FCFE is projected to grow at 3% indefinitely and the cost of equity is 12 % ? (Round

your answer to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Calvert Corporation expects an EBIT of $25,100 every year forever. The company currently has no debt, and its cost of equity is 15.2 percent. The company can borrow at 10 percent and the corporate tax rate is 24 percent. a. What is the current value of the company? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)b-1. What will the value of the firm be if the company takes on debt equal to 60 percent of its unlevered value? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)b-2. What will the value of the firm be if the company takes on debt equal to 100 percent of its unlevered value? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)c-1. What will the value of the firm be if the company takes on debt equal to 60 percent of its levered value? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g.,…arrow_forwardFCF is projected to be $100,000, $125,000 and $150,000 over the next three years. The enterprise value in three years is projected to be $1,000,000. The WACC is 8%. What is the total enterprise value of the firm? If this firm has borrowed $500,000, the value of the firm's equity must be what? Show your work.arrow_forwardA firm’s stockholders expect an 12% rate of return, and there is $20M in common stock and retained earnings. The firm has $7M in loans at an average rate of 9%. The firm has raised $12M by selling bonds at an average rate of 5%. What is the firm’s cost of capital: (a) Before taxes? (b) After taxes with a tax rate of 24%?arrow_forward

- The Montana Hills Co. has expected earnings before interest and taxes of $17,100 forever, an unlevered cost of capital of 12.4 percent, and debt with both a book and face value of $25,000. The debt has an annual 6.2 percent coupon. If the tax rate is 21 percent, what is the value of the firm? $91,016 $137,903 $114,194 $106,667 $146,403arrow_forwardSuppose the firm has a value of $237,000 when it is all equity financed. Now assume the firm issues $65,000 of debt paying interest of 6% per year and uses the proceeds to retire equity. The debt is expected to be permanent. What will be the value of the firm? Enter your answer rounded to two decimal places. Number What will be the value of the equity after the debt issue? Enter your answer rounded to two decimal places. Numberarrow_forwardLast year, Cayman Corporation had sales of $6,608,800, total variable costs of $2,695,237, and total fixed costs of $1,517,037. In addition, they paid $480,000 in interest to bondholders. Cayman has a 21% marginal tax rate. If Cayman's sales increase 10%, what should be the increase in earnings per share? SET YOUR CALCULATOR TO 4 DECIMAL PLACES. ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE % SIGN. FOR EXAMPLE, IF YOUR ANSWER IS 9.4567, ENTER IT AS 9.46.arrow_forward

- A firm expects to generate $100 million in free cash flow in a year. This free cash flow is expected to grow at a constant annual rate of 5%. The firm has a 19% cost of capital, $366 million of debt, and 20 million shares of common stock outstanding. Compute the value of the firm. (show your answers in millions - example, $10,000,000 would be entered as 10)arrow_forwardCede & Co. expects its EBIT to be $163000 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 10 percent. The tax rate is 23 percent. If the company borrows $185,000 and uses the proceeds to buy back equity, what is the weighted average cost of capital after the recapitalisation is complete? O 15.13% O 9.67% O 14.32% O 8.17%arrow_forwardMeyer & Co. expects its EBIT to be $47,130 every year forever. The firm can borrow at 9 percent. Meyer currently has no debt, and the cost of assets is 12 percent, and the tax rate is 20 percent. The company borrows $180,000 and uses the proceeds to repurchase shares. What is the weighted average cost of capital?arrow_forward

- Suppose a firm raises $21 million dollars by issuing debt at a cost of 6.1%, raises $15 million by issuing common stock at a cost of 8.9% and raises an additional $9 million by issuing preferred stock at a cost of 10.7%. What is the average cost of capital per dollar raised (this is similar to the concept of weighted average cost of capital in your finance classes)? (please round your answer to 1 decimal place)arrow_forwardAn all-equity firm that has projected perpetual EBIT of $204,000 per year. The cost of equity is 14.5 percent and the tax rate is 39 percent. The firm can borrow perpetual debt at 5.6 percent. Currently, the firm is considering taking on debt equal to 114 percent of its unlevered value. What is the firm's levered value? $772,386 $858,207 $1,335,132 $1,048,986 $1,239,766arrow_forwardCoca-Cola Inc. (KO) has FCFF of $9.205 billion and FCFE of $7.554 billion. Coca-Cola’s WACC is 7.0 percent, and its required rate of return for equity is 8.5 percent. FCFF is expected to grow forever at 2.07 percent, and FCFE is expected to grow forever at 4.81 percent. Pfizer has debt outstanding of $52.867 billion. What is the total value of Coca-Cola’s equity using the FCFF valuation approach? B. What is the total value of Coca-Cola’s equity using the FCFE valuation approacharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education