FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

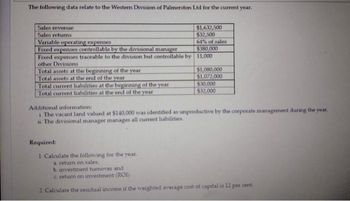

Transcribed Image Text:The following data relate to the Western Division of Palmerston Ltd for the current year.

Sales revenue

$1,632,500

$32,500

Sales returns

Variable operating expenses

64% of sales

$380,000

Fixed expenses controllable by the divisional manager

Fixed expenses traceable to the division but controllable by 11,000

other Divisions

Total assets at the beginning of the year

$1,080,000

Total assets at the end of the year

$1,072,000

Total current liabilities at the beginning of the year

$30,000

Total current liabilities at the end of the year

$32,000

Additional information:

i The vacant land valued at $140,000 was identified as unproductive by the corporate management during the year.

The divisional manager manages all current liabilities.

Required:

1. Calculate the following for the year.

a return on sales,

b investment turnover and

c. return on investment (ROI)

2. Calculate the residual income if the weighted average cost of capital is 12 per cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Divisional Income Statements The following data were summarized from the accounting records for Ruiz Industries Inc. for the year ended November 30, 20Y8: Cost of goods sold: Support department allocations: Commercial Division $459,310 Commercial Division $62,630 Residential Division 214,350 Residential Division 37,130 Administrative expenses: Sales: Commercial Division $83,510 Commercial Division $695,920 Residential Division 76,550 Residential Division 382,760 Prepare divisional income statements for Ruiz Industries Inc. Ruiz Industries Inc. Divisional Income Statements For the Year Ended November 30, 20Y8 Commercial Division Residential Division %24arrow_forwardService Department Charges In divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $75,400 and the Purchasing Department had expenses of $42,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government Contract Sales $1,000,000 $1,600,000 $3,200,000 Number of employees: Weekly payroll (52 weeks per year) 300 150 200 Monthly payroll 75 160 90 Number of purchase requisitions per year 4,000 3,500 3,000 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial…arrow_forwardPlease Do not Give image formatarrow_forward

- Divisional Income Statements The following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 20Y8: Cost of goods sold: Service department charges: Commercial Division $348,510 Commercial Division $47,520 Residential Division 171,510 Residential Division 29,710 Administrative expenses: Net sales: Commercial Division $63,370 Commercial Division $528,050 Residential Division 61,250 Residential Division 306,270 Prepare divisional income statements for Jersey Coast Construction Company. Jersey Coast Construction Company Divisional Income Statements For the Year Ended June 30, 20Y8 Commercial Division Residential Division Income from operations before service department charges $fill in the blank 2 $fill in the blank 3 Cost of goods sold fill in the blank 5 fill in the blank 6 Gross profit $fill in the blank 8 $fill in the blank 9 Administrative…arrow_forwardanswer in text form please (without image)arrow_forwardDivisional Income Statements The following data were summarized from the accounting records for Ruiz Industries Inc. for the year ended November 30, 20Y8: Cost of goods sold: Support department allocations: Commercial Division $420,760 Commercial Division $57,380 Residential Division 203,490 Residential Division 35,250 Administrative expenses: Sales: Commercial Division $76,500 Commercial Division $637,510 Residential Division 72,680 Residential Division 363,380 Prepare divisional income statements for Ruiz Industries Inc. Ruiz Industries Inc. Divisional Income Statements For the Year Ended November 30, 20Y8 Commercial Division Residential Division $ $arrow_forward

- Please do not give solution in image format and show all calculation thankuarrow_forwardProfit Center Responsibility Reporting A-One Freight Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 20Y3. Revenues—Air Division $ 1,086,300 Revenues—Rail Division 1,307,900 Revenues—Truck Division 2,315,700 Operating Expenses—Air Division 688,400 Operating Expenses—Rail Division 778,400 Operating Expenses—Truck Division 1,400,400 Corporate Expenses—Shareholder Relations 165,200 Corporate Expenses—Customer Support 546,000 Corporate Expenses—Legal 262,400 General Corporate Officers’ Salaries 364,900 The company operates three service departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department…arrow_forwardEffect of Proposals on Divisional Performance A condensed income statement for the Electronics Division of Gihbli Industries Inc. for the year ended December 31 is as follows: Sales $4,160,000 Cost of goods sold 2,884,200 Gross profit $ 1,275,800 Operating expenses 735,000 Income from operations $ 540,800 Invested assets $3,200,000 Assume that the Electronics Division received no charges from service departments. The president of Gihbli Industries Inc. has indicated that the division’s return on a $3,200,000 investment must be increased to at least 20.8% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $640,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by $115,200. This decrease in expense would be included as part of…arrow_forward

- Divisional income statements with support department allocations Horton Technology has two divisions. Consumer and Commercial and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: ACCT 102 Chapter 24 - Homework assignment take frame Teen Services Department 2770,000 292,000 Purchasing Department Other corporate administrative expenses Total expense The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows: Consumer Division Commercial Division Total Tech Services $1,519,500 260 410 computers 670 457,000 Purchasing 5,100 purchase orders 1,322,900…arrow_forwardQuestion Content Area Bentz Co. has two divisions, A and B. Invested assets and condensed income statement data for each division for the year ended December 31 are as follows: Line Item Description Division A Division B Revenues $190,000 $125,500 Operating expenses 112,500 92,750 Support department allocations 29,500 12,625 Invested assets 225,000 99,000 Question Content Area a. Prepare condensed income statements for the past year for each division. Bentz Co.Divisional Income StatementsFor the Year Ended December 31 Line Item Description Division A Division B $- Select - $- Select - - Select - - Select - $- Select - $- Select - - Select - - Select - Operating income $Operating income $Operating income Question Content Area b. Using the DuPont formula, determine the profit margin, investment turnover, and return on investment (ROI) for each division. Round the profit margin percentage to two decimal places, the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education