FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

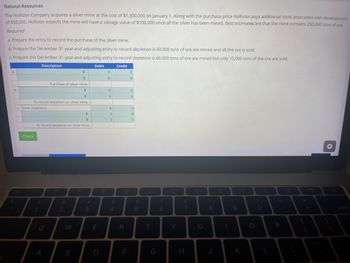

Transcribed Image Text:Natural Resources

The

Hollister Company acquires a silver mine at the cost of $1,300,000 on January 1. Along with the purchase price Hollister pays additional costs associated with development

of $50,000. Hollister expects the mine will have a salvage value of $100,000 once all the silver has been mined. Best estimates are that the mine contains 250,000 tons of ore.

Required

a. Prepare the entry to record the purchase of the silver mine.

b. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined and all the ore is sold.

c. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined but only 15,000 tons of the ore are sold.

Description

Credit

a.

b.

c. Silver inventory

esc

+

To record depletion on silver mine.

Check

!

1

To record depletion on silver mine.

Q

Purchase of silver mine

◆

A

+

2

W

S

+

#

3

Debit

E

D

80

0

0

0

0

0

0

0

$

4

R

F

0

0

0

0

0

0

0

%

5

pe

T

G

6

Y

&

7

H

U

*

8

J

FB

1

(

9

K

O

0

L

P

4)

F11

+

F12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nevada Gold Company (LLC) purchased a gold deposit for $1,500,000. It estimated it would extract 500,000 ounces of gold from the deposit. The company mined the gold and sold it, reporting gross receipts of $1.8 million, $2.5 million, and $2 million for Years 1 through 3, respectively. During Years 1 through 3, Nevada Gold reported net income (loss) from the gold deposit activity in the amount of ($100,000), $400,000, and $100,000, respectively. In Years 1 through 3, the company actually extracted 300,000 ounces of gold as follows: Ounces of Gold extracted per year Year 1 Year 2 Year 3 50,000 150,000 100,000 What is Nevada Gold's depletion deduction for Year 2 if the applicable percentage depletion for gold is 15 percent? Question 8 options: $450,000. $400,000. $375,000. $200,000.arrow_forwardSchefter Mining operates a copper mine in Wyoming. Acquisition, exploration, and development costs totaled $7.5 million. Extraction activities began on July 1, 2024. After the copper is extracted in approximately six years, Schefter is obligated to restore the land to its original condition, including constructing a park. The company's controller has provided the following three cash flow possibilities for the restoration costs: 1. 2. 3. Cash Flow $ 630,000 730,000 830,000 Probability 38% 30% 40% The company's credit-adjusted, risk-free rate of interest is 4%, and its fiscal year ends on December 31. Note: Use appropriate factor(s) from the tables provided. Round other intermediate calculations to the nearest whole dollar. Enter your answers in whole dollars. (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. What is the initial cost of the copper mine? 2. How much accretion expense will Schefter report in its 2024 income statement? 3. What is the book…arrow_forwardCurrent Attempt in Progress Marigold Corp. acquires land for $100000 cash. Additional costs are as follows: Removal of shed Filling and grading Residual value of lumber from shed Paving of parking lot Closing costs Type here to search $430 $104890. O $100000. O$104460. O $120690. 3300 Marigold will record the cost of the land as 150 15500 1310 C P 5 59 -4°C Clear 4) ENG 10: 2022arrow_forward

- 4 02:59:09 Perez Company acquires an ore mine at a cost of $2,240,000. It incurs additional costs of $627,200 to access the mine, which is estimated to hold 1,600,000 tons of ore. 210,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $320,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. eBook Depletion Expense General Journal Calculate the depletion expense from the information given. Note: Round "Depletion per unit" to 3 decimal places. Cost Salvage Amount subject to depletion Total units of capacity Depletion per unit Units extracted and sold in period Depletion expense Help Save &arrow_forwardRequired information [The following information applies to the questions displayed below.] Last Chance Mine (LCM) purchased a coal deposit for $750,000. It estimated it would extract 12.000 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1 million, $3 million, and $2 million for years 1 through 3, respectively. During years 1-3, LCM reported net income (loss) from the coal deposit activity in the amount of ($20,000). $500,000, and $450,000, respectively. In years 1-3, LCM actually extracted 13,000 tons of coal as follows: (Leave no answer blank. Enter zero if applicable. Enter your answers in dollars and not in millions of dollars.) (3) Tons of Coal 12,000 Year 1 2 3 Depletion (2) (2)/(1) Basis Rate $750,000 $62.50 Tons Extracted per Year Year 1 Year 21 Year 3 2,000 7,200 3,800 b. What is LCM's percentage depletion for each year (the applicable percentage for coal is 10 percent)? Percentage Depletionarrow_forwardNatural Resources The Hollister Company acquires a silver mine at the cost of $2,100,000 on January 1. Along with the purchase price Hollister pays additional costs associated with development of $50,000, Hollister expects the mine will have a salvage value of $300,000 once all the silver has been mined. Best estimates are that the mine contains 250,000 tons of ore. Required a: Prepare the entry to record the purchase of the silver mine. b. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined and all the ore is sold, c. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined but only 15,000 tons of the are are sold Description Credit 4 # Purchase of silver mine # = To record depletion on silver mine Siver inventory To record depletion on silver mine Debitarrow_forward

- Hidden Hollow Mining Co. acquired mineral rights for $69,000,000. The mineral deposit is estimated at 60,000,000 tons. During the current year, 13,200,000 tons were mined and sold. a. Determine the depletion rate. If required, round your answer to two decimal places. Sfill in the blank d39a0a00ffc1f93_1 per tonarrow_forwardBarton Corporation acquires a coal mine at a cost of $1,800,000. Intangible development costs total $360,000. After extraction has occurred, Barton must restore the property (estimated fair value of the obligation is $180,000), after which it can be sold for $210,000. Barton estimates that 5,000 tons of coal can be extracted. What is the amount of depletion per ton? a. $426 b. $384 c. $468 d. $360arrow_forwardThe Platinum Touch Mining Company paid $4,000,000 for a parcel of land, including the mining rights. In addition, the company spent $564,700 to prepare the site for mining operations. When mining is completed, it is estimated that the residual value of the asset will be $800,000. Scientists estimate that the site contains 150,000 ounces of platinum. A. What is the average depletion cost per ounce? B. If 12,200 ounces were mined in the first year of operation, what is the amount of the depletion cost?arrow_forward

- Required information [The following information applies to the questions displayed below.] Last Chance Mine (LCM) purchased a coal deposit for $2,088,450. It estimated it would extract 17,550 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1.15 million, $4.35 million, and $3.1 million for years 1 through 3, respectively. During years 1-3, LCM reported net income (loss) from the coal deposit activity in the amount of ($15,400), $667,500, and $662,500, respectively. In years 1-3, LCM extracted 18,550 tons of coal as follows: (Leave no answer blank. Enter zero if applicable. Enter your answers in dollars and not in millions of dollars.) (1) Tons of Coal 17,550 (2) Basis $2,088,450 Depletion (2)/(1) Rate $119.00 Year 1 2,400 Tons Extracted per Year Year 2 11,450 Year 3 4,700 c. Using the cost and percentage depletion computations from parts (a) and (b), what is LCM's actual depletion expense for each year? Depletion Expense Year 1 Year 2 $…arrow_forwardDow Deep Mining Co acquired mineral rights for $56,000,000. The mineral deposit is estimated at 70,000,000 tons. During the current year, 18,200,000 tons were mined an a. Determine the depletion rate. It required, round your answer to two decina aces A) Depletion rate per ton.arrow_forwarddevuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education